Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

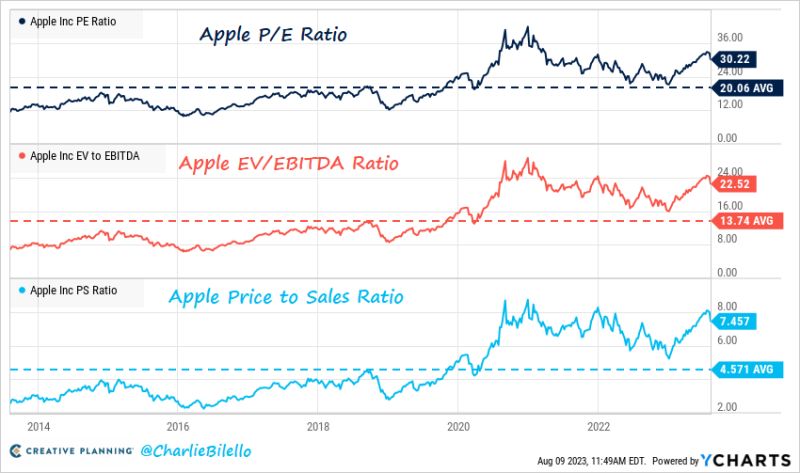

"Magnificent 7" stocks valuations are NOT cheap. Example: Apple

Apple's P/E Ratio: 30x 10-year average: 20x Apple's EV/EBITDA Ratio: 23x 10-year average: 14x Apple's Price to Sales Ratio: 7.5x 10-year average: 4.6x $AAPL Source: Charlie Bilello

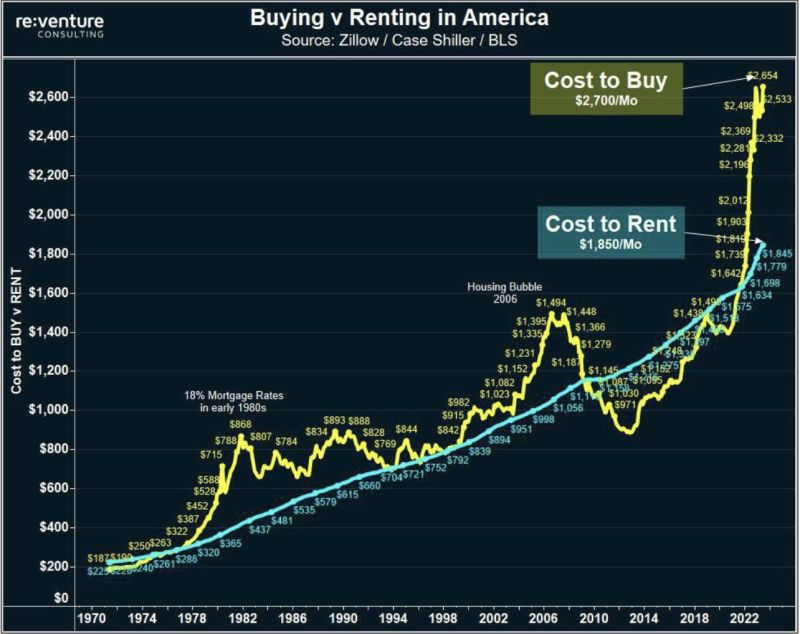

The cost of both buying and renting a house in America has skyrocketed since 2020

Buying a house now costs $2,700/month on average, up an alarming ~86% in 3 years. Renting a house now costs $1,850/month on average, also up ~25% in 3 years. Owning a home has become a luxury. Source: The Kobeissi Letter

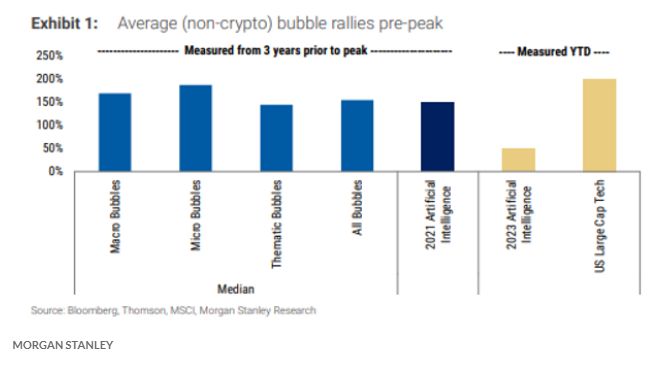

On average, bubbles rise 217% during the 3 years leading up to the peak according to data from Morgan Stanley

Megacap Tech stocks are already up 200% year-to-date. Source: Barchart

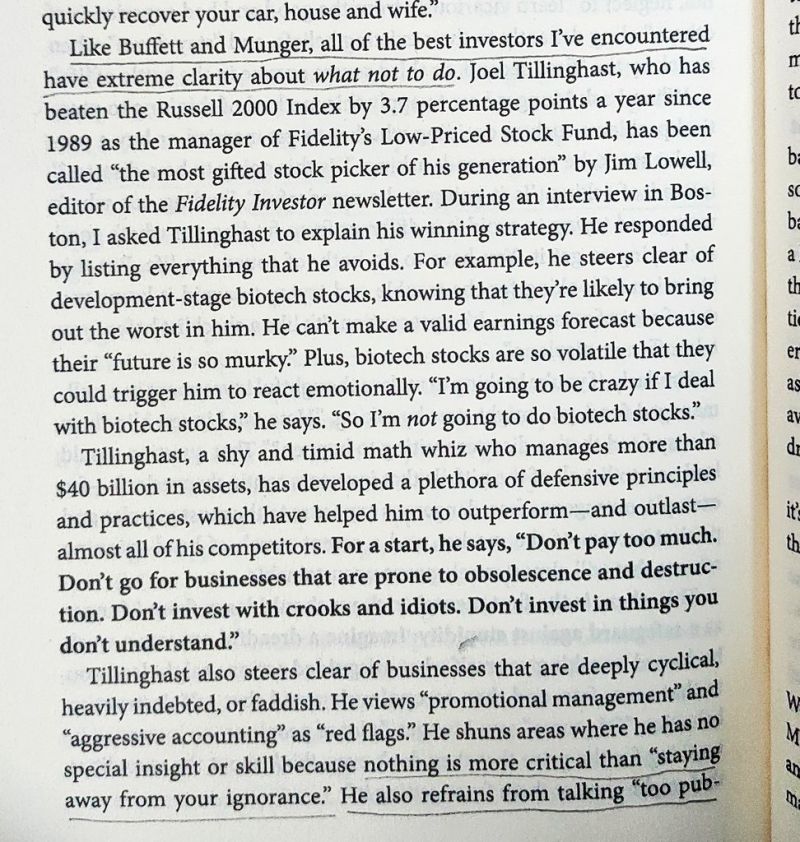

What not to do is more important than what to do in the stock market What not to do?

🔷 Don't pay too much. 🔷 Don't go for businesses that are prone to obsolescence and destruction. 🔷 Don't invest with crooks and idiots. 🔷 Don't invest in things you don't understand Source: Investment Books (Dhaval)

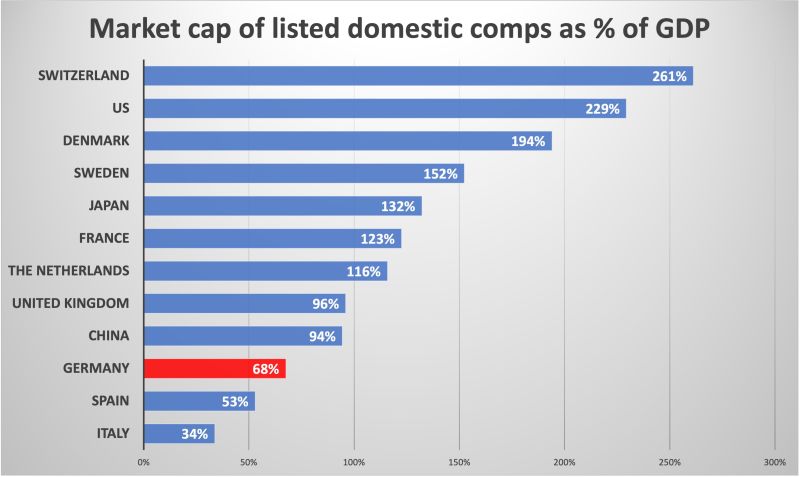

Market cap of listed domestic companies as a % of GDP for selected countries

Switzerland is way ahead of peers in the ranking. US comes next Source: HolgerZ

The U.S. Now Has:

1. Record $17.1 trillion in household debt 2. Record $12.0 trillion in mortgages 3. Record $1.6 trillion in auto loans 4. Record $1.6 trillion in student loans 5. Record $1.0 trillion in credit card debt Total mortgage debt is now more than double the 2006 peak. Meanwhile, 36% of Americans have more credit card debt than savings while student loan payments are set to resume for the first time since 2020. This is all while mortgage rates just hit 7.1% and credit card debt rates hit a record 25%. Source: The Kobeissi Letter, Hedgeye

Bitstamp joins eToro, Binance.US in suspending trade for SEC-flagged tokens

Luxembourg-based Bitstamp is halting trade in the US for seven cryptos classified as securities by the SEC. From Aug. 29 onwards, the platform will discontinue trading for AXS, CHZ, MANA, MATIC, NEAR, SAND and SOL. In legal actions against Binance and Coinbase, the SEC asserted that these tokens, among others, met the standards of a security. Offering alleged securities on a crypto exchange brings about issues such as heightened regulatory oversight, potential legal liabilities, and regulatory complexities.

Bitstamp said in an announcement on Tuesday that new trades won’t be allowed with these assets from later this month, and any current trades will be halted.Users were prompted to complete any buy or sell transactions they wanted with the impacted assets before the deadline.

Source: Blockworks

Investing with intelligence

Our latest research, commentary and market outlooks