Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Is the US IPO market coming back to life?

Instacart sold 22 million shares at $30 each in an initial public offering on Monday, raising $423 million in the process. The offering, which values the grocery delivery company at around $10 billion, is the second high-profile IPO in a matter of days, after British chipmaker Arm had made its trading debut on the Nasdaq stock exchange last Thursday. With Klaviyo, a marketing automation company, also planning to raise up to $550 million in its initial public offering on Tuesday, this week is a clear sign of life from the U.S. IPO market, which had dried up completely in 2022 after a record-breaking 2021. According to Dealogic data analysed by EY, IPO activity already picked up slightly in the first half of the year, as companies raised $10.1 billion in 63 initial public offerings in the U.S., compared to $4.7 billion in 51 IPOs in the first six months of 2022. With inflation looking likely to have peaked, rate hikes nearing an end and equities having rebounded from last year’s lows, the market backdrop looks more positive now that it did at any time in the past 18 months. Source: Statista

An ugly canadian CPI, surging crude oil prices and cautious positioning ahead of tomorrow's FOMC decision have pushed #us treasuries yields to their highest since 2007...

Bonds are now at their cheapest to stocks since Oct 2007... Source: Bloomberg, www.zerohedge.com

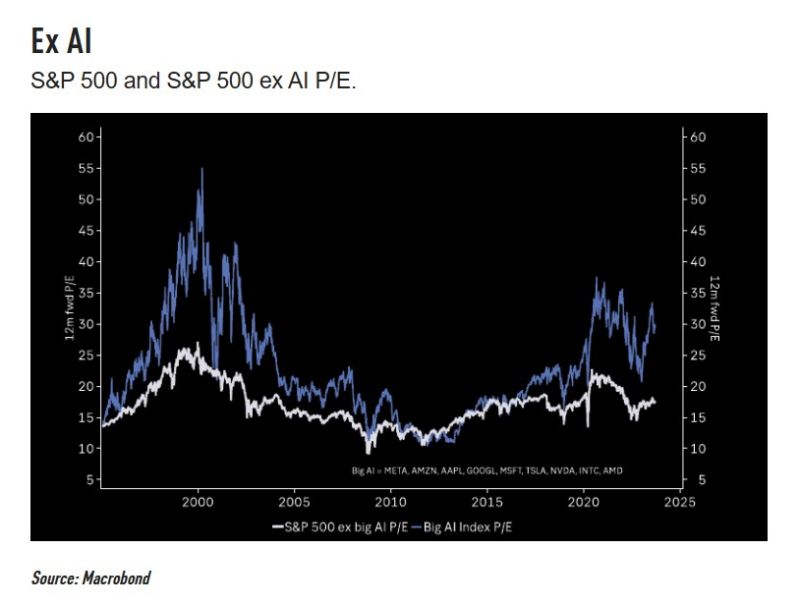

A tale of 2 markets: S&P 500 "big AI" stocks 12-month forward P/Es vs. S&P 500 "ex-big AI" stocks 12-month forward P/Es

Source: TME, Macrobond

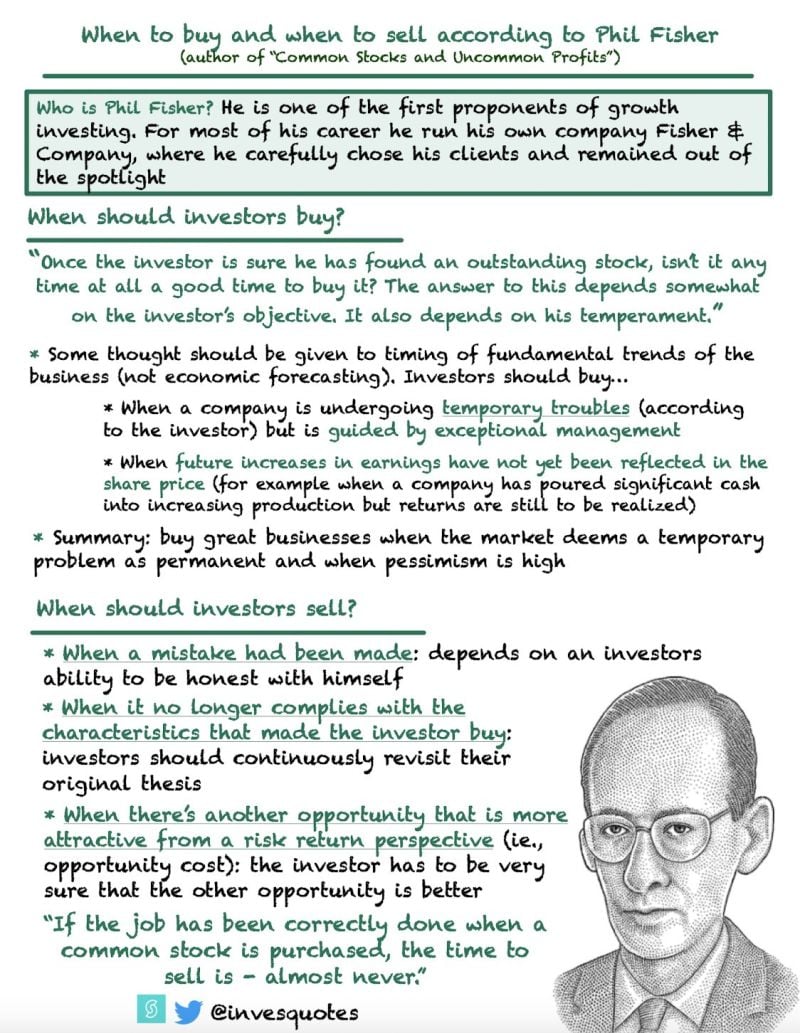

Phil Fisher's advice on when to buy and when to sell, as described in Common Stocks and Uncommon Profits

H/t : Invesquotes via Investment books Dhaval

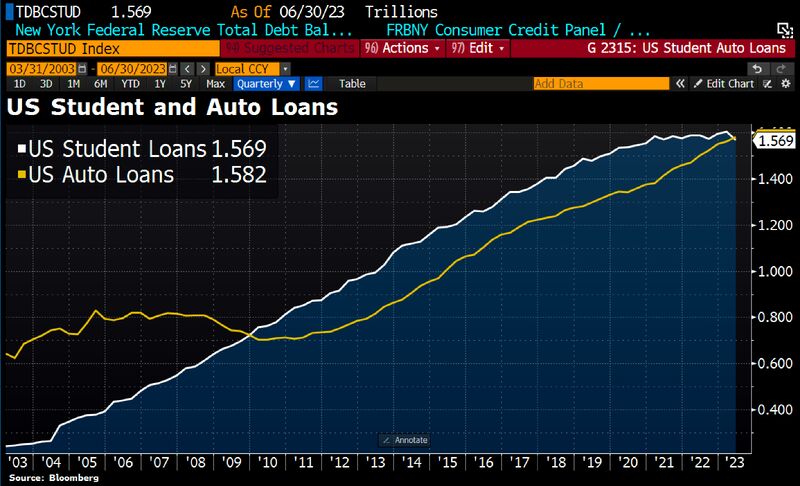

From October onwards, US consumers face a double whammy: student loans + auto loans...

Suspended Student loan payments helped fuel the auto market over the last several years. Auto loans pass Student loans in consumer debt load for the first time in 13yrs, which means consumers face a double-whammy starting in October w/existing auto payments & resumed student loan obligations. Auto loan delinquencies are on the rise and more consumers could fall behind if unemployment increases. Source: Bloomberg, HolgerZ

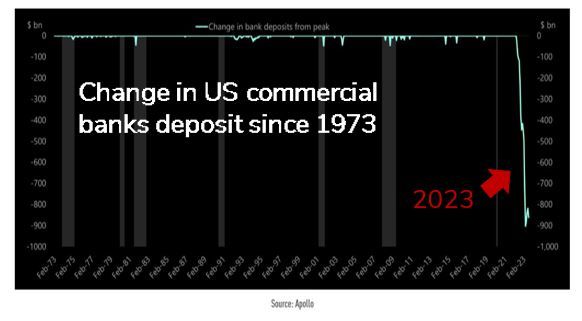

In the US, the slow motion bank run continue...

Interest Rates on Deposits, by Bank: 1. Wells Fargo: 0.15% 2. Citibank: 0.05% 3. Chase: 0.01% 4. Bank of America: 0.01% 5. US Bank: 0.01% Rates on Alternatives to Bank Deposits: 1. CDs: 5.0% 2. Money Market: 4.5% 3. Treasury Bonds: 4.0% Deposits continue to flow out of banks at a historic pace with $1 trillion+ withdrawn over the last year. The era of "free" money for large US banks is coming to an end. They must raise interest paid on deposits or capital will continue to leave. Source: The Kobeissi Letter, Apollo

Crypto VC Firm Blockchain Capital Raises $580 Million

Crypto-focused Blockchain Capital has raised $580 million across two new funds, one of the biggest raises for the asset class this year and the largest for the venture firm in its 10-year history.

Blockchain Capital, which has an existing $2 billion in assets under management, will use the fresh capital to back crypto startups in areas including decentralized finance and gaming as well as infrastructure, general partner Kinjal Shah said in an interview with Bloomberg News.

Source: Bloomberg

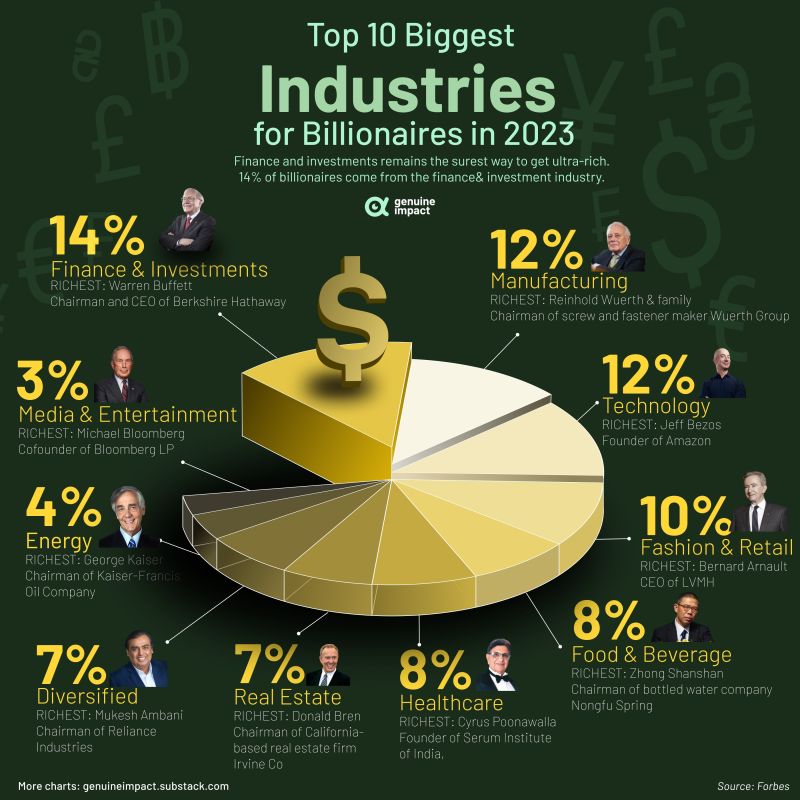

From which industries are billionaires coming from? 💰

There are various ways to become wealthy. But finance and investments remain the surest path to becoming a billionaire🤑. Chart by Genuine Impact

Investing with intelligence

Our latest research, commentary and market outlooks