Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

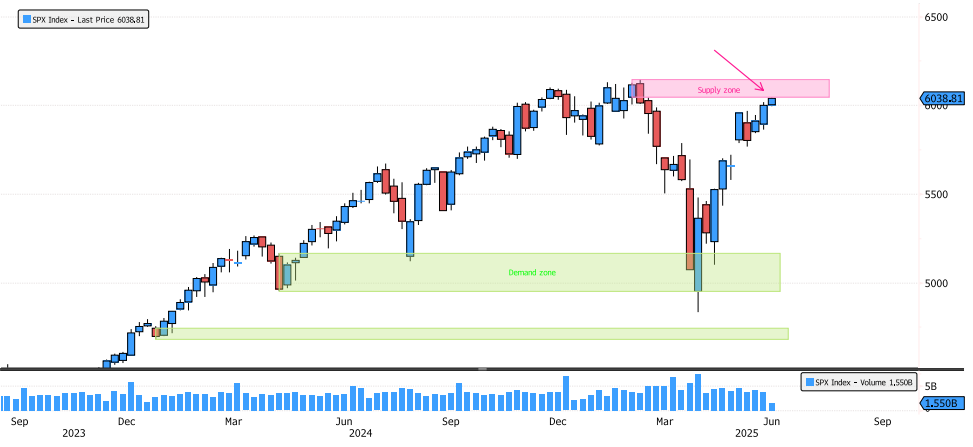

S&P 500 Index Entering Supply Zone

After a stunning 25% rebound in just 1 month, the S&P 500 is now entering the supply zone between 6047-6147. Will it have enough strength to break through this level and post a new high? Source: Bloomberg

Novo Nordisk First Positive Sign in Bear Market

For the first time since June 2024, Novo Nordisk saw a positive close yesterday! While the long-term bearish trend hasn’t reversed yet, we’re seeing positive developments on the daily chart. The weekly chart remains bearish. The end of April rebound from the support zone between 365-380 is encouraging, but we’ll need more price action to confirm these first steps. Source: Bloomberg

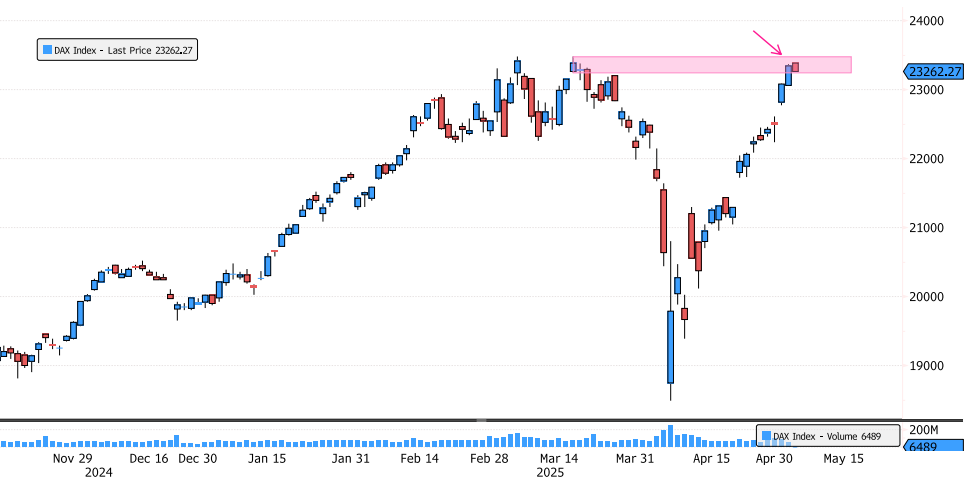

DAX Index Reaching Ultimate Supply Zone

The DAX Index has now rebounded 26% since the lows! Will the market be able to break through the last supply zone between 23,240-23,476? Keep an eye on the price action and support at 23,133. Source: Bloomberg

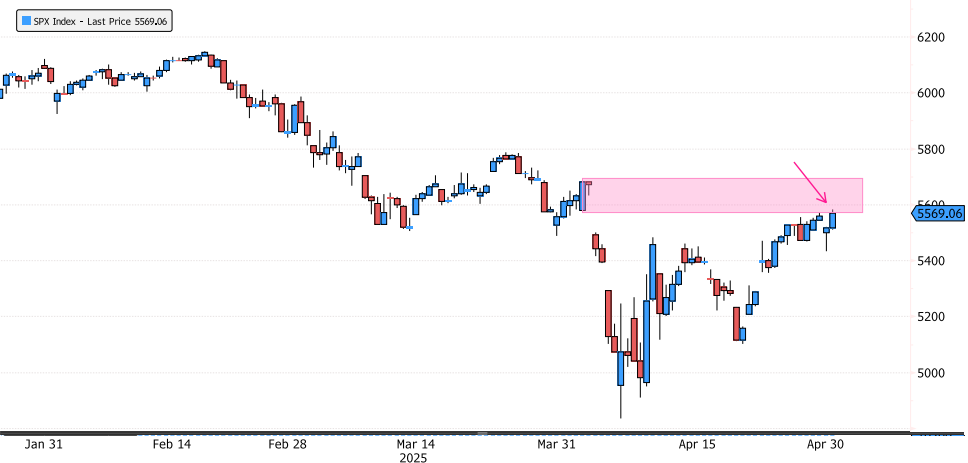

S&P 500 Index Back on 1st Supply Zone

The S&P 500 Index has rallied 17% since the lows and is now back on the 1st important supply zone between 5571-5695. Will it be able to close above 5695? Keep an eye on the price action over the next few days. Source: Bloomberg

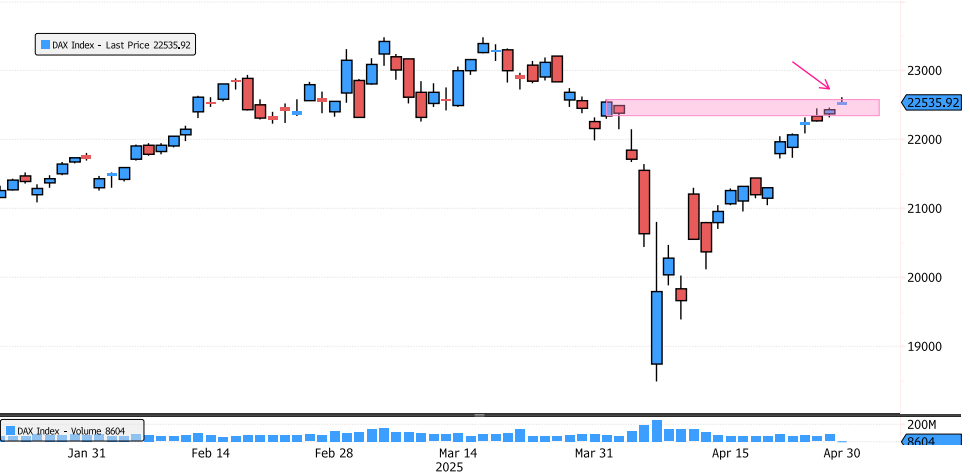

DAX Index Back on 1st Supply Zone

The DAX Index has recovered 22% since the lows in just 17 opening days! It’s now reaching the first supply zone between 22,343-22,573. Will the market be able to close above 22,573? Keep an eye on the price action over the next few days. Source: Bloomberg

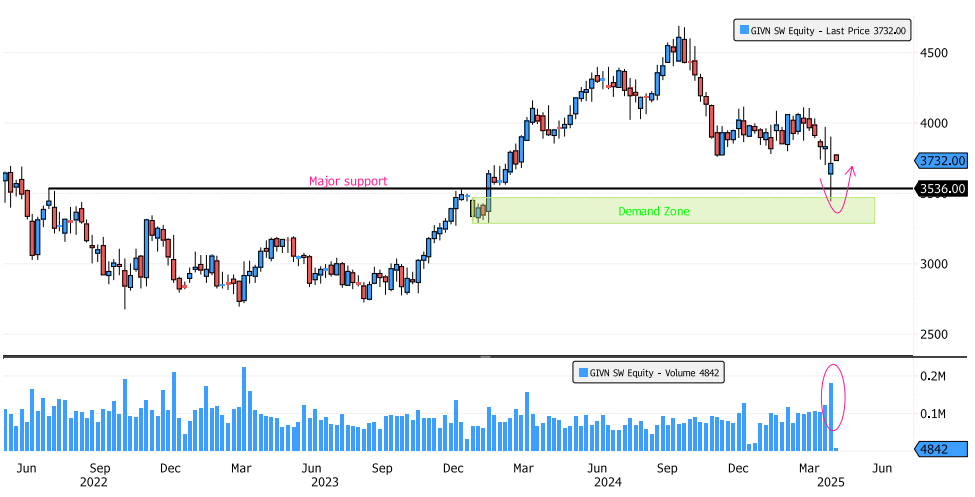

Givaudan Positive Reaction Last Week

Givaudan (GIVN SW) showed a positive reaction last week, rebounding strongly and closing the week above major support at 3536. The stock rebounded sharply from the demand zone between 3287-3468, and has consolidated 26% since the September 2024 high. It’s also at the 61.8% Fibonacci retracement. These technical levels aligning suggest a significant moment for the stock.Source: Bloomberg

Nvidia Entering Major Support Zone

After a 34% consolidation since January, Nvidia is now back on the major swing support zone between 90.69-103.41. Keep an eye on the price action for potential opportunities. Source: Bloomberg

ASML Approaching Major Support Zone

ASML has consolidated 44% since July 2024! For the moment, the trend remains bearish, but the stock is approaching a major support zone between 534-566. Keep an eye on the price action in the next few days for any potential opportunities. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks