Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

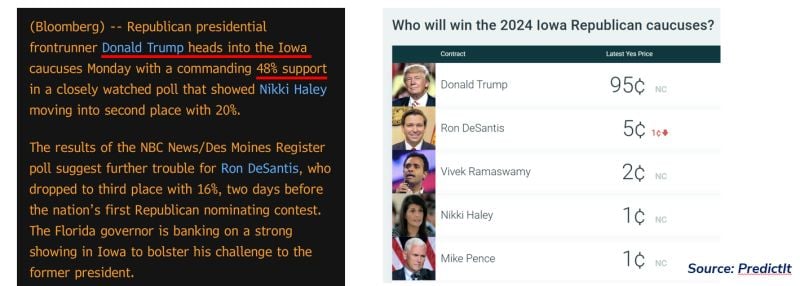

US 2024 Presidential race: Trump heads into Iowa caucuses

The Iowa caucus on January 15 launches the long designation process of the Republican and Democrat candidates to the US presidential election. On that day, only Republicans will vote (Democrats will hold their own later in 2024). While Iowa is a small state, and not very representative of the country’s population (90% of Iowa’s population is white), it is seen as very important for candidates to gather positive momentum for the remaining of the campaign and the following state caucus and primaries. In the current context, the Iowa caucus may already provide a hint on whether any challenger to Trump within the Republican party has the potential to compete with the former President, or not. Source: Bloomberg, PredictIt

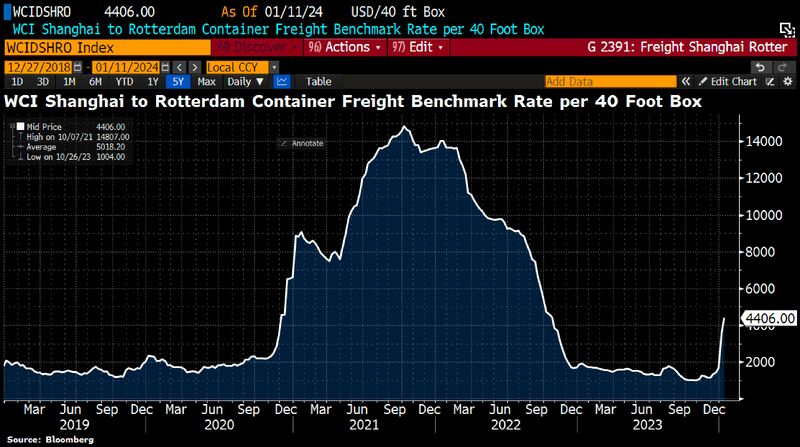

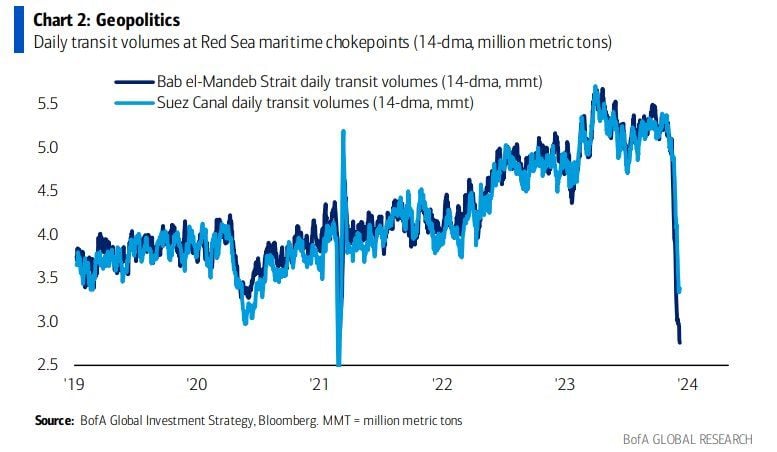

The Red Sea's inflation threat:

The disruptions in the Red Sea have roiled global supply chains and pushed up freight costs. The Houthis have pledged a “big” response to airstrikes. Iran wins either way w/US airstrikes on Houthis in Yemen. Source: HolgerZ, Bloomberg

Key takeaways from Taiwan's President election;

1) Re-elected President Lai Ching-te (DPP party) favors closer ties with the US and an expected status quo regarding the situation of Taiwan and the existing relationships. We don’t expect any significant change in Taiwan’s policies 2) We note that US President Biden statement post-election has been very balanced (Official congratulations to Lai-Ching Te but no support to Taiwan independence vote) Source: Bloomberg

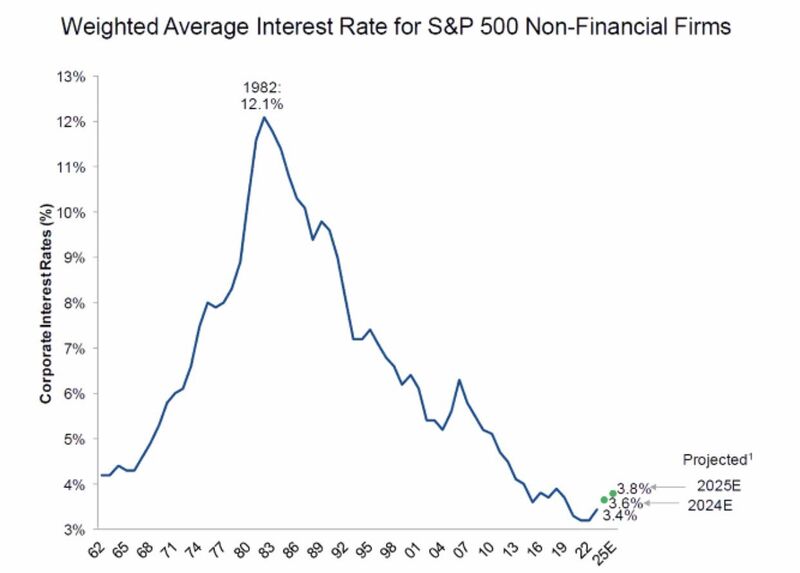

Weighted Average interestrate for sp500 non-financial firms is expected to pick-up in 2024e and 2025e but remains quite low by historical standard.

Source: Michel A.Arouet

Is this the reason why the Fed might be forced to cut rates in March?

We could have: 1. Reverse repo ends (see chart below) 2. BTFP expires 3. Fed cuts (allegedly) 4. QT ends (allegedly) I.e 3 and 4 could counter-balance 1 and 2

Investing with intelligence

Our latest research, commentary and market outlooks