Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

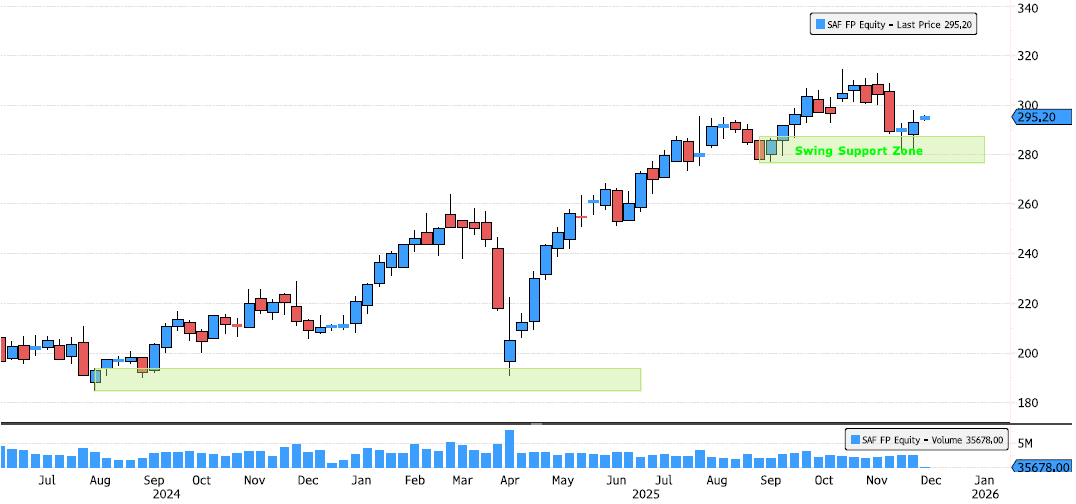

Safran Bouncing Off Swing Support Zone

Safran is showing early signs of strength after a healthy consolidation phase. After a 10%+ pullback since October, the stock is now rebounding off the 276–286 swing support zone. The long-term trend remains firmly bullish, with price action continuing to respect major higher-timeframe supports. Source : Bloomberg

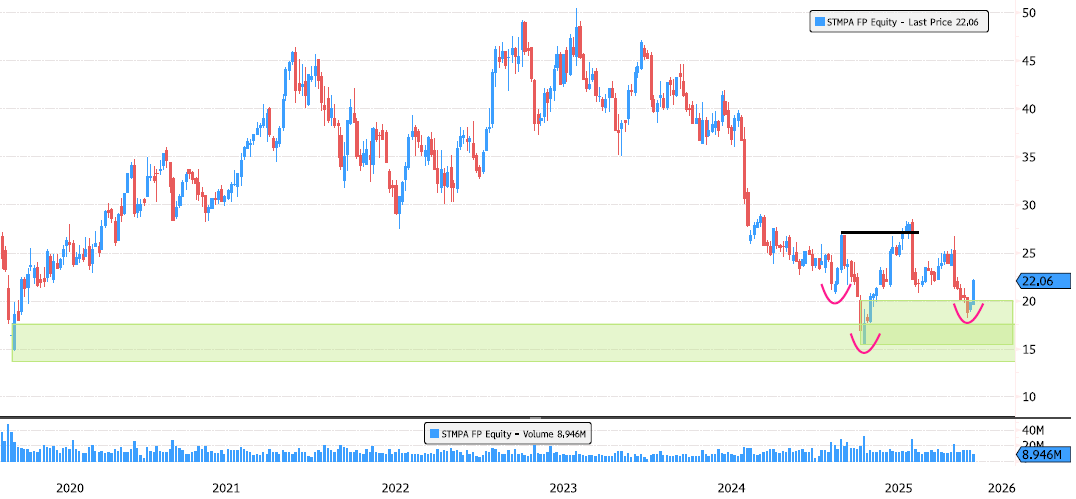

STMicroelectronics : low in place?

After a 69% consolidation from the July 2023 high, STMicroelectronics may finally be showing signs of a structural shift. - April rebound inside the key support zone 13.73–17.55 - Bullish breakout in July, opening the door to a potential trend reversal - Retest of swing support at 15.50–20.07, followed by a higher low formation - Structure improving, but confirmation still needed Keep an eye on volume — it could provide the next confirmation. Source: Bloomberg

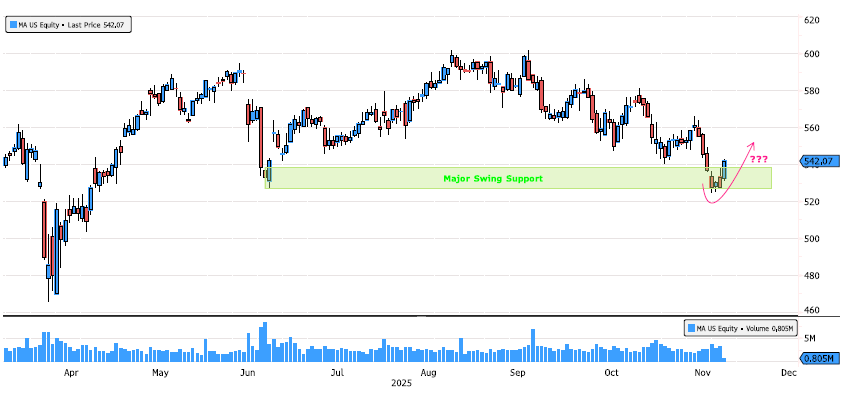

Mastercard rebounding on Swing Support

After a 12% consolidation since the August high, Mastercard is now showing constructive price action on a major swing support zone at 527–538. This area has acted as a strong demand zone in the past — daily and weekly closes will be key to confirm whether buyers are stepping back in with conviction. Source: Bloomberg

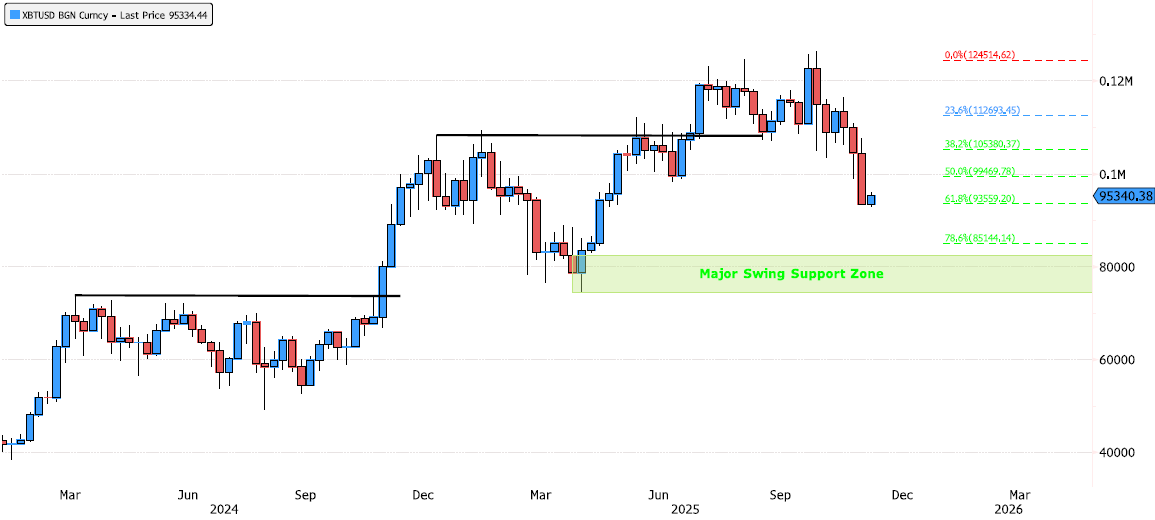

Bitcoin – Next Support Levels

Bitcoin has consolidated 26% since the October highs! Now trading in the discount zone (below the 50% Fibonacci retracement). 👉 Key levels to watch: Imbalance zone: 86'450 – 92'850 Major swing support: 74'424 – 82'531 ⚠️ Critical level that must hold: 74'424 Now it’s all about looking at price action in these key areas. Source: Bloomberg

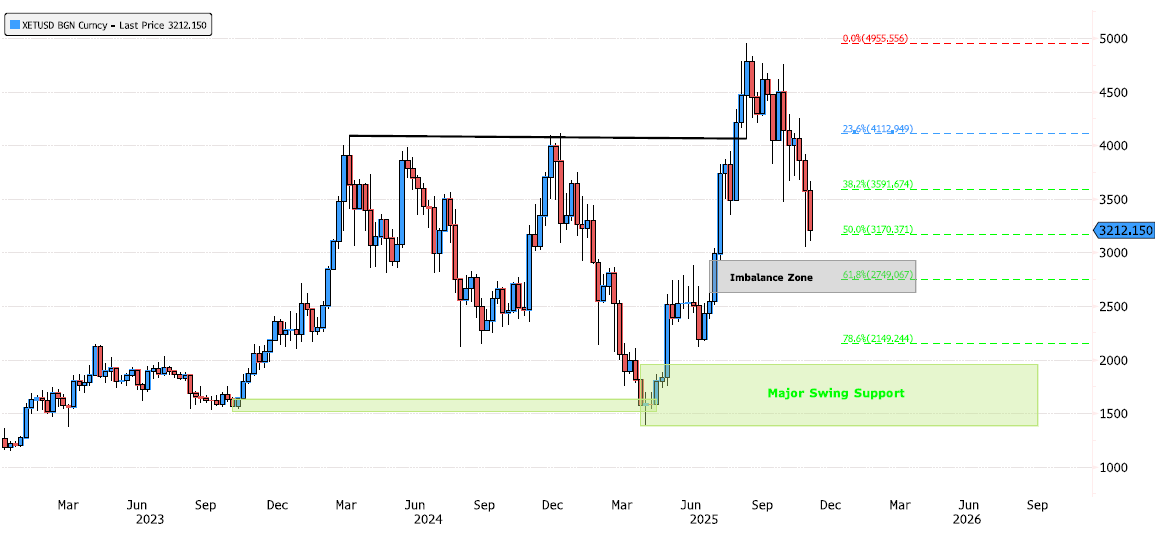

Ethereum – Next Levels to Look At

Ethereum is now down 38% since the August highs! For the moment, there are no clear signs that the consolidation is over. We’ve reached the discount zone (50% Fibonacci retracement), so it’s time to watch how price reacts around key support areas: 3170 → 50% Fibonacci retracement Imbalance zone → 2636–2933 Minor support → 2114 Major swing support zone → 1385–1955 These levels could offer potential reversal setups if buyers step back in. Stay alert for signs of momentum shifting! Source: Bloomberg

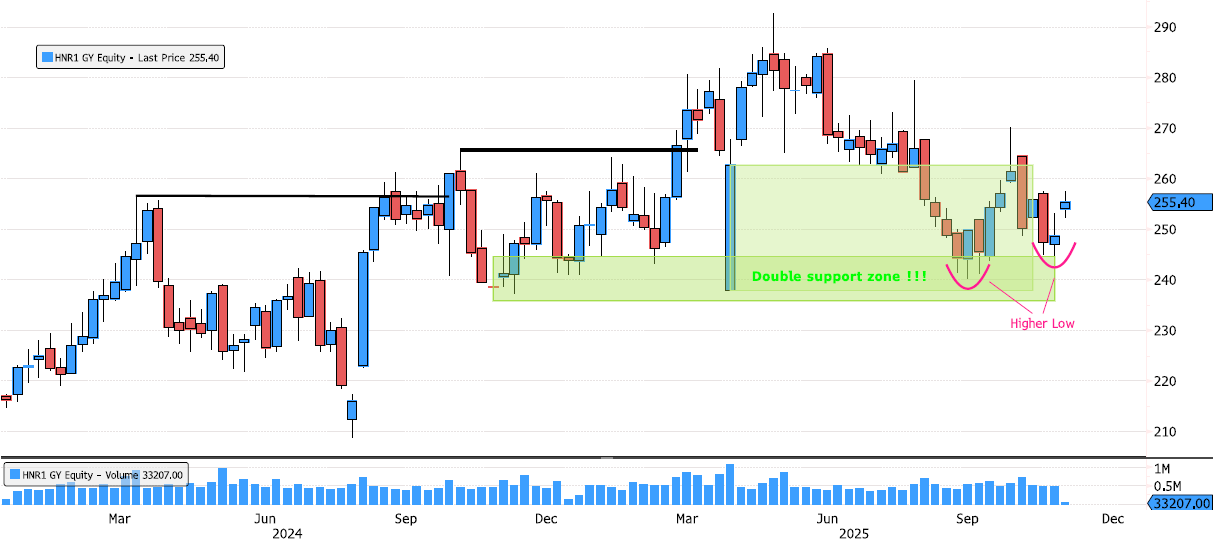

Hannover Rueck – Higher Low Confirmed!

After an 18% consolidation since May, Hannover Rueck seems to be regaining strength. A first low formed in September, followed by a 12% rebound — a sign of buyers stepping back in. Recently, the stock retested the double support zone and confirmed a higher low, strengthening the case for a potential trend reversal and offering what looks like a second opportunity for momentum traders. Source: Bloomberg

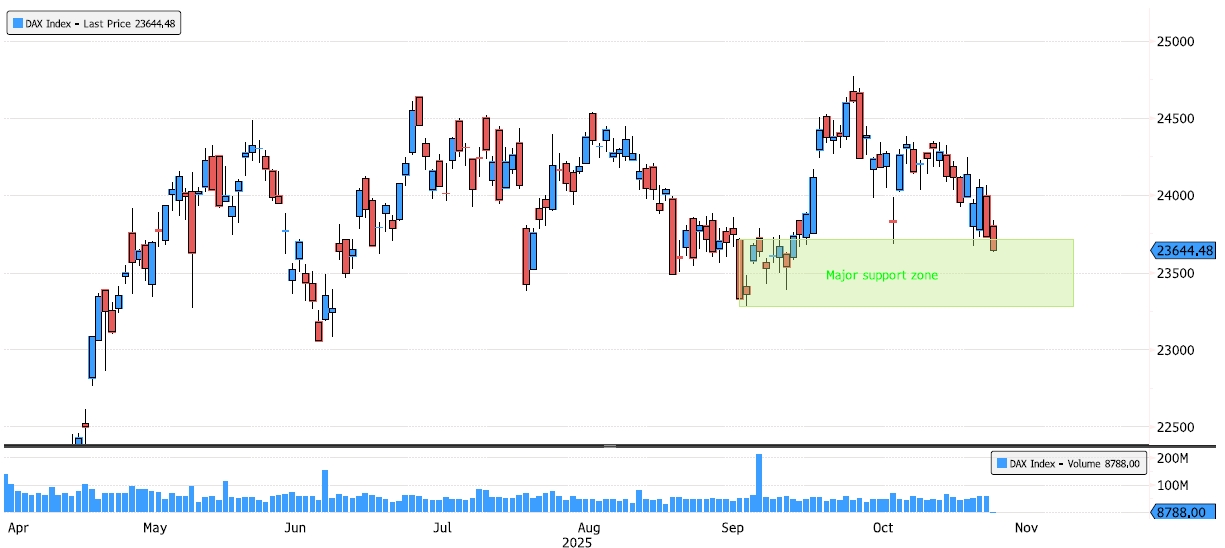

DAX Index reaching major swing support zone!

Nearly 5% consolidation since the October high! A lot of stops have been triggered after breaking below 23,684, providing the fuel for a potential rebound toward new highs. The index is now entering a major swing support zone between 23,284 and 23,712 — keep an eye on price action in the coming days to confirm a possible low. Source: Bloomberg

Givaudan – Trend reversal on short-term time frame

After a 32% consolidation since September 2024, we’re now seeing signs of a short-term trend reversal! This is a very advanced signal that still needs confirmation from breakouts on longer time frames. On the monthly chart, Givaudan has reached an imbalance zone that could act as a strong support area — and we’re about 10% away from the major support zone starting around 2875. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks