Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

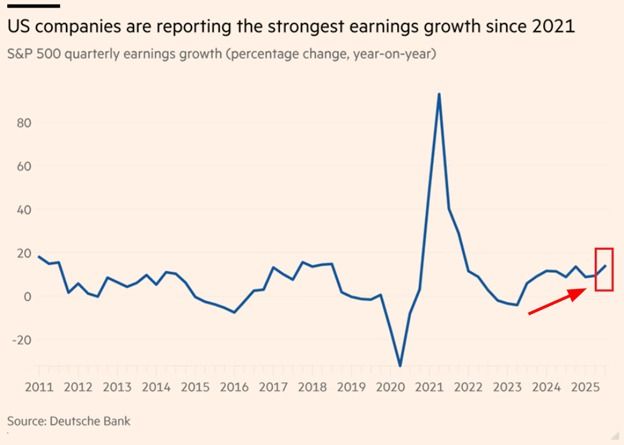

US corporate earnings growth is booming:

S&P 500 quarterly earnings growth is up to +18% YoY in Q3 2025, the highest since Q3 2021. Excluding the post-pandemic recovery, this marks the strongest growth since 2018. This comes as 6 of the 11 S&P 500 sectors reported positive average EPS growth in Q3, a material improvement from just 2 sectors in Q2. Additionally, median profit growth in the Russell 3000 index hit +11% YoY, the highest since Q3 2021 and up from +6% in Q2. Overall, the frequency of earnings beats is now among the highest on record. Earnings momentum is incredibly strong. Source: FT, Global Markets Investor

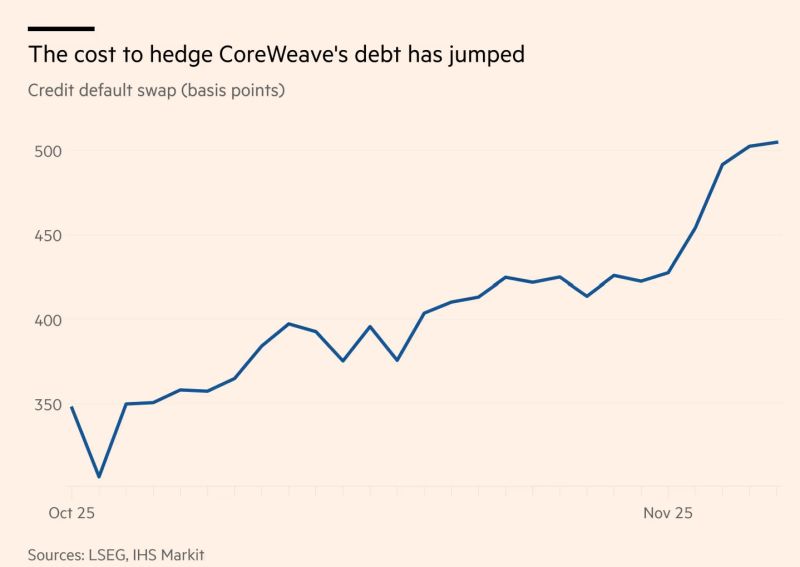

Data centre operator CoreWeave’s stock has fallen more than 20 per cent over the past two weeks, alongside the drop in bigger names.

On Tuesday, the company’s shares were down a further 16 per cent after it lowered its forecast for annual revenue as a result of expected data centre delays. The cost to protect against a default on CoreWeave’s debt has jumped as the equity price has fallen, with the group’s five-year credit default swaps trading at 505 basis points, from below 350bp at the start of October, according to LSEG data. Source: FT

Germany creates a substantial infrastructure package and then allocate 50% of it to other purposes.

At least, that's what a study finds. Source: FT

*SOFTBANK SHARES FELL AS MUCH AS 10% (before recovering somewhat to close at -3.5%)

Maybe liquidating NVDA to invest in its biggest cash-incinerating client wasn't the best idea... Source. zerohedge

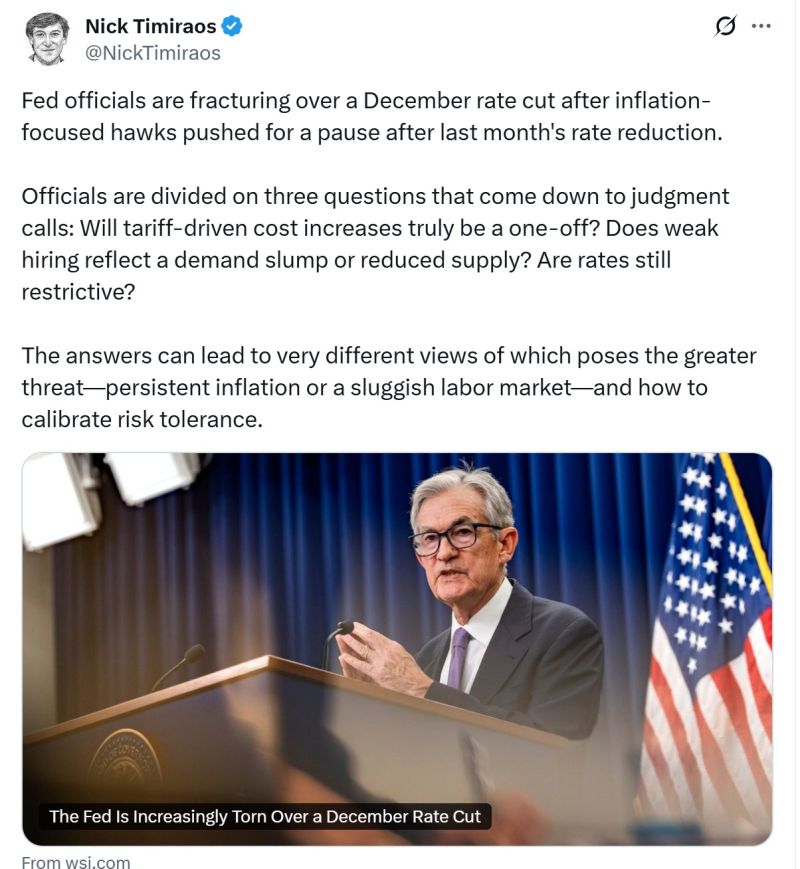

Odds of a rate cut at Fed December meeting have increased again (70%+) but Fed officials remain divided on three questions that come down to judgment calls:

1. Will tariff-driven cost increases truly be a one-off? 2. Does weak hiring reflect a demand slump or reduced supply? 3. Are rates still restrictive?

🌍 The IEA just dropped a bombshell:

If the world stays on its current path, oil and gas demand will keep rising for the next 25 years. That’s right — no peak this decade, no major drop in CO₂ emissions, and likely no chance of keeping global warming below 1.5°C. 🔥 2024 was the hottest year on record. Yet the International Energy Agency says “climate change is rapidly declining on the global energy agenda.” Why? Governments are prioritizing energy security and affordability over climate goals. Growth of electric vehicles is slowing. Demand for energy from AI, air conditioners, and manufacturing is exploding. 📈 Under the IEA’s new “Current Policies” scenario: Oil demand grows from 100M → 113M barrels/day by 2050 EV adoption plateaus around 40% by 2035 Gas demand continues to climb Coal finally peaks — but still lingers 💡 Even so, renewables will shoulder most of the new electricity demand — especially in India, SE Asia, Latin America, and Africa. ⚠️ Translation: The clean energy revolution is real… …but fossil fuels aren’t going anywhere unless policies change fast. Source: FT

The index is derived from state-level employment, wage, and unemployment data, capturing how many U.S. states experience significant labour-market deterioration at any given time.

About $1.5T may come from investment-grade bonds, plus $150B from leveraged finance and up to $40B a year in data-center securitizations. Even then, there’s still roughly a $1.4T funding gap likely filled by private credit and governments. Source: Wall St Engine

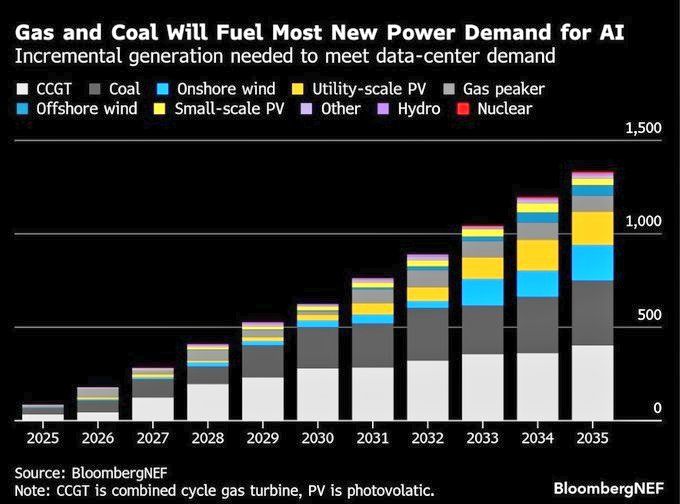

And the winner of the power demand is .... Coal !

Source: Bloomberg, @AzizSapphire

Investing with intelligence

Our latest research, commentary and market outlooks