Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

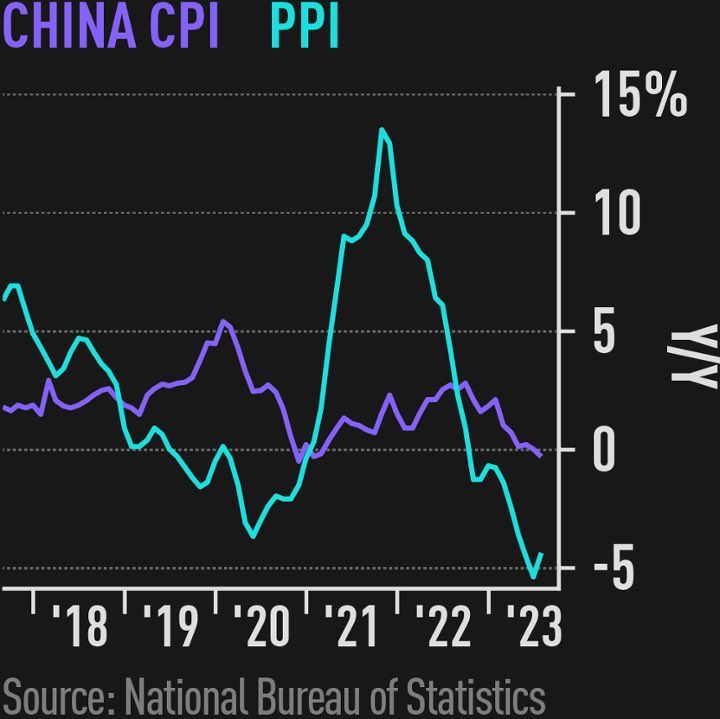

China's consumer and producer prices both declined in July for the first time since November 2020, a sign of deflation pressure amid weakening demand

CPI dipped 0.3% from a year earlier while PPI retreated for a 10th consecutive month, sliding 4.4%. "China is in deflation for sure," said Robin Xing at Morgan Stanley. "The question is how long." The statistics bureau attributed the CPI decline to the high base of comparison, saying the dip is likely to be temporary. Source: J-C Gand

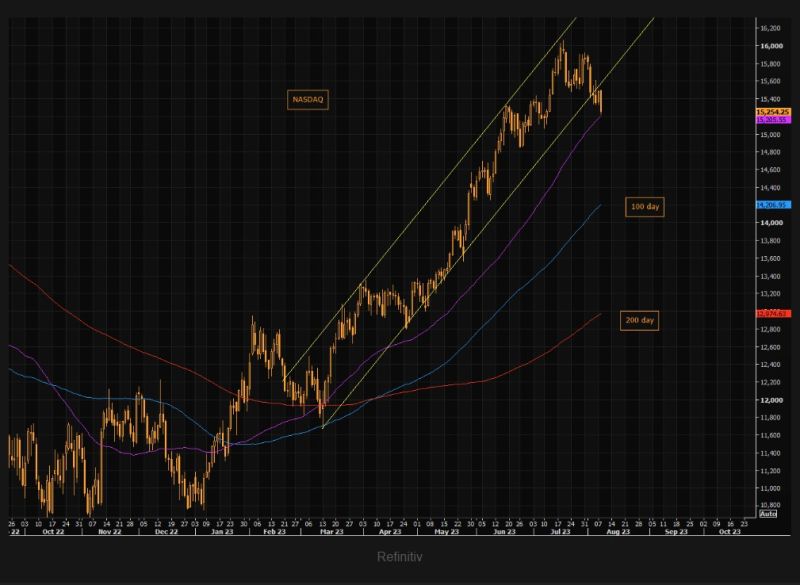

NASDAQ is currently trading right on the 50 day moving average

15200 is a short term level to watch, but the bigger support is at 15k. NASDAQ is now established "well" below the channel. Source: The Market Ear, Refinitiv

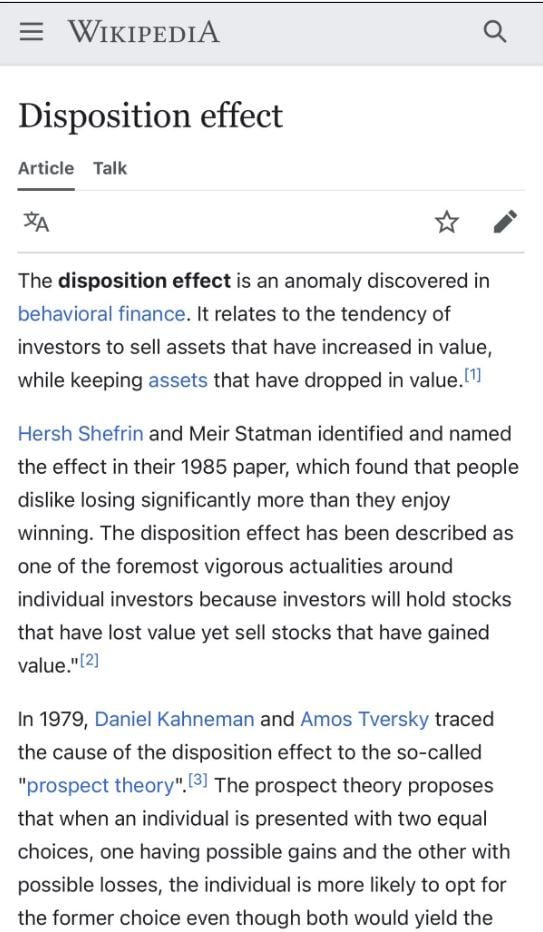

Have you heard about the "disposition effect" aka the tendency of investors to sell assets that have increased in value?

As momentum roll-over, can this #behavioralfinance bias trigger a sell-off of the "Magnificent 7" (Apple, Nvidia, etc.) in teh US and the GRANOLAS (LVMH, L'Oréal, etc,) in Europe?

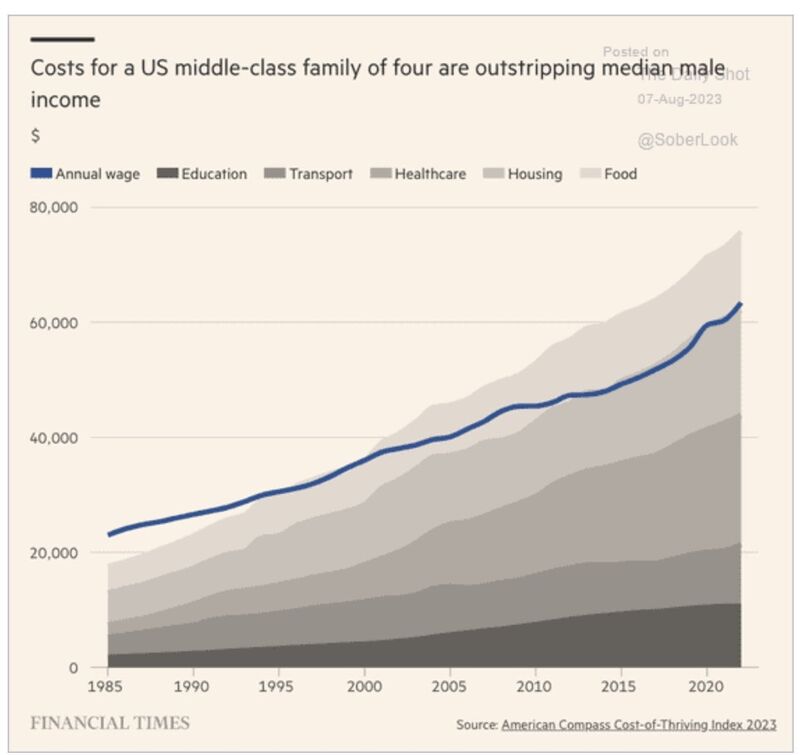

Financial demands of supporting a US family of 4 have surpassed what a single salary can adequately provide

Source: FT

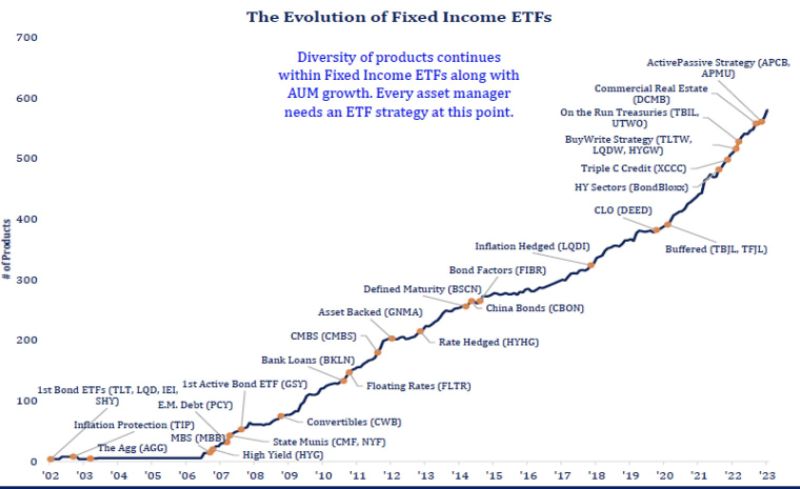

The evolution of fixed income ETFs in one picture...

This chart really shows off how far things have come in 20 years and how far the ETF industry goes with an asset class. Source: Todd Sohn thru Eric Balchunas

Total credit card indebtedness increased by $45 billion in the April-through-June period, an increase of more than 4%

That took the total amount owed to $1.03 trillion, the highest gross value in Fed data going back to 2003. The increase in the category was the most notable area as total household debt edged higher by about $16 billion to $17.06 trillion, also a fresh record. As card use grew, so did the delinquency rate. The Fed’s measure of credit card debt 30 or more days late rose to 7.2% in the second quarter, up from 6.5% in Q1 and the highest rate since the first quarter of 2012 though close to the long-run normal, central bank officials said. Total debt delinquency edged higher to 3.18% from 3%. Source: CNBC

The trend is your friend until it ends??? Apple ($AAPL)

Source: Tradingview

Investing with intelligence

Our latest research, commentary and market outlooks