Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

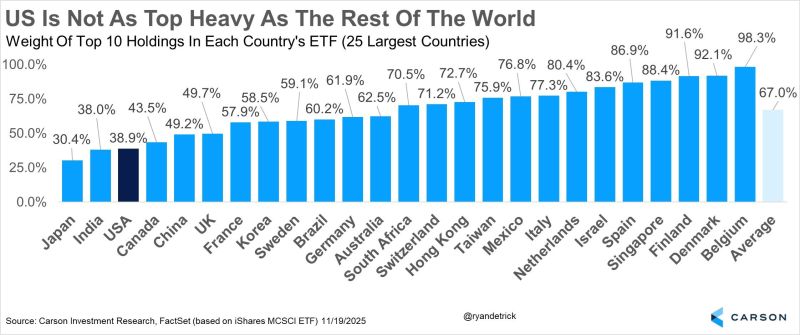

Great chart from Ryan Detrick thru Eugene Ng on X

The top 10 stocks account for ~39% of the US stock market. But many more countries are far higher, China ~49%, Australia 62%, Taiwan 76%, and even Singapore is ~88%.

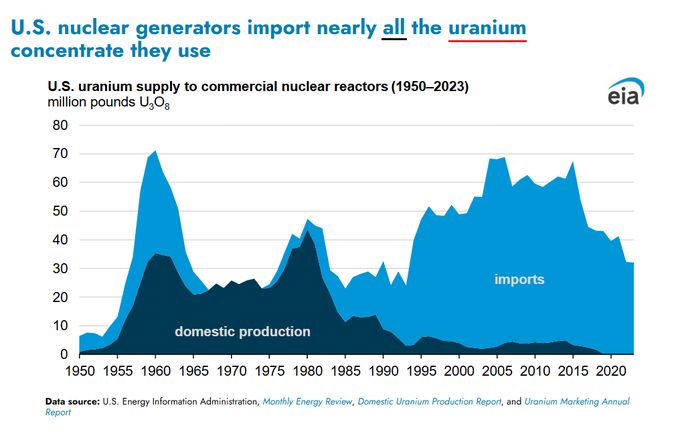

🤯 The Hidden Vulnerability Powering America: 20% of US Electricity is on Borrowed Time.

Did you know Nuclear energy generates 20% of all US electricity? That's our clean, reliable base load. But here’s the terrifying truth: 🇺🇸 The US once supplied nearly all its own Uranium fuel. TODAY: The US imports nearly 100% of the uranium we use. Let that sink in. One-fifth of US power generation is entirely dependent on foreign governments. In a world defined by geopolitical turbulence and supply chain risk, this isn't just an economic issue—it's a massive national security risk. The Mandate is Clear: The US must shift from relying on external sourcing to securing a resilient, domestic nuclear fuel cycle. Self-sufficiency is no longer optional; it’s paramount for energy independence and long-term stability. Source: Lukas Ekwueme @ekwufinance

BREAKING: Apple

Over the past week, • Apple’s chip chief considers leaving • Apple’s AI chief leaves • Apple’s Policy chief leaves • Apple’s Head of UI leaves • Now a 53% chance Tim Cook leaves (according to Kalshi) What is going on? Source: Kalshi @Kalshi

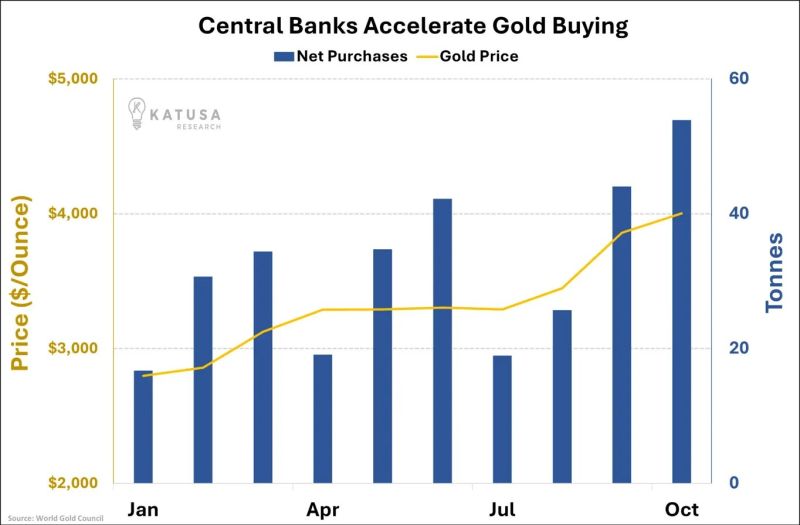

This chart destroys every "gold is too expensive" argument

They were buying 20 tonnes when gold was at $3,000. Now they're buying 55 tonnes at $4,000. Source: Katusa Research @KatusaResearch

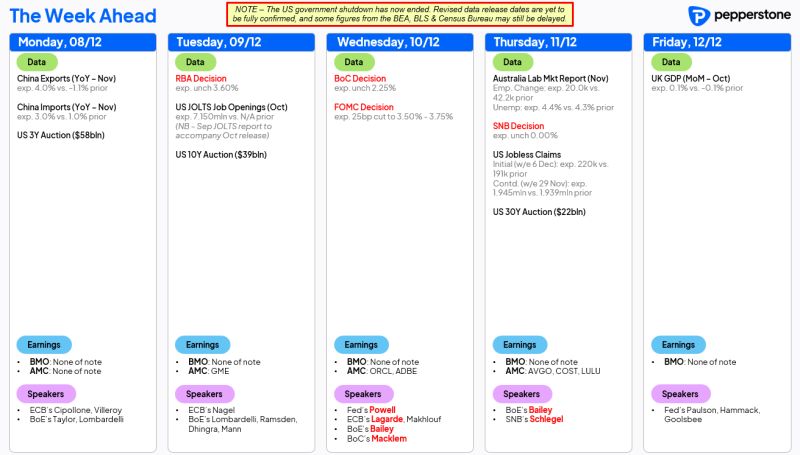

Key events for the week ahead...

FOMC set for a third straight 25bp cut...while RBA, BoC & SNB should stand pat...JOLTS & UK GDP highlight the data docket...while a chunky slate of Treasury supply awaits... ORCL & AVGO highlight the earnings calendar... Source: Pepperstone

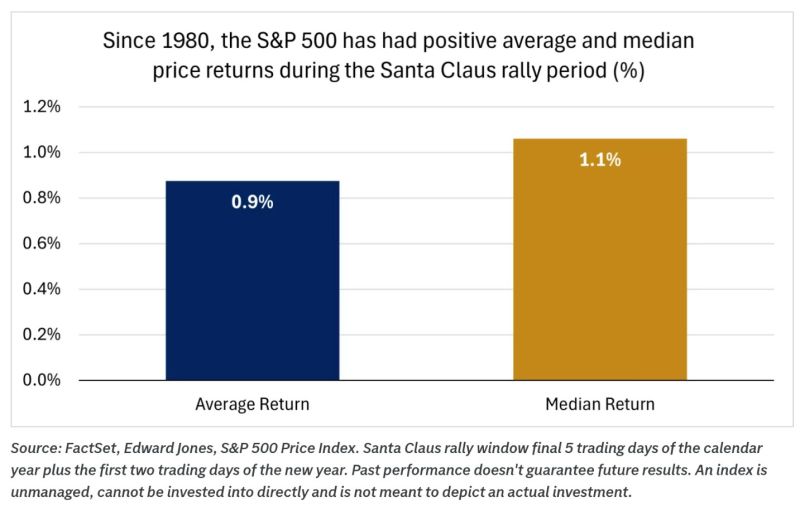

Will Santa be coming to town this year? 🎅

The last five trading days of the year plus the first two trading days of the new year are known as the "Santa Claus rally". Since 1980, there have been positive returns 73% of the time, with average S&P 500 upside of 1.1%. Source: Edward Jones thru Markets & Mayhem

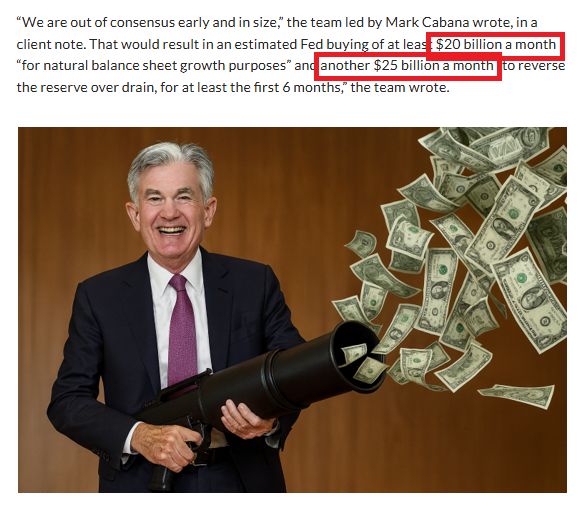

Federal Reserve expected to begin buying back an all-time high $45 billion of debt each month beginning in January 🤯👀

Source: Barchart

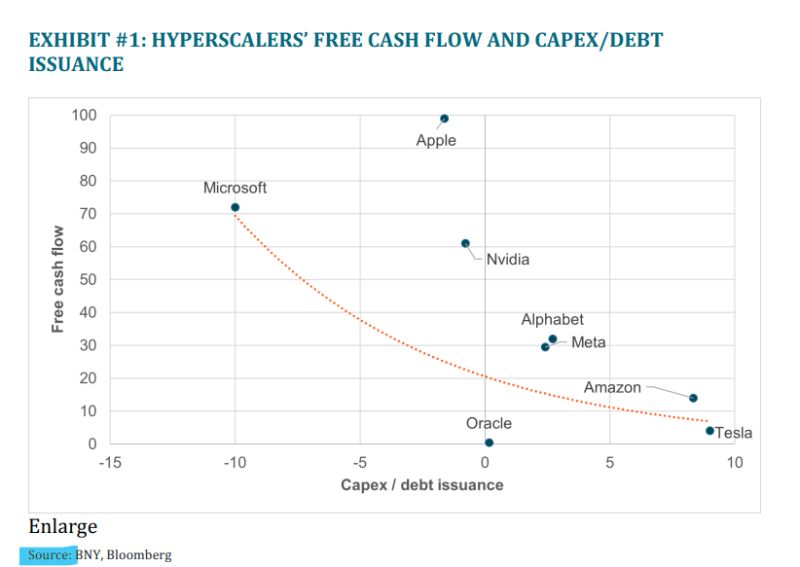

🚨 The AI Boom's Ticking Time Bomb: Debt, Valuation, and the Cost of Capital

BNY just dropped a massive reality check. Everyone is celebrating the Magnificent 7's AI investments, but how are they paying for this revolution? The playbook is simple: Free Cash Flow OR... massive debt. (Look at Oracle's recent debt noise—it's a leading indicator). The Math That Makes Value Investors Sweat: The Mag 7 (ex-Tesla) forward P/E is nearly 30x. That's nowhere near "value investor comfort." The market is demanding a clear ROI by 2026. The pace of this AI buildout is directly tied to two things: Future Earnings and the Cost of Capital. The Domino Effect: If Margins Drop or Borrowing Costs Rise, the AI investment boom must slow down. That deceleration hits U.S. GDP hard. Hello, Federal Reserve and Government intervention? The feedback loop's timing will dictate how the entire equity market trades. 2026's Real Headwinds: Everyone expects lower rates, but don't forget the silent killers: Term Premiums Government Deficits (Crowding out private investment) Future Tax Risks The core question isn't whether AI is real—it's whether the current investment pace is sustainable until the returns finally justify the spending. This is the true AI bubble concern. Are we watching a self-sustaining cycle, or an investment spree built on borrowed time (and borrowed money)? Source: Neil Sethi

Investing with intelligence

Our latest research, commentary and market outlooks