Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

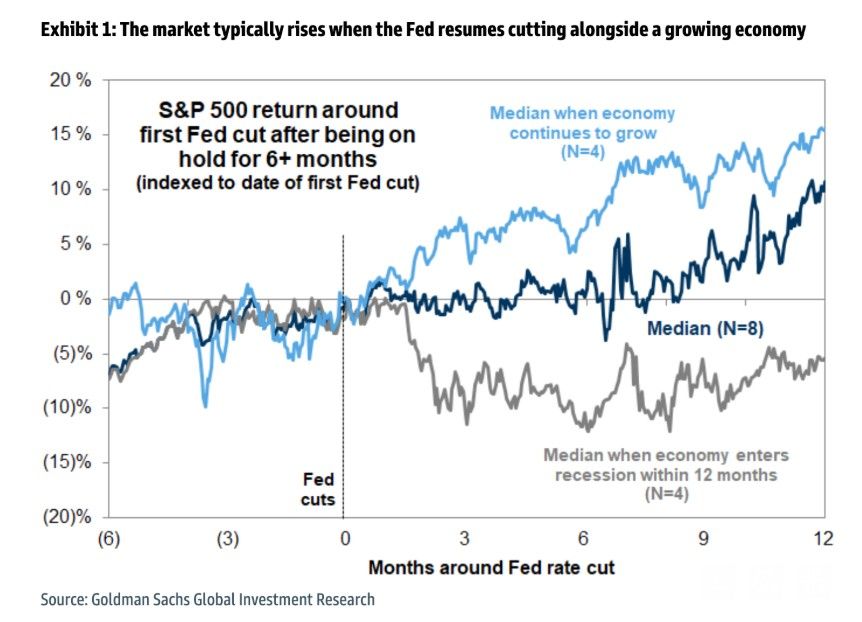

The Fed is in command

1. Stocks: all-time high, 2. Home Prices: all-time high, 3. Bitcoin: all-time high, 4. Gold: all-time high, 5. Money Supply: all-time high, 6. National Debt: all-time high, 7. CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target", 8. Fed: cutting interest rates next week. Source: Charlie Bilello

Elon Musk has lost his title as the world's richest person to Larry Ellison, the co-founder of Oracle and an ally of US President Donald Trump

Ellison's wealth surged to $393bn (£290bn) on Wednesday morning, surpassing Musk's $385bn (£284bn), according to the Bloomberg Billionaires Index. Source : bloomberg

Real estate has held its spot as America’s favorite long-term investment for the 12th year in a row, ahead of stocks, gold, and savings accounts

Source : pacaso, chartr

Should we consider this as a leading indicator?

Sotheby’s revenue from commissions and fees on sales fell -18% Profit before tax at Sotheby’s Holdings UK fell -21% Source: The Coastal Journal

Investing with intelligence

Our latest research, commentary and market outlooks