Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

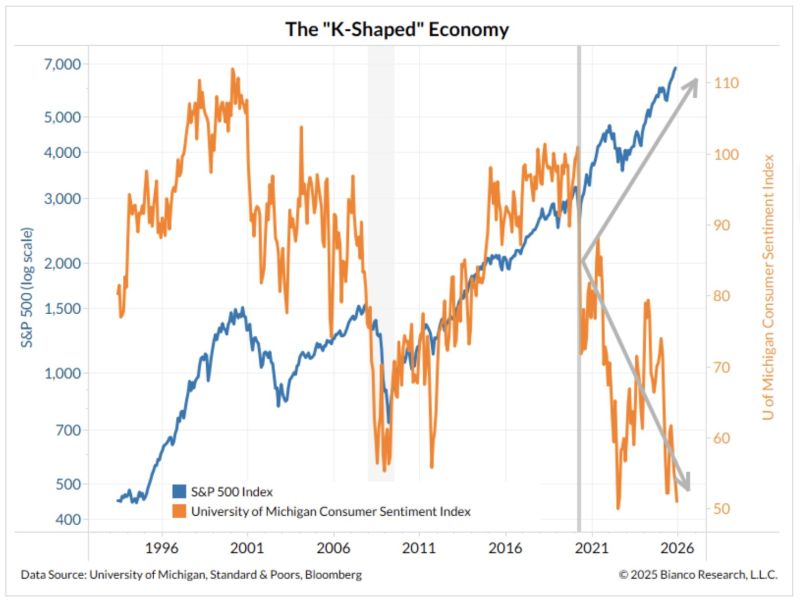

Consumer confidence down, stock market up

A K-shaped economy captured in one chart. (via Bianco Research thru HolgerZ)

How far can this go?

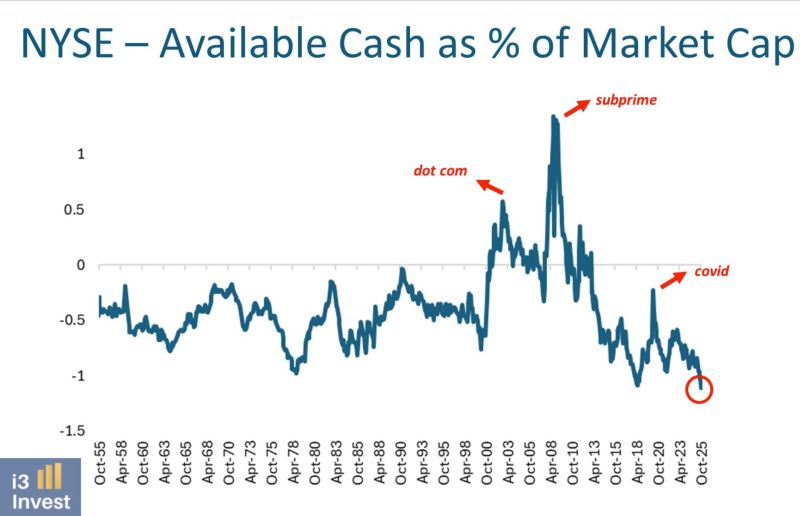

Investors are in "all-in mode", as NYSE available cash as a percentage of market cap has just reached its lowest level ever. Source: Guilherme Tavares i3 invest

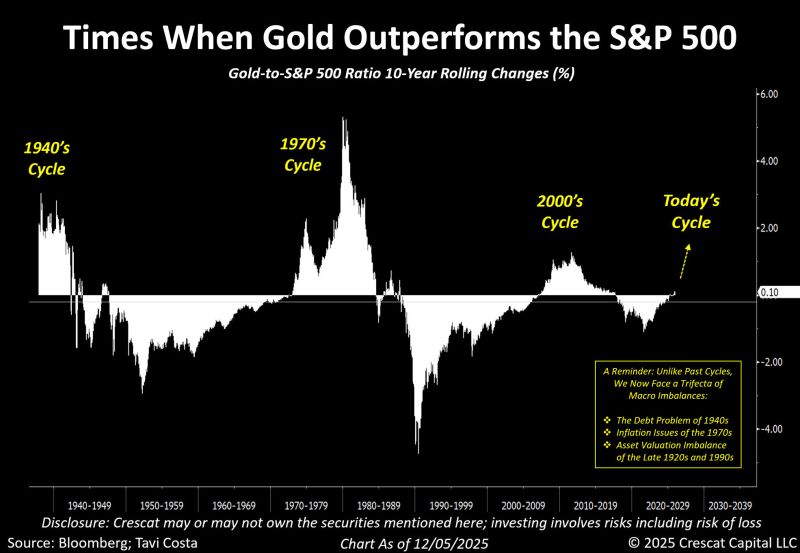

Gold relative to S&P 500: are we just at the start of the cycle?

A fascinating chart by Otavio (Tavi) Costa Gold relative performance dynamic follows very long-term cycles, and we’re likely only in the early stages of this one. As Tavi points out, we now face a trifecta of macro imbalances: ▪️The Debt Problem of the 1940s ▪️Inflation Issues of the 1970s ▪️Asset Valuation Imbalance of the Late 1920s and 1990s Source: Bloomberg, Crescat Capital

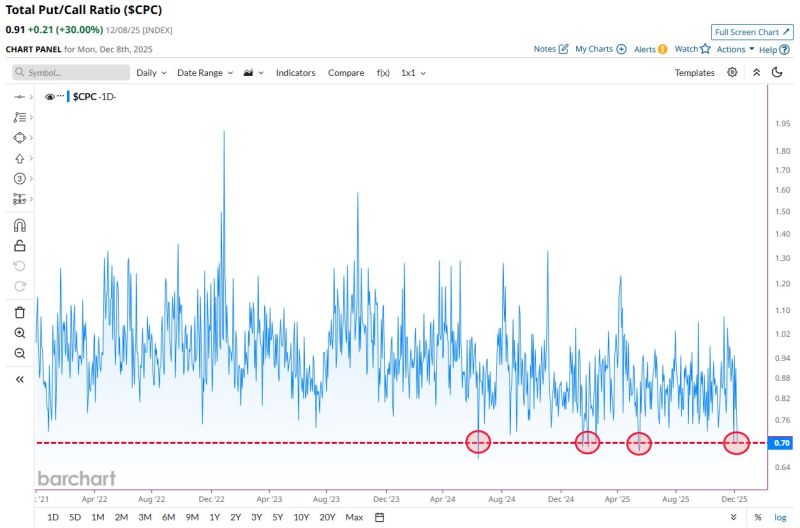

Total Put/Call Ratio fell to 0.70 on Friday, one of the lowest levels in the last 4 years 👀

Source: Barchart

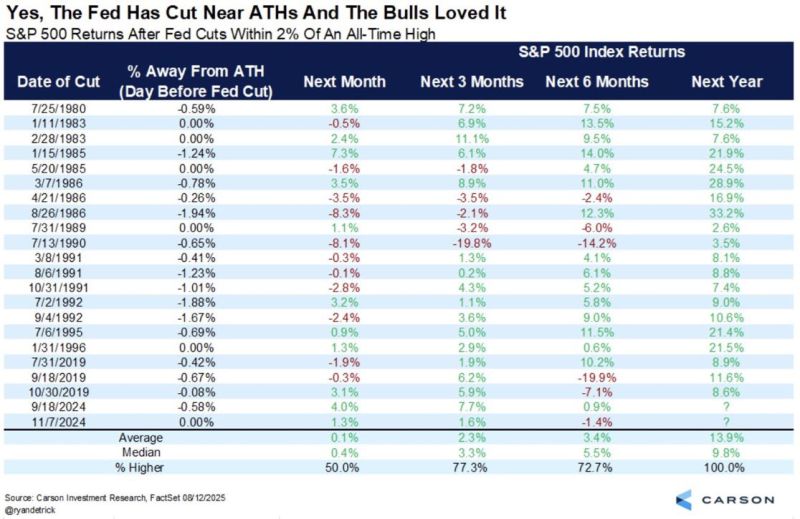

When the Fed cuts interest rates within 2% of stock market all-time highs, the S&P 500 has gone on to finish higher over the next 12 months 20 out of 20 times (100% hit rate) 🚨🚨🚨

Note however that the market reaction in the 3 to 6 months is mixed Source: Carson, Barchart

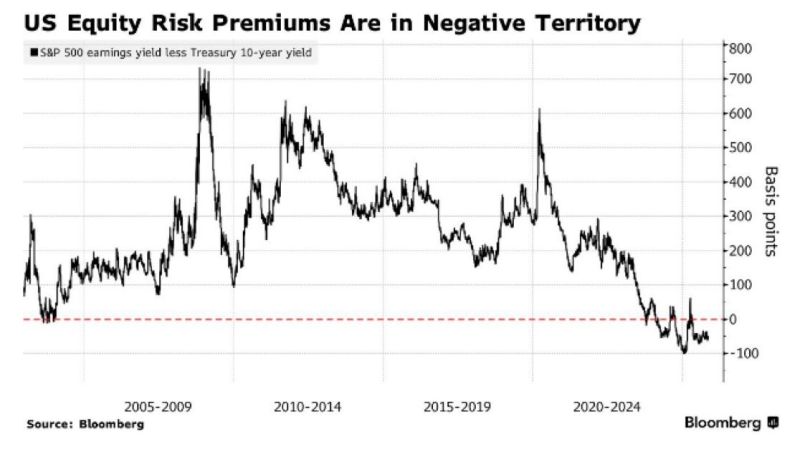

U.S. Equity Risk Premium is now negative 🚨

On a risk-adjusted basis, stocks offer zero return for investors 👀 Source: Bloomberg, Barchart

🚨Very interesting comment by Bull Theory @BullTheoryio on why Bitcoin always dumps at 10 a.m. when the U.S. market opens ?

Yesterday, Bitcoin erased 16 hours of gains in just 20 minutes after the US market opened. ‼️ Since early November, BTC has dumped most of the time after US market opens. The same thing happened in Q2 and Q3. 📌 @zerohedge has been calling this out repeatedly, and he thinks Jane Street is the most likely entity doing this. Bull Theory then highlighted that when you look at the chart, the pattern is too consistent to ignore: a clean wipe out within an hour of the market opening followed by slow recovery. That’s classic high-frequency execution. They add that it actually fit their profile: • Jane Street is one of the largest high-frequency trading firms in the world. • They have the speed and liquidity to move markets for a few minutes. They then assume (this is NOT verified) that what Jane Street does in a consistent manner is the following: 1. Dump BTC at the open. 2. Push the price into liquidity pockets. 3. Re-enter lower. 4. Repeat daily. And by doing this, they might have accumulated billions in $BTC. As of now, Jane Street holds $2.5B worth of BlackRock’s IBIT ETF, their 5th largest position. Does it mean that the dump in BTC isn't due to macro weakness but due to manipulation by one major entity??? What’s your take?

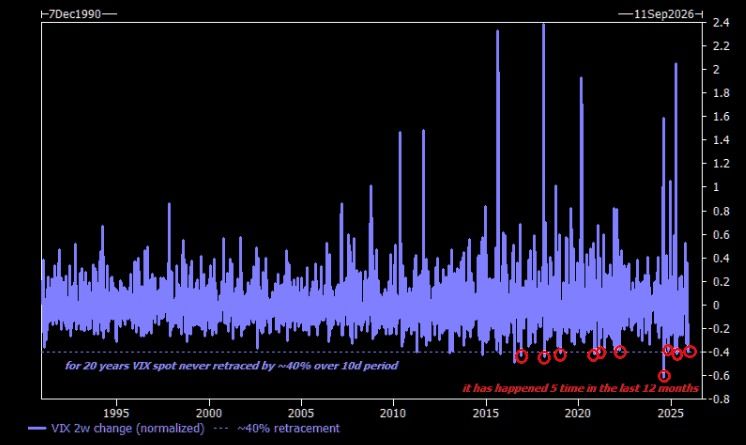

Before 2011, VIX never retraced 40% in two weeks…

It’s happened five times in the past twelve months. Source: The Market Ear @themarketear

Investing with intelligence

Our latest research, commentary and market outlooks