Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Berkshire Hathaway breakout ?

Berkshire Hathaway (BRK/B US) has had an incredible 13% rally since last major resistance 319-320 and a 40% rally since the lows in October 2022 ! Stock is now on resistance 362.10. Will it have enough strenght to breakout ? Source : Bloomberg

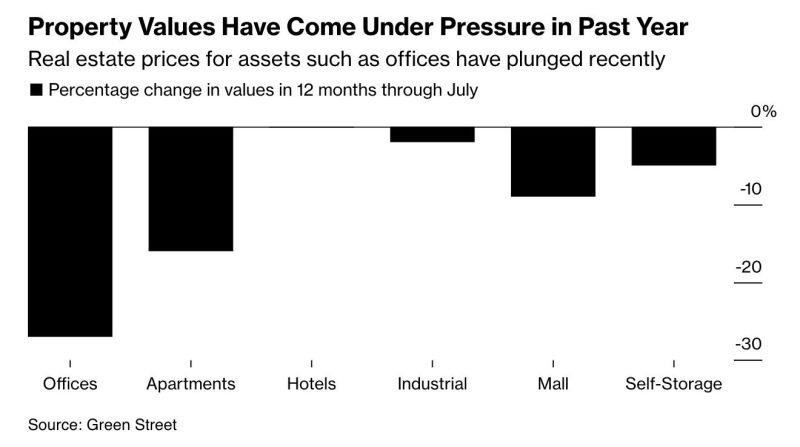

Property values in commercial real estate are beyond bear market territory

- Office buildings are down nearly 30% over the last year ALONE. - Apartments down 15% and underperforming malls. - Hotels are flat as markets await a potential drop in consumers spending. - Real estate markets are feeling the effects of higher interest rates. Source: The Kobeissi Letter, Bloomberg

SP500 seasonality and 4-year cycle analysis suggests a consolidation before a year-end rally

Source: Nautilus Research

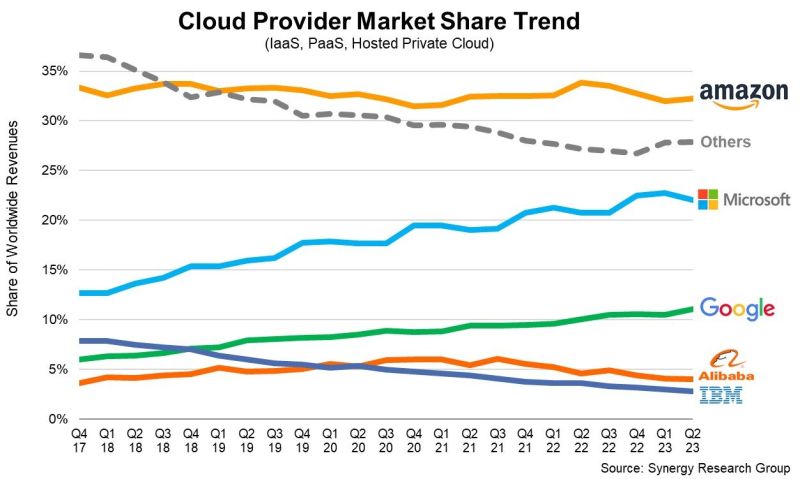

Cloud Infrastructure Services Market

$65 billion in spending in Q2 2023. → +18% Y/Y and +3% Q/Q. Market share: 🟧 $AMZN AWS 32%. 🟦 $MSFT Azure 22%. 🟩 $GOOG GCP 11%. Big 3 = 65% of the market. Estimates by Synergy Research Group. Source: App Economy Insight

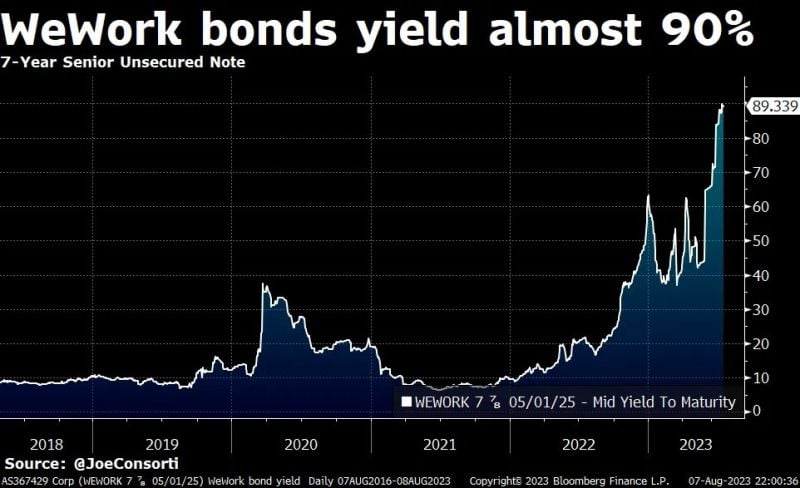

WeWork bonds yield almost 90%

When they mature in 2025, what will #wework do? Borrow again or sell its assets? tThere doesn't seem to be any 'soft landing' for US office space... Source: Joe Consorti, Bloomberg

Reckitt Benckiser back again on major support level

Reckitt Benckiser (RKT LN) is back on a major support zone. 1st support is the March 2020 trend support at 5575. 2nd one is support zone 5400-5500 that has been tested about 10 times. Keep an eye on these major levels. Source : Bloomberg

Pernod Ricard back above support 196.80

Pernod Ricard (RI FP) is back above major support 196.80 for the 3rd time since June. Stock is showing strenght on this major support level. Keep an eye on it as it's a key level. Source : Bloomberg

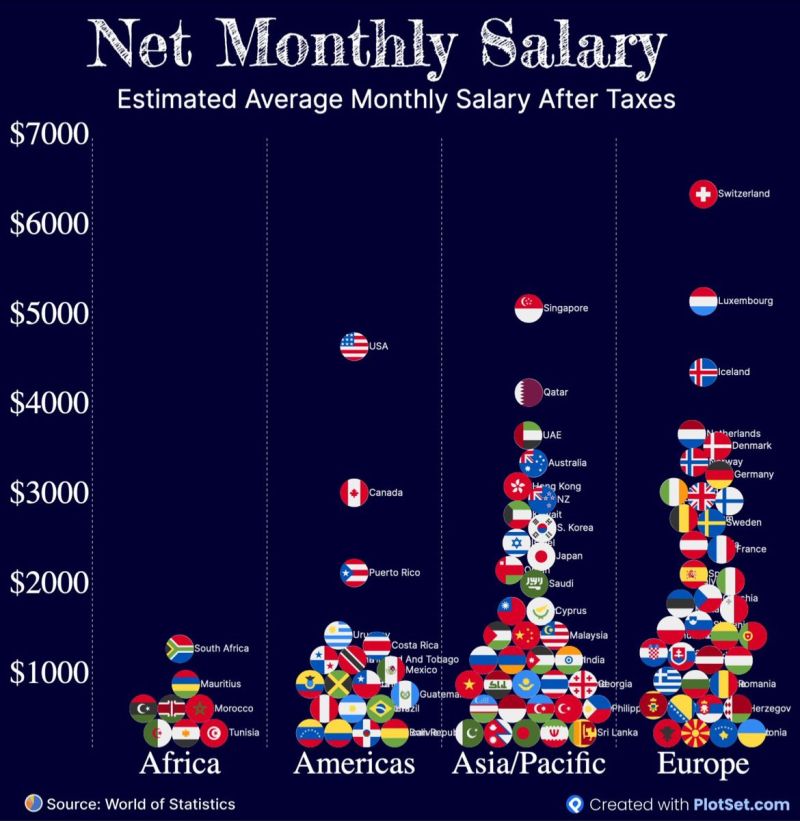

Average monthly salary after tax:

Source: World of statistics

Investing with intelligence

Our latest research, commentary and market outlooks