Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Many analysts point their fingers towards the options market for signs of stock market trouble. Goldman says dealers in ‘short gamma’ for first time this year

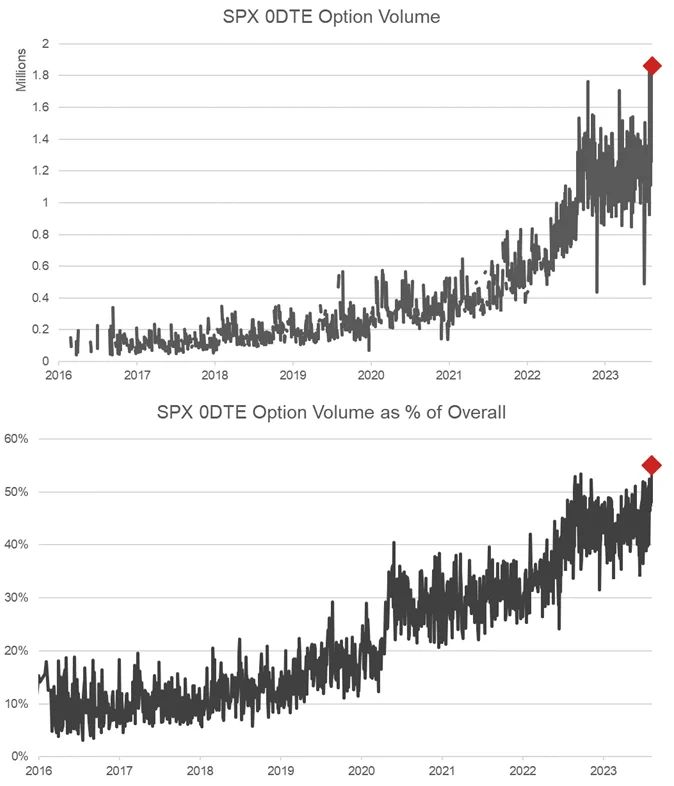

Meanwhile, we have a new 0DTE* options volume record. *Zero days to expiration options, or 0DTE options for short, are options contracts that expire and become void the same day that they’re traded. When an option reaches this stage, there’s not much more time left to act on the right to buy or sell the underlying asset. The window is small, and the move that the trader is plotting needs to happen fast. 0DTE options trading has entered the mainstream in recent years and is a popular premium collecting strategy. Source: www.zerohedge,com, Bloomberg, investopedia

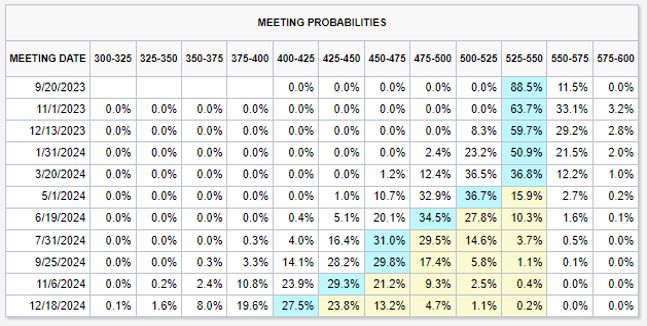

What are the latest moves when it comes to market expectations on Fed rates ?

A Fed HIKE of 25 bps by NOVEMBER moved from 30% to 33%. It is still below 50%. So not priced in. But a 3% increase (30% to 33%) is the biggest up move in a month. Furthermore, odds of rate CUTS are dropping. Markets now do not see any rate cuts until May 2024 in the base case. 3 months ago, markets expected 4 rate cuts in 2023. Markets seem to be bracing for a long Fed "pause." Source: The Kobeissi Letter, Bianco Research

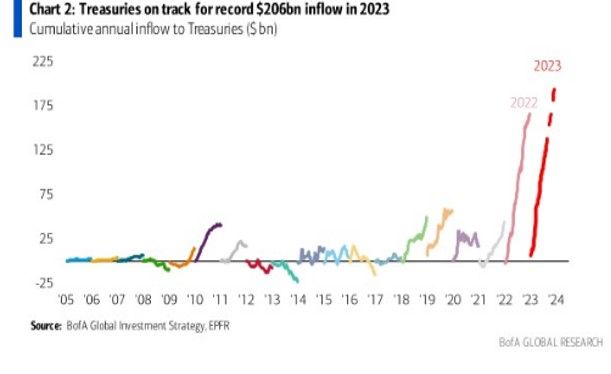

US Treasuries yields keep going up despite record INFLOWS. As shown by BofA, US Treasuries are on track for the largest inflow EVER ($127bn YTD is equivalent to $206bn annualized)

Yet, yields don’t fall as US 10-year hit 4.13% this week as inflation reports failed to reverse the trend. What will happen to yields if investors start to panic and dump their US Treasuries? Or should we on the contrary see the hefty yield paid by US Treasuries as a buffer which continues to attract yield chasers and thus prevent yields to rise too high and too quickly? Source: BofA

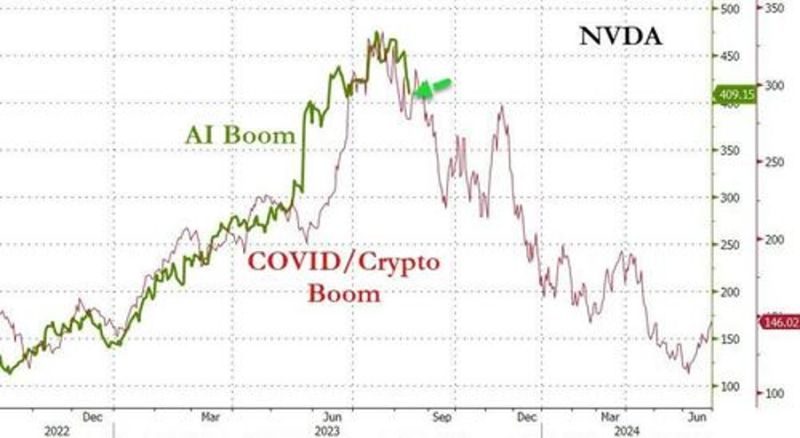

Nvidia ($NVDA) was the big loser, down over 8% on the week (its biggest weekly loss since Sept 2022...)

Will the stock repeat a similar de-bubbling process than the one which took place after the crypto/mining boom? (at the time, Nvidia chips were seeing growing demand from the crypto miners but the buzz faded when crypto crashed) Let's keep in mind that Nvida is now a much BIGGER WEIGHT in the key US equity indices than it used to be at the time... Source: Bloomberg, www.zerohedge.com

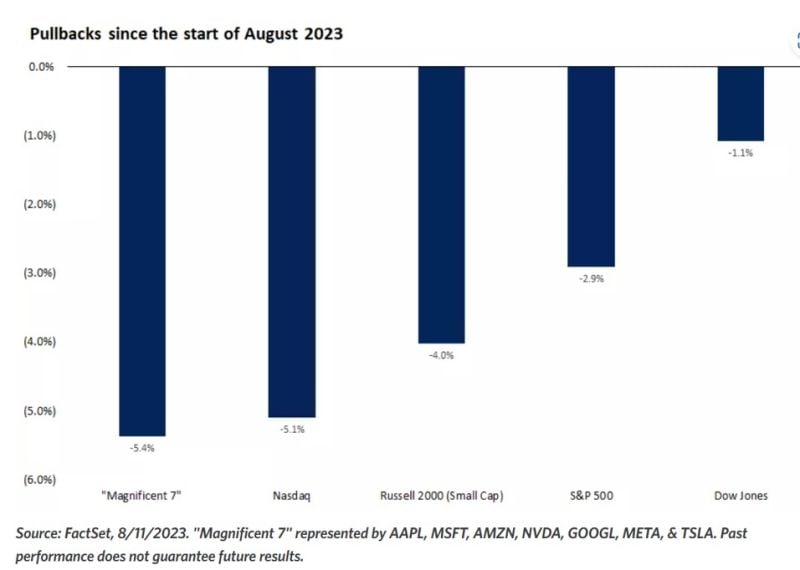

Within US equities, Large-cap technology stocks have corrected the most since the start of August as shown by declines in the "Magnificent 7" and NASDAQ index.

Source: Edward Jones

US money-market assets have reached a new record of $5.5 trillion

US Treasuries are on course for a record year of inflows as investors chasing some of the highest yields in months pile into #cash and #bonds, according to Bank of America Corp. strategists. Cash funds attracted $20.5 billion and investors poured $6.9 billion into bonds in the week through August 9, strategists led by Michael Hartnett wrote in a note, citing data from EPFR Global. Meanwhile, US #stocks had their first outflow in three weeks at $1.6 billion. Flows into Treasuries have reached $127 billion this year, set for an annualized record of $206 billion, BofA said. The buoyant demand shows how alluring fixed-income markets remain even as the bond rally and economic slowdown many were predicting last year has failed to materialize. The yield on 10-year US Treasuries was trading at around 4.09% on Friday, up from a low of around 3.25% in April, and near a 15-year high touched last year. Source: Bloomberg, Lisa Abramowicz

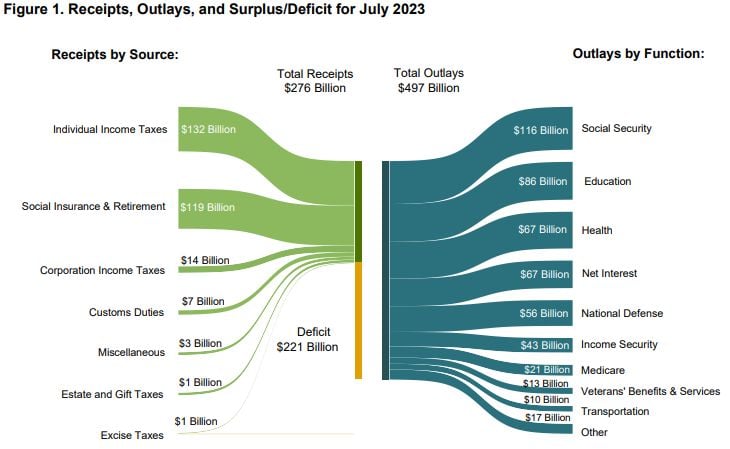

The US just published their budget numbers showing a $221 BILLION deficit in July ALONE

With $276 billion in receipts, the US spent a massive $497 billion last month. Total interest on US debt YTD is now at $726 BILLION. US spending problem is getting worse. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks