Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

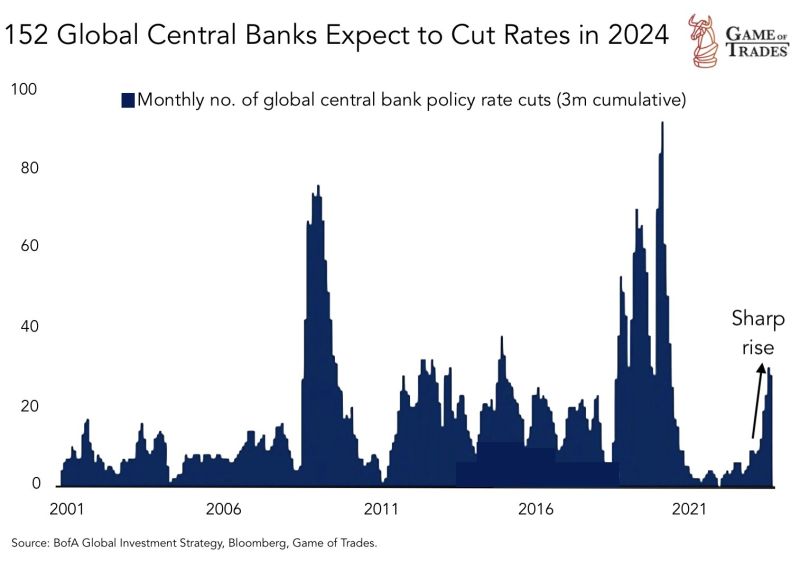

After an aggressive tightening cycle, 152 centralbanks around the world expect to cut rates in 2024, including the Fed.

Source: Games of Trades

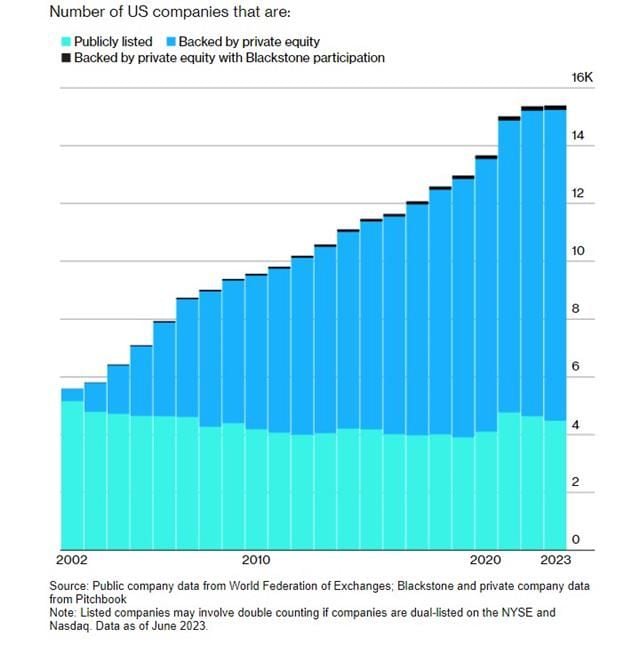

More and more companies are staying private for longer, avoiding IPOs until much later in their growth cycle (if they get there at all).

Source: Markets & Mayhem

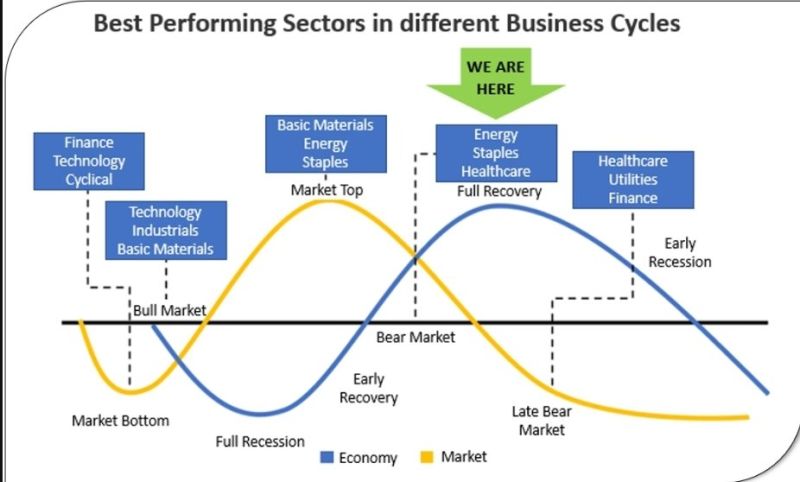

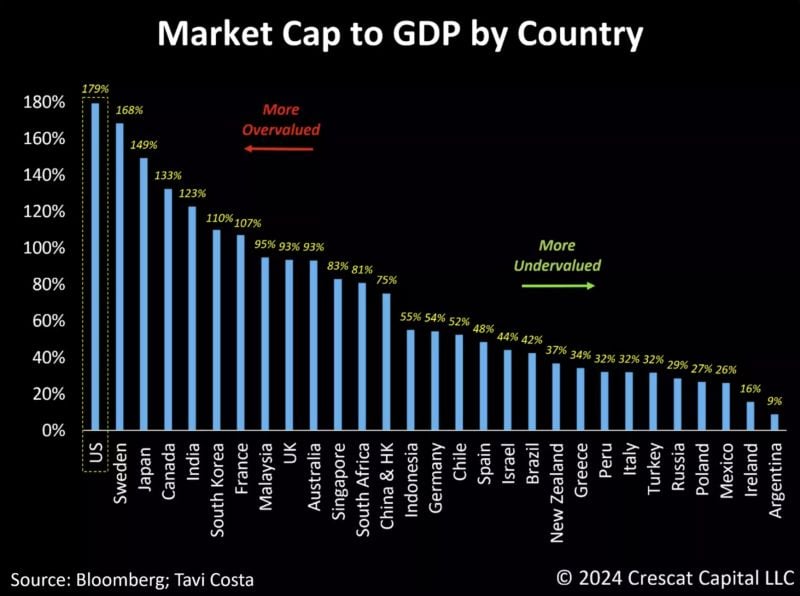

The current macro environment across global equity markets presents a sharply divided investment setup for 2024 and the remainder of the decade.

Source: Tavi Costa

Swiss inflation vs. German inflation.

The inflation rate in Switzerland is already well below the target of 2%. At 1.7%, it is a full 2ppts lower than the German rate. Source: Bloomberg, HolgerZ

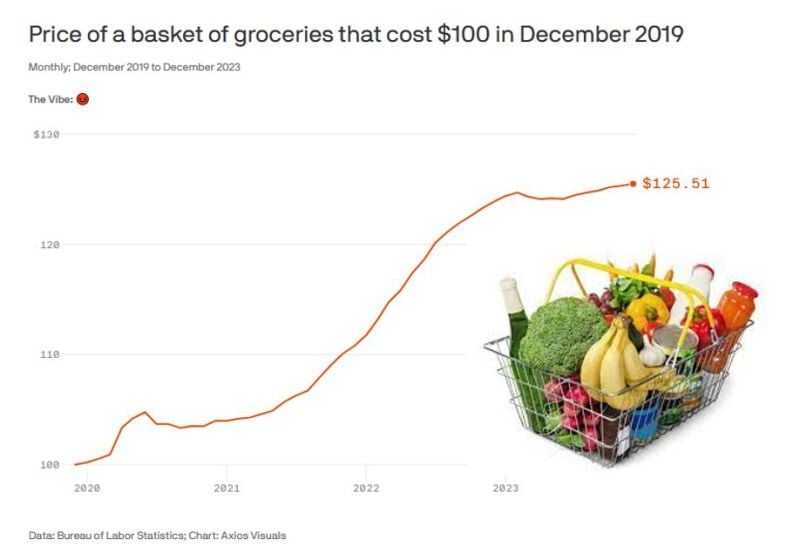

Your grocery bill has increased more than 25% over the last 4 years!

Source: barchart

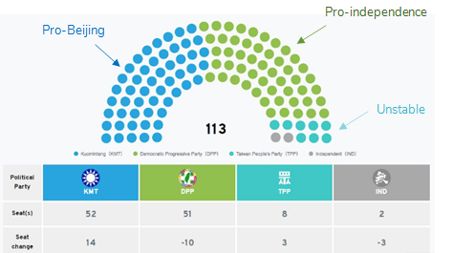

Some new developments in Taiwan's presidential & legislative elections.

The DDP’s Lai Ching-te won Taiwan’s 2024 presidential election on Saturday with 40% of the vote, but the ruling party failed to hold onto its parliamentary majority. Pro-Beijing Kuomintang, or KMT, won 52 seats in the legislature — one more than the DPP which lost 10 seats in Taiwan’s parliament from its previous 61, giving up its majority. Lai Ching-te will face a split parliament that will likely moderate his policy agenda, with Taiwan People’s Party (TPP) seen as the king maker with eight seats since neither of the two major parties won an outright majority in the 113-seat Legislative Yuan. What’s next? The split legislature) will mean the Lai administration will struggle to pass much of his agenda unless either coordinating with the TPP or just focusing on the few areas where there may be broader consensus. The outcome could see President Lai embracing a more restrained China policy — particularly since KMT and TPP have advocated a more conciliatory posture — even as Beijing is likely to ramp up pressure on Taiwan’s government when Lai is officially inaugurated as president in May. The new parliament will take office next month. Beijing will pay particular attention to signals from Lai’s inauguration speech. Apart from military exercises, Beijing may also impose new tariffs or sanction Taiwanese companies that are political donors to the DPP. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks