Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

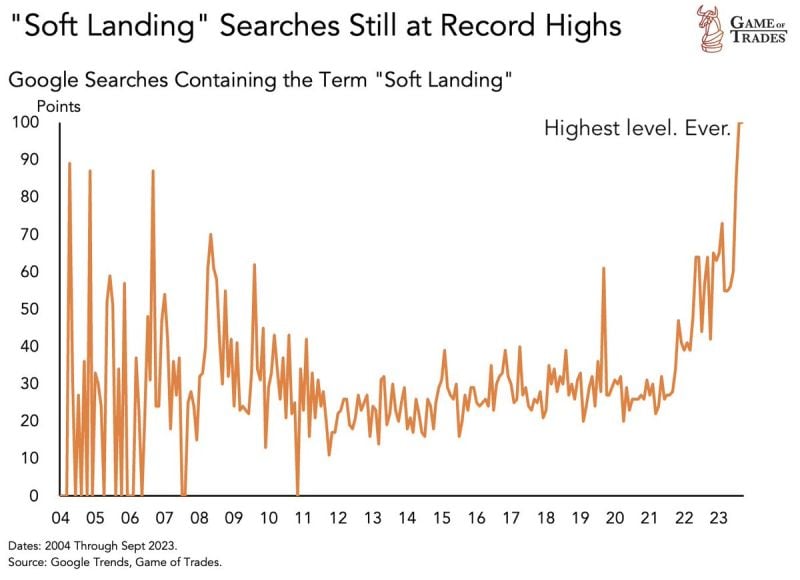

“Soft Landing” is still the consensus. But consensus doesn’t have a good track record...

Source: Game of Tardes

US 10-year Treasury yield is skyrocketing and now at 4.63%, its highest since June 2007

Since last week’s Fed meeting, the 10-year note yield is up 35 basis points. Since the last Fed rate hike in July, the 10-year note yield is up 60 basis points. Meanwhile, Fed rate HIKE expectations have NOT changed. As highlighted by the Kobeissi Letter, odds of another rate hike have actually gone DOWN. But, a long Fed PAUSE is being priced-in now. All as record levels of US Treasuries are being issued while FED balance sheet reduction pace has been accelerating (QT). This bear steepening is pushing the dollar UP and weighing on stocks valuations especially long duration ones, i.e tech darlings. Source. CNBC, The Kobeissi Letter

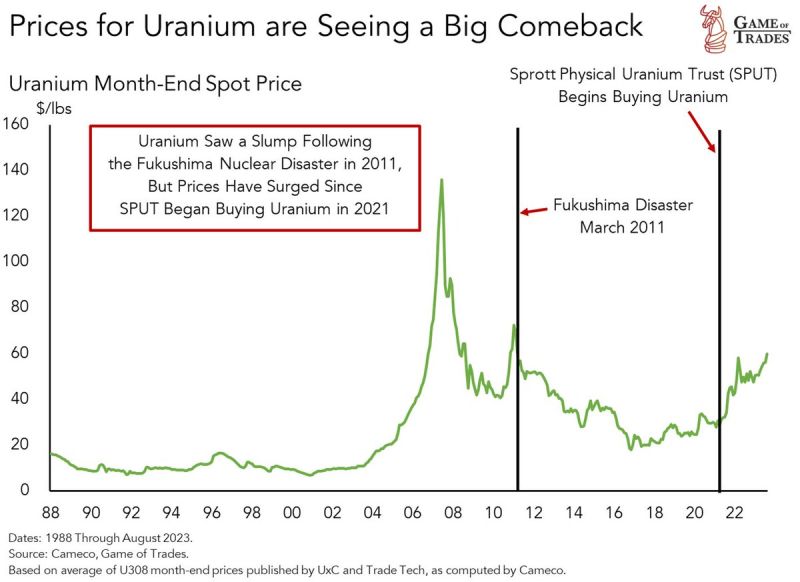

Uranium is back

The massive deficit + price insensitivity should be a solid tailwind Source: Game of trades

Sentiment among consumers in Germany keeps deteriorating as persistently high inflation encourages people to save & blots out chances of a recovery before year-end

GfK German Consumer Sentiment Index drops to -26.5 in Oct from -25.6 in Sep. An indicator BELOW 0 signals YoY contraction in private consumption. Source: HolgerZ, Bloomberg

This chart by Goldman shows the regime change which has been in place over the last few weeks

Despite the rise in 30-year real yields, short duration stocks (i.e value and the likes) were underperforming long duration ones (i.e IT/growth stocks). Things are now normalizing as short duration stocks are progressively catching up in terms of relative performance. The growth/IT basket probably needs 30-year real yield to reverse trend in order to outperform again...

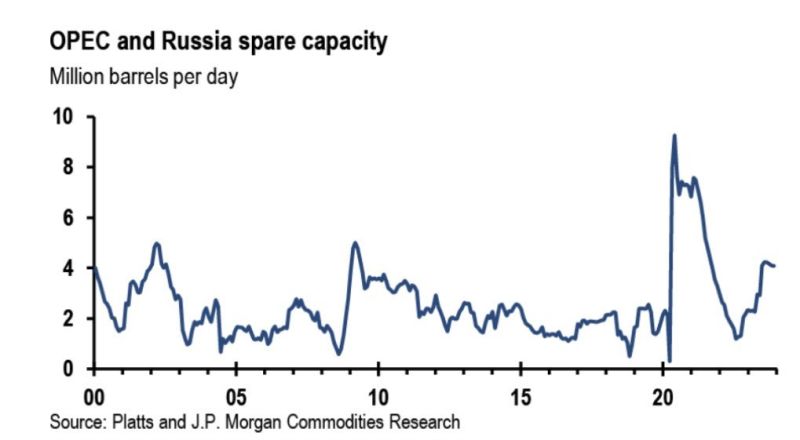

Oil is up 30% this quarter but is there more to come?

As tweeted by The Kobeissi Letter, Russia and 3OPEC are now cutting a massive 4 million barrels per day of crude oil production. This is the highest level of production cuts outside of recessions over the last two decades. As Saudi Arabia and Russia extend production cuts of 1.3 million barrels per day, supply is going to remain limited for a while. OPEC has proven multiple times over the last three years that they are committed to higher oil prices. Source: The Kobeissi Letter, JP Morgan

A tale of two type of investors...

who will be right? Hedge Funds continue to short treasuries at historic levels while asset managers are building their largest long positions ever recorded! Source: FT, Barchart

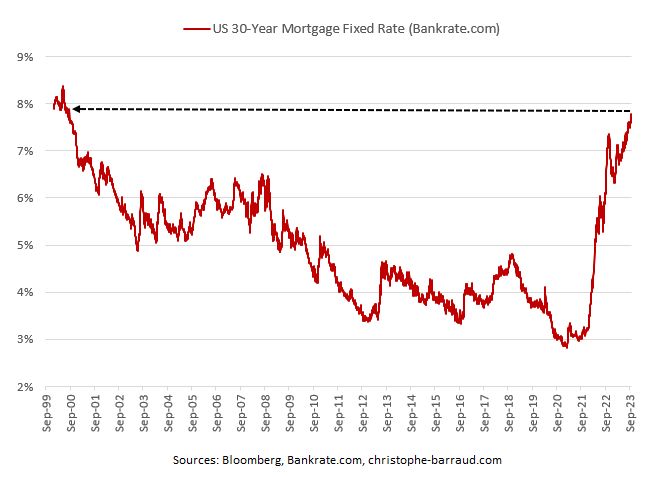

Housing | According to Bankrate.com‘s data, US 30-Year fixed-rate mortgage reached 7.78%, the highest rate since August 2000

*This situation is expected to have a significant effect on closed sales from September to November. Source: C.Barraud

Investing with intelligence

Our latest research, commentary and market outlooks