Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Salesforce in a Good Spot!

Salesforce (CRM) has been consolidating since December 2024 and is now down 38%. The stock is back in the major swing support zone between 212-273. Last week was particularly interesting, with a break below the April lows creating a liquidity grab and a reversal, forming a Hammer candle. Source: Bloomberg

Berkshire Reaching Major Support Zone

Berkshire Hathaway has consolidated more than 15% since the May highs and is now approaching the major swing support zone between 440-456. Keep an eye on the price action over the next few days for potential developments. Source: Bloomberg

AstraZeneca Trying to Breakout

After several months of rebounding from the major support zone between 9330-9730, AstraZeneca is now showing signs of a potential breakout. Keep an eye on the 11086 resistance for any confirmation of the breakout. Source: Bloomberg

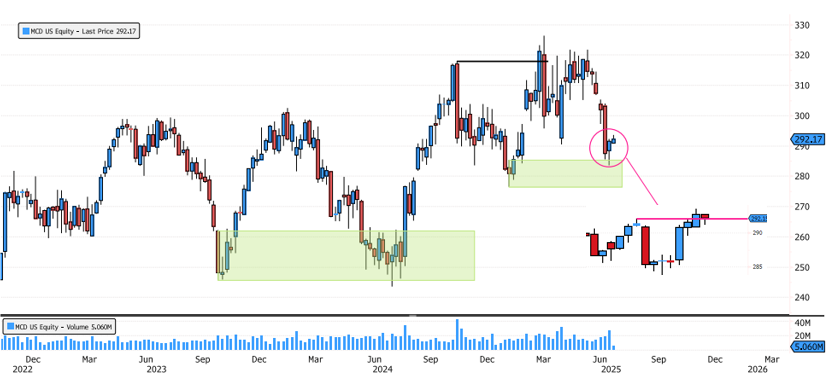

McDonald's Reacting on Major Swing Support

McDonald's (MCD) has consolidated 13% since the highs and is now back on the major swing support zone between 276-286. Yesterday, we saw some positive price action on the 4-hour chart, indicating a potential short-term trend change. Keep an eye on the price action over the next few days for further developments. Source: Bloomberg

BYD Entering Major Support Zone

Since the May high, BYD (1211 HK) has consolidated more than 20%! The stock is now entering a major support zone between 103-123. Additionally, BYD is back at the 61.8% Fibonacci retracement, which places it in the discount zone. Keep an eye on the price action over the next few days for potential developments. Source: Bloomberg

UBS Showing Positive Reaction Above Major Support

UBS has retested the major support zone between 22.54-24.74 for the second time. The last retest in April saw an exaggerated move, with the stock dipping as low as 20.66, but it managed to close within the support zone, confirming its significance. This week, the price action has been positive, with the stock holding steady above support. Keep an eye on the 26.37 level—if the stock closes above this level on Friday, it would be a strong bullish signal. Source: Bloomberg

Chainlink Reacting off Major Support

Chainlink (XLIUSD) is currently rebounding off the major support zone between 8.11-11.06. The last rebound, in April, saw an impressive 78% move! Keep an eye on the 14.17 resistance level for potential further developments. Source: Bloomberg

Crude Oil Double Bottom?

Crude Oil WTI made a massive move today. While the long-term trend remains bearish, we are seeing signs of a short-term trend reversal. The market is back in the long-term range between 62-94. The key level to watch is 72.28 resistance. A close above this level would not only confirm the trend reversal but also validate the Double Bottom pattern. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks