Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

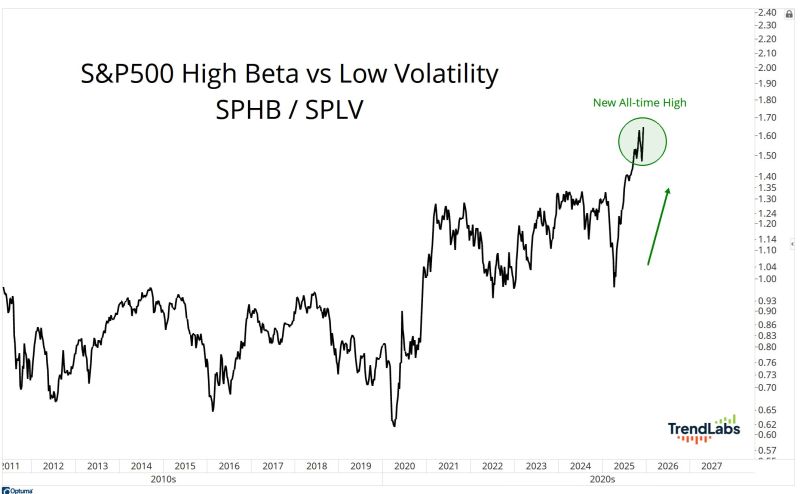

J-C Parets: When we talk about healthy sector rotation, this is exactly what that means.

High Beta is making new all-time highs, AND it's making new all-time highs relative to Low Volatility. That's not weak breadth. That's not deterioration. That's called a raging bull market.

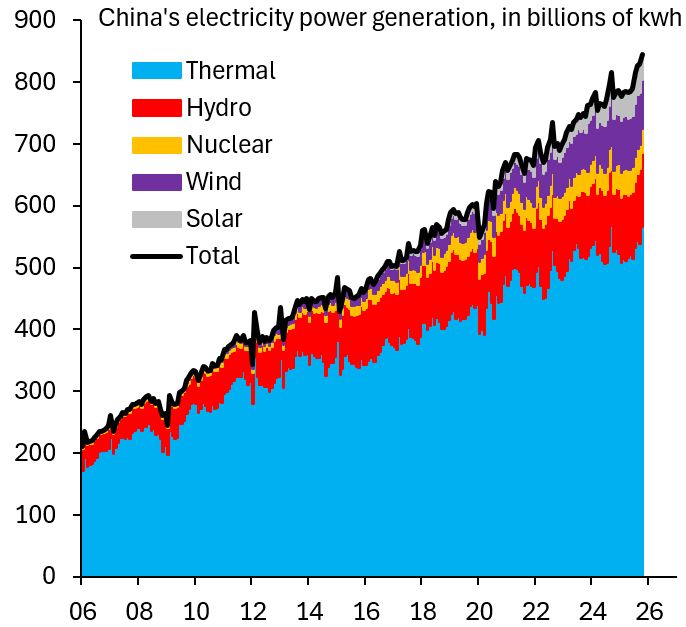

Lots of people are going on about cheap electricity in China and how this will allow it to win the AI race with the US.

Here's the thing about that electricity: it's from burning fossil fuels like coal - see chart below courtesy of Robin Brooks. Note however that China has massive plans to progressively replace fossil fuels by renewables and nuclear.

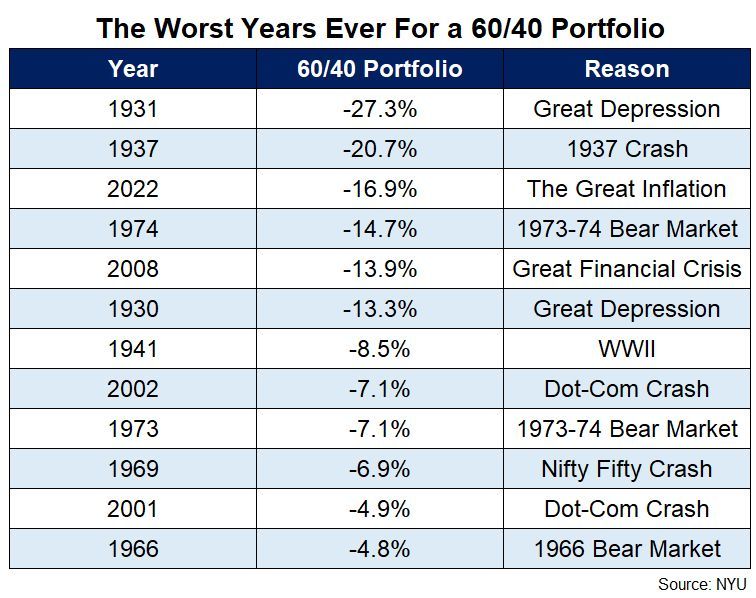

Boring Investing Still Works

"Introducing more complexity into your portfolio can make it much harder to manage. The fees are higher, they’re more illiquid, it’s harder to rebalance, and there isn’t nearly as much transparency." Source: Ritholtz @RitholtzWealth NYU

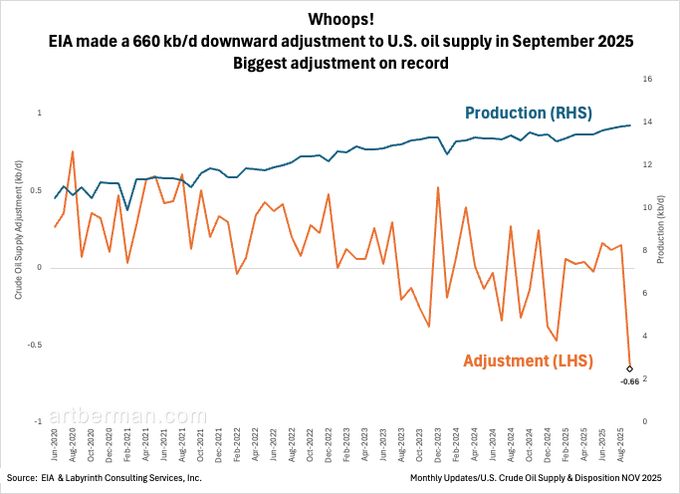

The IEA’s “historic oil glut” narrative is collapsing in real time.

US production, the foundation of their entire forecast, has now been quietly revised downward. And not by a small amount. This is the largest US supply revision in the IEA’s entire history. 660,000 kbpd just for the month of September The reason: - US shale, the only global source of meaningful growth for 15 years, is peaking. - Tier 1 acreage is drilled out - Gas-to-oil ratios are exploding - Water cuts are rising across every major basin - Decline rates are accelerating as sweet spots exhaust Shale’s boom phase gave the world a decade of easy barrels, masking the fact that the rest of the world wasn’t investing. Its bust phase will do the opposite... leave a supply hole the world cannot fill in the short term.

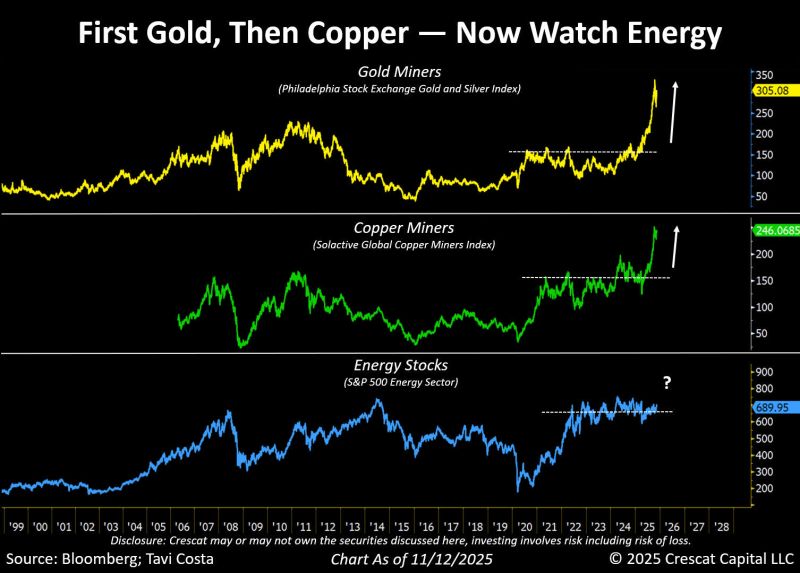

Otavio (Tavi) Costa just made a case for energy stocks, which have been quietly inching higher.

Here's his view: ▪️Positioning remains deeply bearish. ▪️U.S. oil and gas rigs are contracting meaningfully. ▪️Oil is trading near one of the cheapest levels in history relative to the money supply. ▪️Energy’s weight in the S&P 500 is hovering near record lows. He sees energy equities as one of the most fundamentally attractive corners of the market right now. Your thoughts? Source: Tavi Costa, Crescat Capital, Bloomberg

🛑 WAKE UP CALL: Could the AI Trade trigger a 15-20% S&P 500 correction? (Goldman Sachs Analysis)

It's not about the current earnings—it's about the Capex future. And if that future changes, the market is in for a shock. Goldman Sachs just dropped a massive warning. The Core Risk: AI Spending Reversal They say that our current S&P 500 valuation is priced for an incredible, long-term AI Capex boom (spending on AI infrastructure). What if that boom stalls? If AI capex growth expectations revert to early 2023 levels, GS estimates the S&P 500 valuation multiple could see a 15-20% DOWNSIDE. That's a huge potential correction driven only by multiple compression. The Extreme Scenario (The Nightmare Fuel) -> Imagine the Hyperscalers slamming the brakes on spending. 🔴 The expected Capex for 2026 is approximately $433 billion. A reversion to the 2022 Capex level of $158 billion would result in a massive reduction of $275 billion—the "Lost Capex." 🔴This $275 billion shortfall represents a 30% reduction to the consensus estimate of $1 trillion in S&P 500 sales growth. Consequently, the expected S&P 500 revenue growth rate would drop sharply from the consensus of 6% to approximately 4%. ➡️ Ultimately, this decrease in spending would pose a substantial downside risk to both the AI investment trade and the broader S&P 500 market. The Takeaway for investors: This isn't about today's P&L. It's about the market's perception of tomorrow's AI-driven growth. A dramatic cut in capex would signal the long-term AI earnings thesis is broken, leading to a much steeper decline in stock valuations than a simple revenue reduction would suggest. 🔑 Don't miss this point: Near-term revenues might only drop modestly, but the hit to long-term earnings growth expectations will crush valuations. Source: Goldman Sachs, Neil Sethi @neilksethi

When you see this chart, do you really want to go short Tesla ?

Source: J-C Parets, TrendLabs

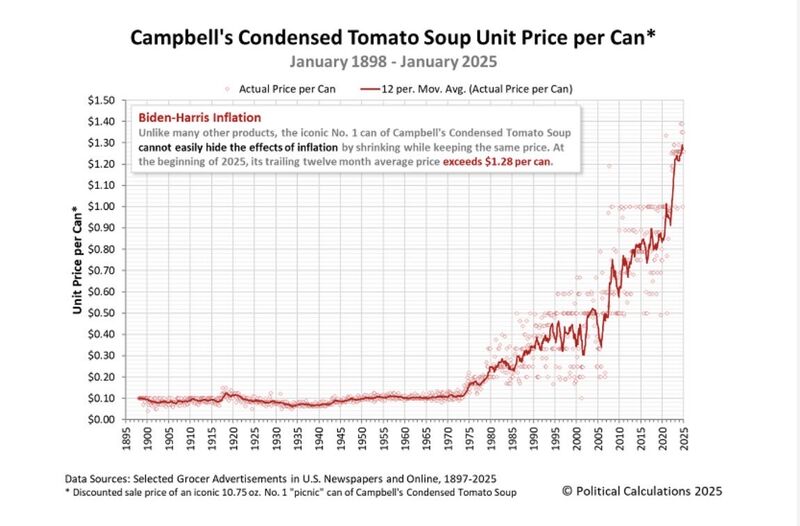

"One of the more straightforward ways to show debasement is via the price of Campbell’s tomato soup."

"Rather than relying on a complex set of estimates and substitutions, it’s just a history record of what the same can of soup cost over time.” Source: Lyn Alden thru The Long View @HayekAndKeynes

Investing with intelligence

Our latest research, commentary and market outlooks