Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

HAVE YOU EVER HEARD ABOUT DE-EUROIZATION ?

Based on SWIFT international payments, we are witnessing 'de-euroization' and not 'dedollarization. The euro's share in SWIFT global payments has dropped to 23% from 38% at the start of the year. Are Russia's SPFS and China's CIPS eating up the euro? Meanwhile, China's share in SWIFT payments reached an all-time high of 3.47% in August. Source: HolgerZ, Bloomberg

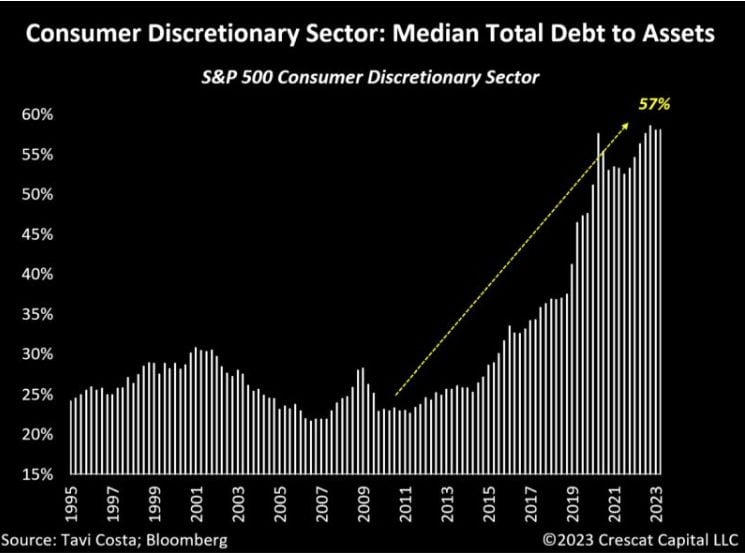

Consumer balance sheets are getting stretched

Accumulating debt during a low interest rates environment is one thing. But in light of the continuous surge of the price of money, the US consumer is probably starting to feel the pain Source: Crescat Capital, Bloomberg

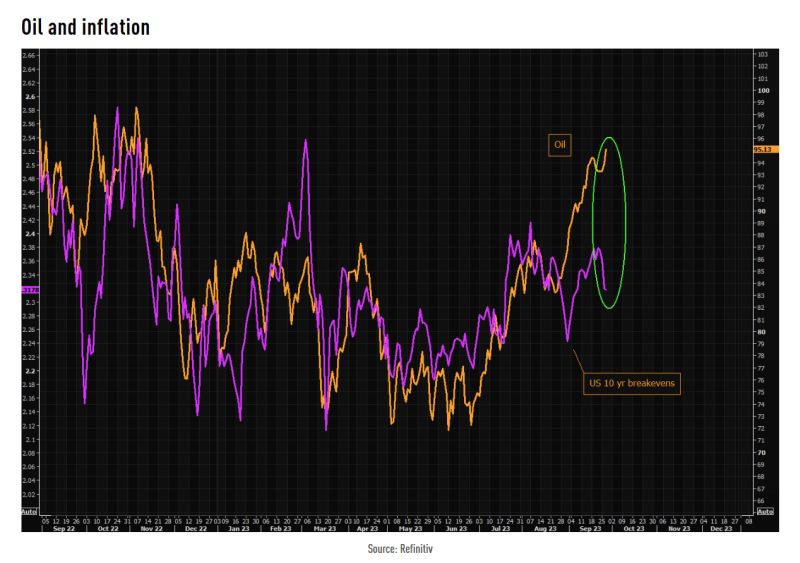

The gap between oil and 10 year breakevens is huge...

Does it mean that the market sees higher oil prices as a "growth killer" and thus disinflationary at some stage? Source chart: TME, Refinitiv

GS Financial conditions index is tightening significantly, now at the tightest since November 2022...

This is probably what the FED wants to see...until something breaks... Source: www.zerohedge.com, Bloomberg

Apollo just said that bonds are now more attractive than equities...

The spread between corporate bond yields and the S&P 500 earnings yield just hit its highest since 2008, at 1.5%. This spread was negative for nearly 13 years before turning positive in mid-2022. Even in 2020 this spread did not turn positive amidst the global lockdowns. Source: The Kobeissi Letter, Apollo

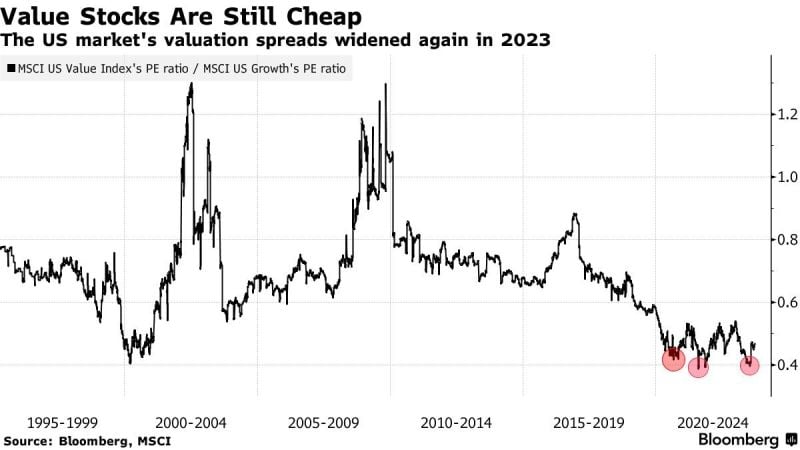

Value Stocks are trading near the cheapest levels of the past 30 years

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks