Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

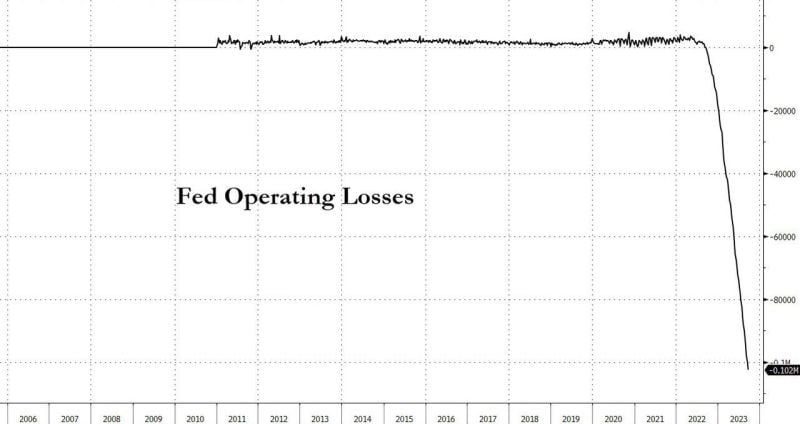

For The First Time In 13 Years, The Fed Is Cutting Workers As It Books $100 Billion In Losses

The FED has booked $100 billion in losses in recent months on operations that currently involve paying more in interest to banks on reserve deposits at the Fed than the central bank earns from its roughly $7.5 trillion portfolio of bonds and mortgage-backed securities. Source: www.zerohedge.com, Bloomberg

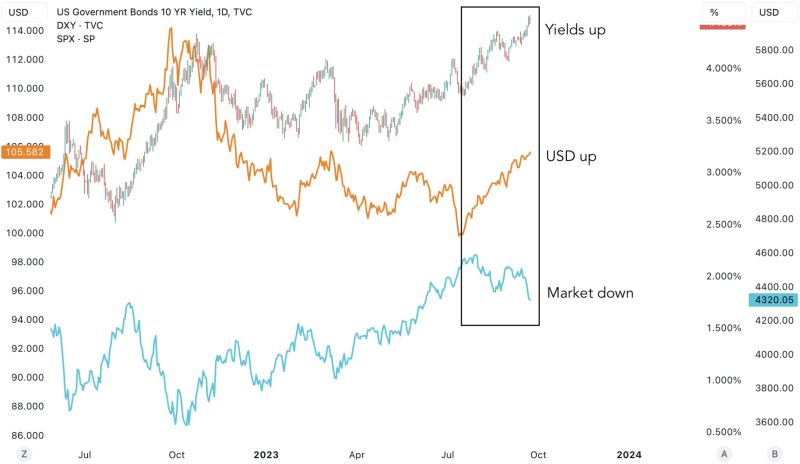

The S&P 500 is now down 340 points, or 7.5%, since the Fed removed a recession from their forecast

On July 26th, the Fed raised rates and said they were not longer expecting a recession. The Fed marked the EXACT high in the S&P 500 which just hit its lowest levels since June. Since then, rate cut expectations were pushed out by a year and corporate bankruptcies hit their highest levels since the pandemic. Is the market losing faith in the Fed again? Source: The Kobeissi Letter

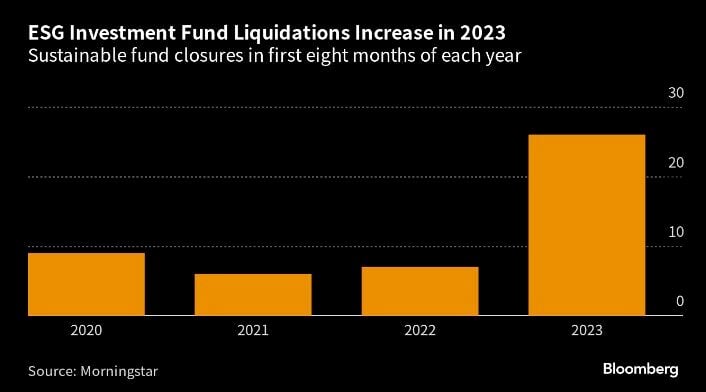

What’s the BIG SHORT right now? ESG Stocks.

Hedge funds are calling out fake green claims and overblown valuations boosted by stimulus. Blackrock & State Street are shutting down some ESG funds. Liquidation of ESG funds in 2023 is already larger than the last 3 years combined, And the year is not over.... Source: Genevieve Roch-Decter, CFA, Bloomberg

Markets summarized in one chart: Yields up, USD up and Equities down

Source: Game of Trades

A $90 BILLION VALUATION FOR OPENAI?

OpenAI is in discussions to possibly sell shares in a move that would boost the company’s valuation from $29 billion to somewhere between $80 billion and $90 billion, according to a Wall Street Journal report citing people familiar with the talks. Employees would be allowed to sell their existing shares rather than the company issuing new ones, the Wall Street Journal said. In April, OpenAI picked up just over $300 million in funding from backers such as Sequoia Capital, Andreessen Horowitz, Thrive and K2 Global at a valuation of $29 billion. That was separate to a big investment from Microsoft announced earlier this year, which closed in January. The size of Microsoft’s investment was believed to be around $10 billion. Source: Techcrunch

Yes, the S&P 500 chart ($SPX) "looks" terrible (Head & Shoulders, trading below 50d and 100d MA, etc.) but it also looked ugly during September 2021 and had a last leg up in the 4 months that followed

Source: Nautilus Research

Wealth by wealth category, average wealth per US household, in Q2, 2023 (wealth = assets minus debts)

The top 50% (= 65 million households) are between fairly well off to immensely rich. Source: www.wolfstreet.com

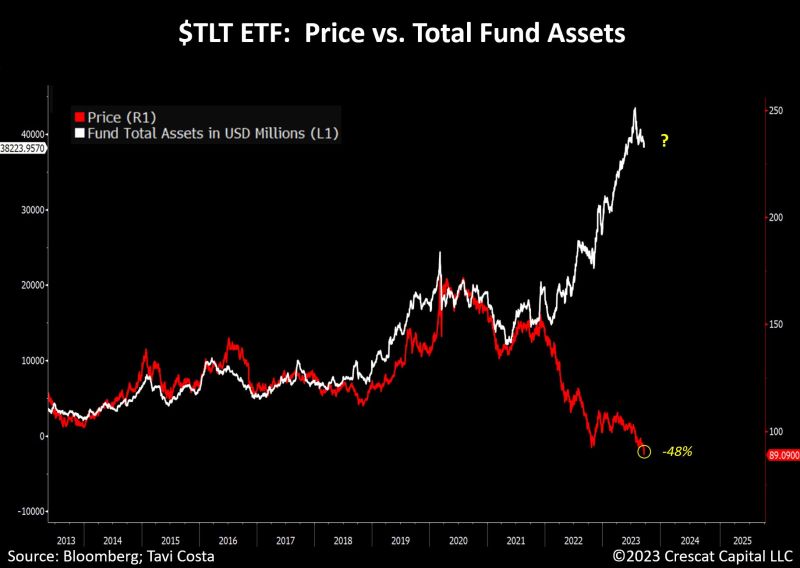

Bond tracking ETF, $TLT, just closed at its lowest level since February 2011

The ETF is now officially down 50% from its high just 3 years ago in 2020. Yet, investors continue to desperately pour money into Treasuries despite the massive underperformance. Indeed, despite the rise in bond yields, investors keep piling into $TLT (iShares US Treasuries 20year+) etf. Another $750m last week as 60/40 portfolios are stubbornly allocating funds to this underperforming asset, hoping for a return to a disinflationary environment. As mentioned by Eric Balchunas / Bloomberg, it is quite rare seeing an ETF taking in so much money ($16b YTD, #2 overall) while being down so much and so consistently (especially when you can get just as much yield with no duration risk...). Such a behaviour happened with the China Internet ETF $KWEB... not a great omen... Source: Bloomberg, Eric Balchunas, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks