Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Booking Holdings rebounding on 50% retracement

The stock has consolidated about 15% since July and reached the imbalance zone between 4,878 and 5,038. This area also corresponds to the 50% Fibonacci retracement from the latest swing (4,096–5,839). A confirmation is still needed to validate that this level will hold — keep an eye on 5,327 for a potential breakout confirmation. Source: Bloomberg

JPMorgan Chase – Positive rebound on swing support

The stock rebounded two days ago on a key swing support zone! Support at 291.44 was tested but managed to hold, with a close above that level. This could mark the end of the consolidation phase and the beginning of a new upward move. Source: Bloomberg

Nestlé – Trend Reversal Confirmed

After a 46% consolidation since January 2022, we finally have confirmation that the trend is reversing. The breakout above 78.27 marks the end of the consolidation phase, establishing 70.42 as the likely low. Interestingly, the stock broke below its 2003 long-term trend in July this year, but has now reclaimed it, confirming that this historical level remains valid. While a pullback could occur following a new high, it’s still too early to define a swing top — momentum is clearly back. Source: Bloomberg

Aryzta reaching first support

Aryzta remains in a bullish long-term trend. Currently in the discount zone (below 50% Fibonacci) and even below 61.8% (last swing 57.72 – 87.60). It’s now trading on the first support zone at 66.40 – 70.48. 👉 A rebound could take shape here, so keep an eye on the price action. That said, we can’t exclude a break lower with a retest of the major support zone 57.72 – 61.60. Source: Bloomberg

Bitcoin consolidation phase, key levels

The last swing 83'479 – 124'514 is now in consolidation phase. 👉 Key levels to watch for a potential rebound: 107'278 → minor support 99'469 → 50% Fibonacci retracement 98'252 → strong support zone Source : Bloomberg

DAX Index nearing key support !

Since the July 10th highs, the DAX has pulled back more than 5%, while the S&P 500 gained around 5% over the same period. The index is now approaching a major support zone at 23,050–23,250. Watch closely in the coming days — price action around these levels could be decisive. Source: Bloomberg

Chocoladefabriken Lindt – Retesting Breakout Level

After a consolidation of more than 16% since the June highs, Lindt has now come back to retest the support zone at 11'090–11'750, which also coincides with the February breakout level. We’re seeing constructive price action on the shorter timeframes, suggesting that this level is attracting buyers and could act as a solid base. Source: Bloomberg

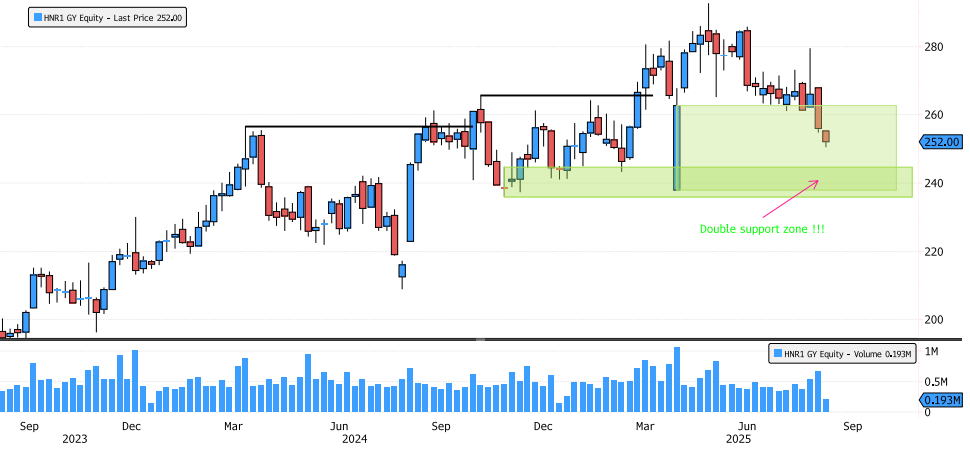

Hannover Rück Approaching Double Support Zone

Hannover Rück has been in a bullish long-term trend since 2012! The last swing has consolidated 15% since the May highs, nearing the 78.6% Fibonacci retracement. The stock is now entering the major weekly swing support zone between 238-262, while also approaching the second major support zone from the January 2024 swing at 236-244. Keep an eye on the price action to confirm the potential end of this consolidation. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks