Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

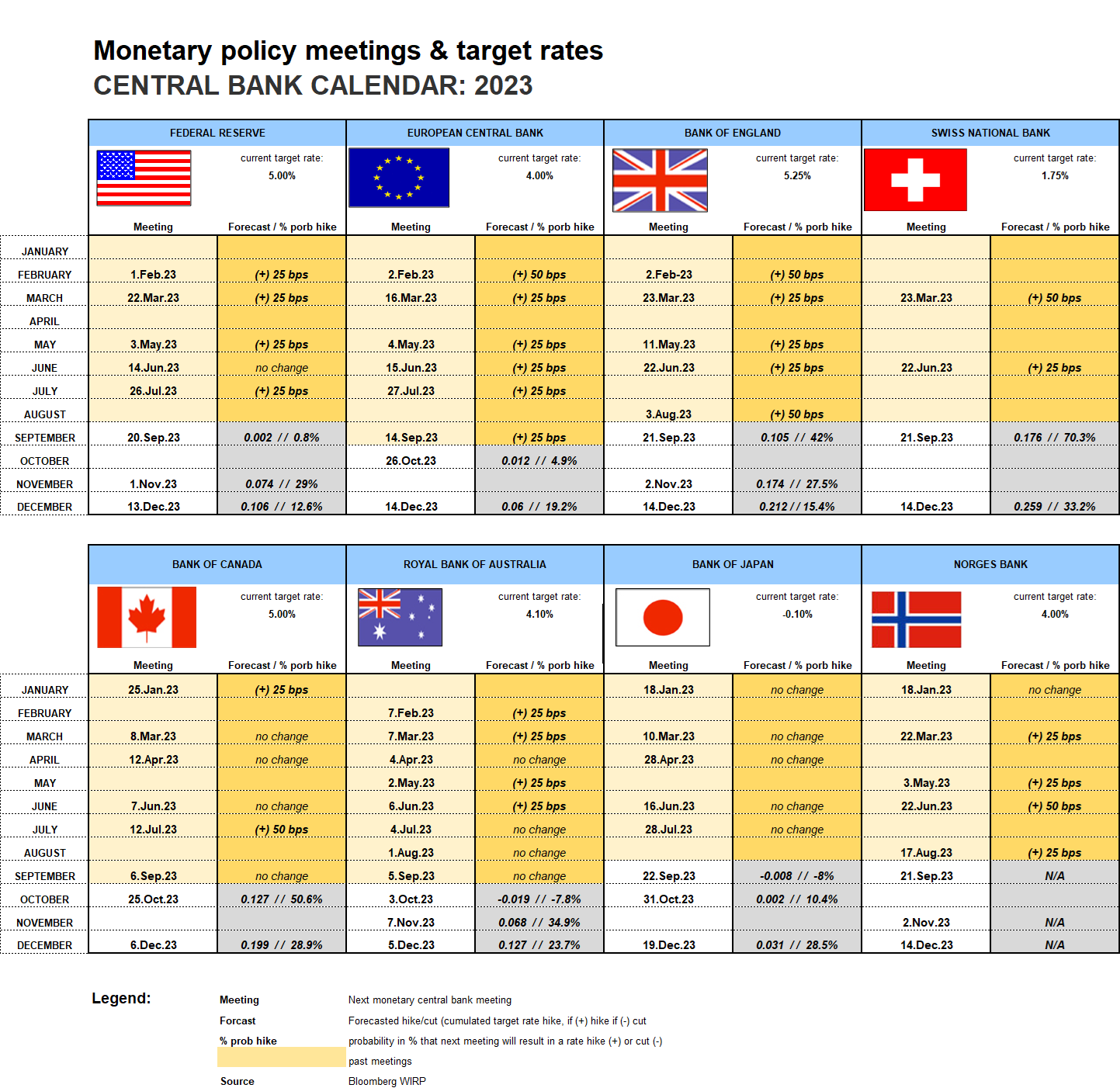

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

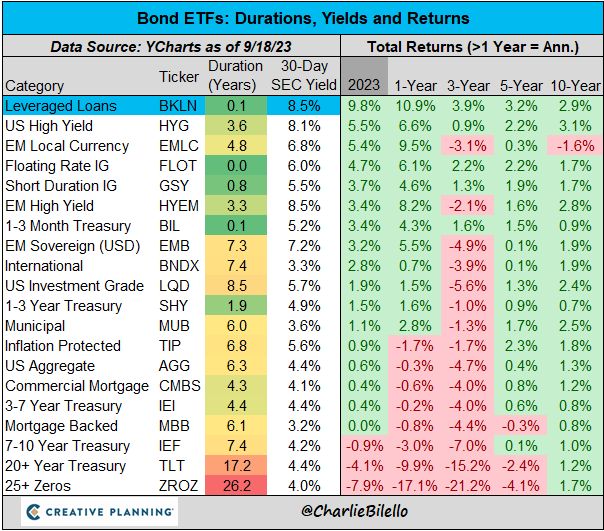

The best performing segment of the bond market this year? Leveraged Loans, up close to 10%. $BKLN

Source: Charlie Bilello

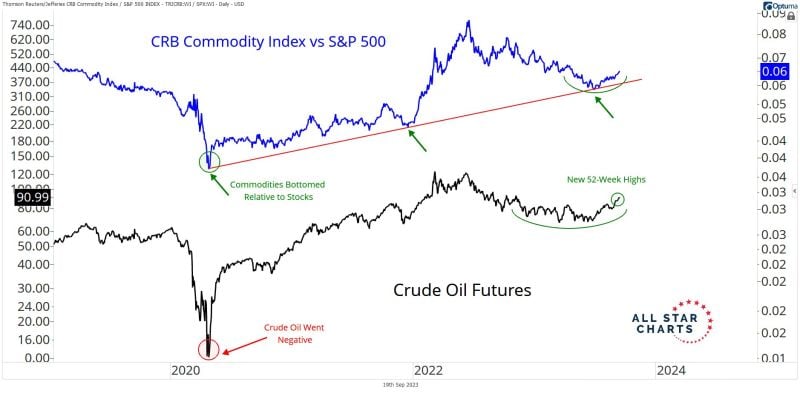

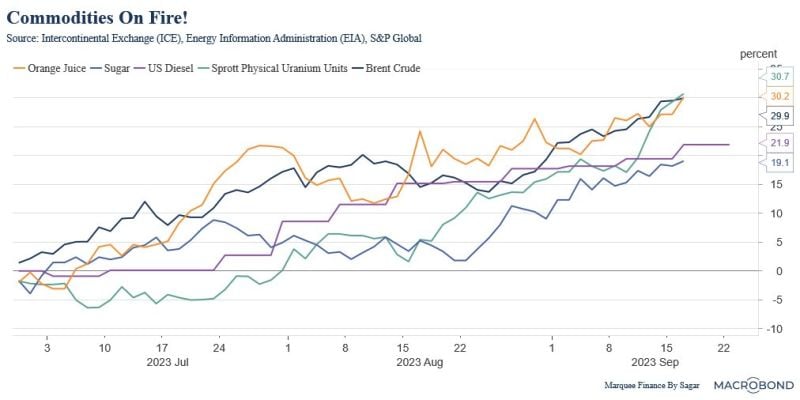

With the rise of oil prices, there is currently a revival of the "commodities super-cycle thesis"...

Source: J-C Parets

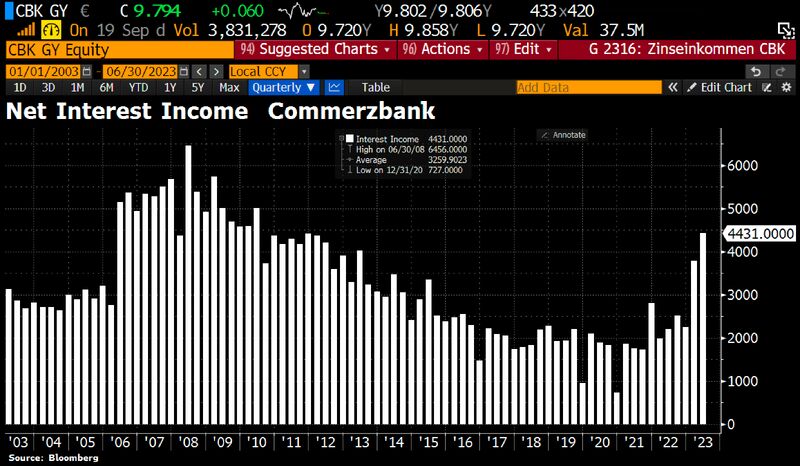

German banks are NOT passing on the increased interest rates to their customers

Commerzbank, Germany's 2n-largest retail bank, has announced it will increase net interest income to €8bn. Commerzbank has increased its deposit beta - a measure of how much of a rate increase it passes along to savers - slower than initially expected. The bank will end this year with something around a deposit beta of avg 40%. Source: HolgerZ, Bloomberg

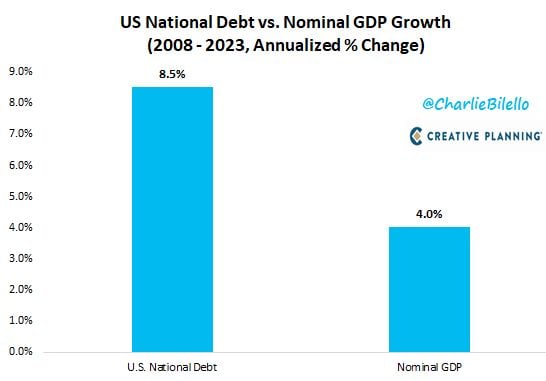

Over the last 15 years, the US National Debt has increased at a rate of 8.5% per year versus an increase in economic growth (nominal GDP) of 4.0% per year

Source: Charlie Bilello

Gold breakout just before FOMC meeting ?

Gold (XAU) is showing signs of breakout of May downtrend. Keep an eye on it as FOMC meeting should confirm or not the breakout. Source : Bloomberg

United Auto Workers (UAW) threaten to expand strike, according to WSJ

4 days after workers at Ford, Stellantis, and GM went on strike, strikers are threatening to expand. Currently, 13,000 out of 144,000 UAW workers are on strike. A strike by the entire UAW would cost US automakers nearly $600 million PER DAY. This is the first time in history that all 3 US automakers are on strike. Source: The Kobeissi Letter

Since the June bottom, crude oil, uranium, sugar and orange juice are up 20-30%. Is the risk of a second wave increasing?

Source: The Macro Guy

Investing with intelligence

Our latest research, commentary and market outlooks