Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

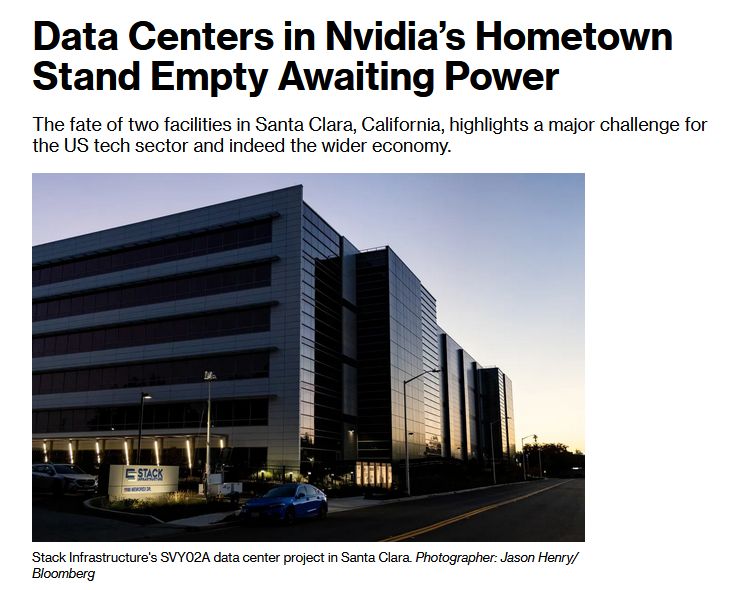

You can't print energy...

zerohedge: "The money is not the problem: AI is the new global arms race, and Capex will eventually be funded by governments (US and China). If you want to know why gold/silver/bitcoin is soaring, it's the "debasement" to fund the AI arms race. But you can't print energy".

UK house prices rose at the fastest rate last month since January.

Source: Financial Times

US companies announced 153k job cuts in October, a 175% increase from a year ago.

This was the highest number of layoffs for any October in over 20 years and the most for any single month in Q4 since 2008. Source: Charlie Bilello, LSEG

The best performing stocks in the S&P 500 this year...

Source: Charlie Bilello

Germany, continues to lose ground on global stock markets.

The market value of German equities has dropped to just 2% of total global market capitalisation, as the early-year momentum has completely faded. Source: HolgerZ, Bloomberg

Lot of panic out there, but don't lose faith in November yet.

S&P 500 up 10% YTD heading into November? November higher 13 of the past 14 years. Final two months of the year higher 16 times in a row. Source: Ryan Detrick, CMT @RyanDetrick

Investing with intelligence

Our latest research, commentary and market outlooks