Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

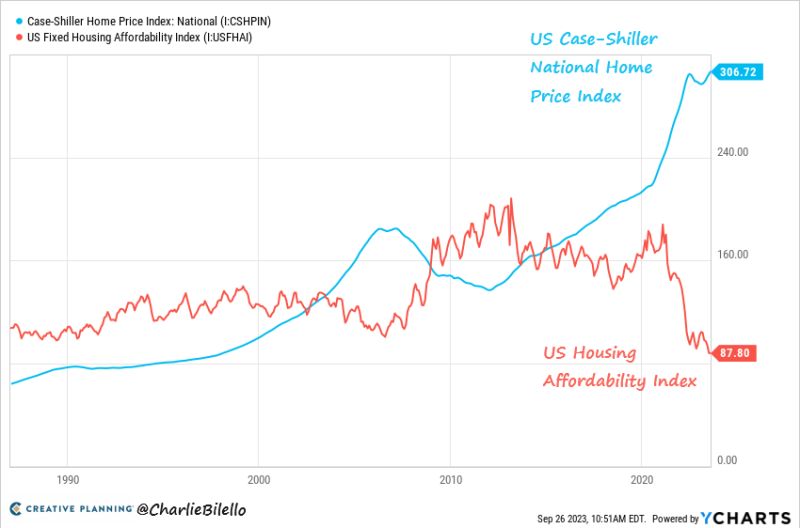

US Home Prices hit a new all-time high in July while affordability has plummeted to record lows

Source: Charlie Bilello

World trade volumes fell at their fastest annual pace for almost three years in July

Closely watched figures signal rising interest rates are beginning to impact global demand for goods. Trade volumes were down 3.2 per cent in July compared with the same month last year, the steepest drop since the early months of the coronavirus pandemic in August 2020. The latest World Trade Monitor figure, published by the Netherlands Bureau for Economic Policy Analysis, or CPB, followed a 2.4 per cent contraction in June and added to evidence that global growth was slowing. After booming during the pandemic, demand for global goods exports has weakened on the back of higher inflation, bumper rate rises by the world’s central banks in 2022, and more spending on domestic services as economies reopened following lockdowns. The about-turn in export volumes was broad based, with most of the world reporting falling trade volumes in July. China, the world’s largest goods exporter, posted a 1.5 per cent annual fall, the eurozone a 2.5 per cent contraction, and the US a 0.6 per cent decrease. Source: FT

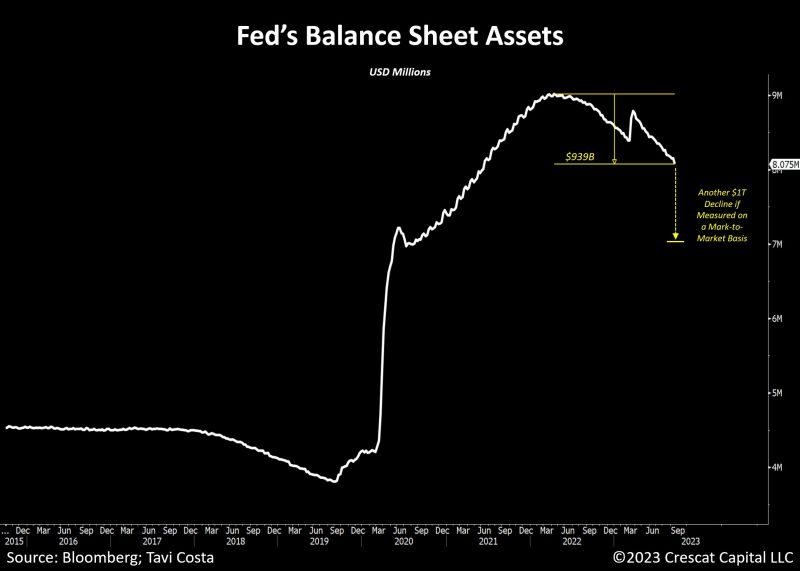

Treasury notes, bonds, and mortgage-back securities account for over 80% of the Federal Reserve's balance sheet

Last week, the Fed's balance sheet plunged by almost $75BN last week, its biggest weekly drop since July 2020. The Fed's balance sheet is now over 10% below its April 2022 peak. But this is WITHOUT taking into account the current drop in value of the bonds held on the balance sheet. Indeed, if they were to be re-evaluated using a mark-to-market methodology, the Fed's assets could be reduced by another $1 trillion. To provide some context, he recent decline in market value would likely exceed the entirety of their QT policy thus far, which accounted for $939B. This would essentially revert their balance sheet size back to 2020 levels. Source: Bloomberg, Tavi Costa

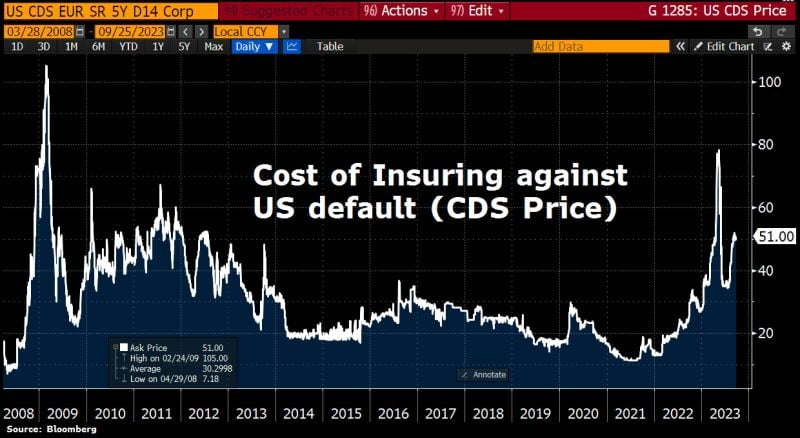

A government shutdown would reflect negatively on America’s credit rating, says Moody’s, the only remaining major credit grader to assign the US a top AAA rating

“While government debt service payments would not be impacted & a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years,” analysts led by William Foster wrote in a report Monday. Source: Bloomberg

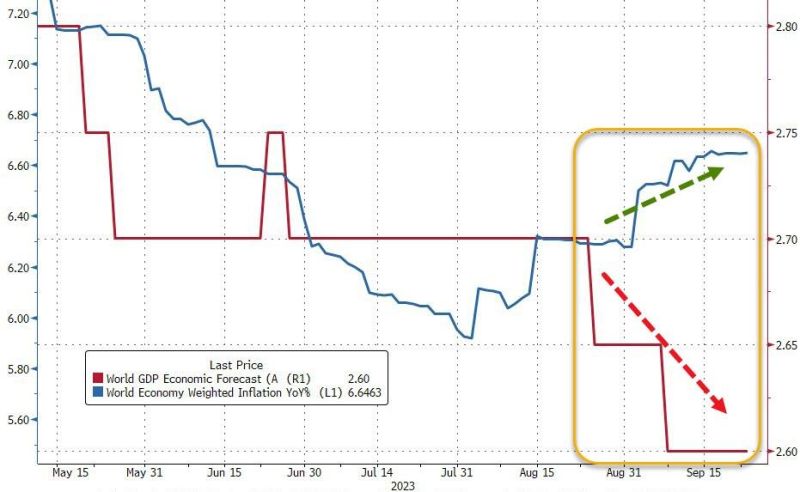

This chart explains by itself why the market mood has been deteriorating over the last few weeks:

Growth forecasts moving down / world inflation going up. What else? Source: www.zerohedge.com, Bloomberg

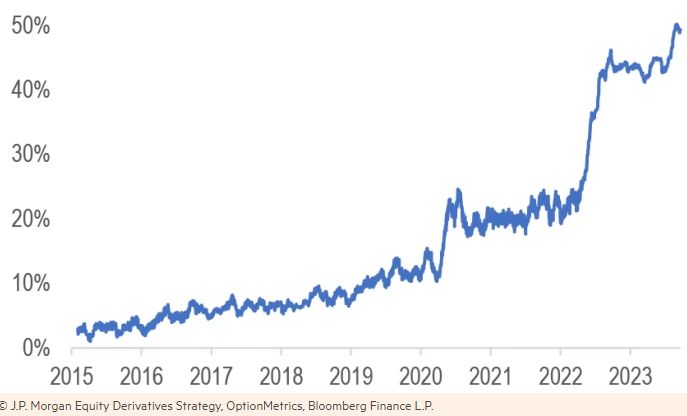

Zero Day Options (0DTE) now account for half of total SP500 options volume

Source: Barchart

$AMZN Amazon to invest up to $4B in AI startup Anthropic

💰 Largest investment ever for AWS. 🔎 Google previously invested $300M. 🤖 Anthropic's Claude LLM-based chatbots rivals OpenAI's ChatGPT. The generativeAI battle is heating up. Source: App Economy Insights

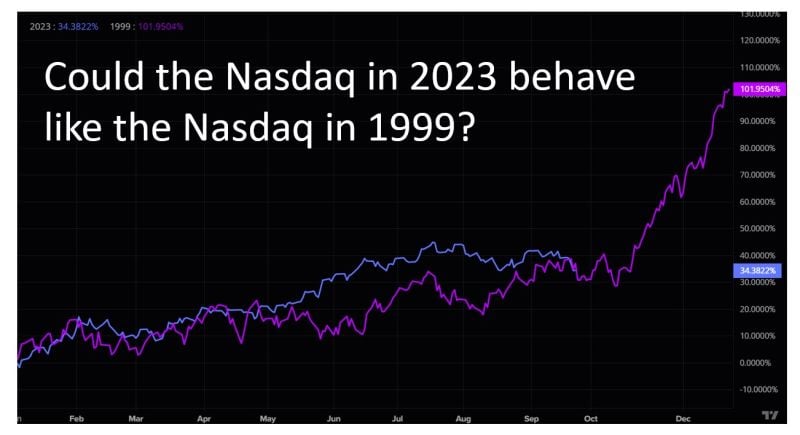

NASDAQ's 1999 analogy chart isn't perfect but given the amount of shorting by hedge funds and short gamma selling by dealers, a squeeze in Q4 (the historically strongest quarter) is a possibility

Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks