Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it...

According to NY Post, banking giant UBS is ramping up its threats to leave Switzerland and set up shop in the US — a radical response to Swiss regulators who have proposed onerous new capital requirements on the financial behemoth. Source : New York Post

"MAYBE WE’LL PAY OFF OUR $35 TRILLION HANDING THEM A CRYPTO CHECK, A LITTLE BITCOIN"

Source: Documenting Saylor @saylordocs

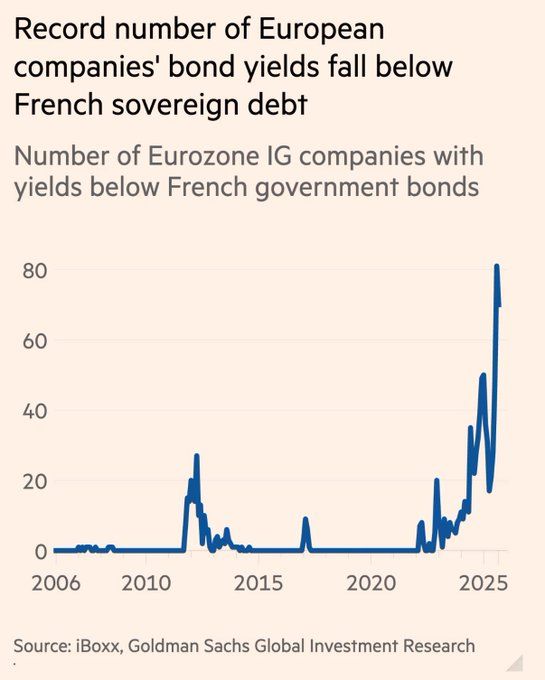

The ECB has tentatively allowed a little bit of price discovery in the bond market

The French government wakes up to discover their cost of funding is higher than L'Oréal's. Source: Hanno Lustig, FT

China economic slowdown deepens in August

➡️ Retail sales rose 3.4% in August from a year earlier, missing analysts' estimates for a 3.9% growth and slowing from July's 3.7% growth. ➡️ China’s industrial output growth slipped 5.2%, the worst performance since August last year. ➡️ Fixed-asset investment, reported on a year-to-date basis, expanded just 0.5%, a sharp slowdown from the 1.6% expansion in the January to July period. ➡️ China's survey-based urban unemployment rate in August came in at 5.3%. Source: CNBC

Markets Up, Morale Down: A Summer of Disbelief by JC Parets, CMT

Throughout the summer, investors were wrong about stocks. And it was one of the greatest summers in stock market history. Below is the futures positioning among asset managers and hedge funds: the blue line represents the S&P 500, and the lighter green line shows you how underinvested they've been. They sold into the hole and never got the chance to get back in. This was a textbook V-bottom, and they're still not back in. This is one of those things that can help keep a bid underneath the market. Source: J-C Parets

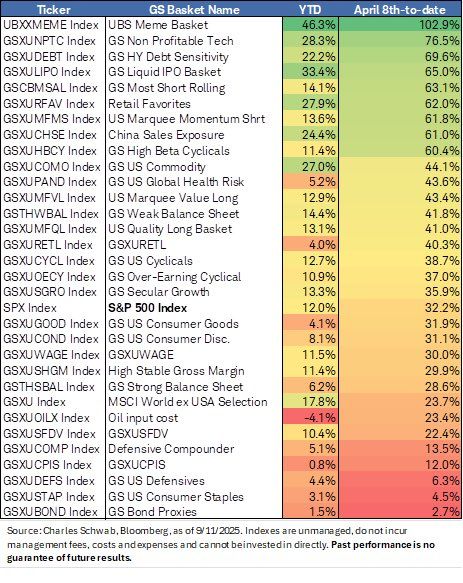

Meme stocks continue to power higher since early-April lows, alongside other retail trader favorites; while classically-defensive baskets bring up the rear

Source: Liz Ann Sonders, Bloomberg

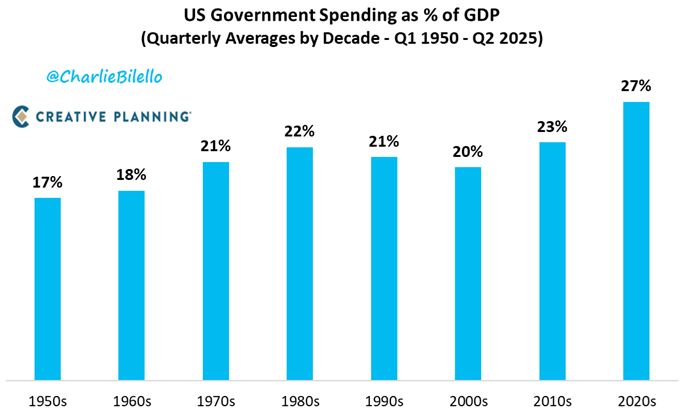

US Federal Government Spending as % of GDP...

1950s: 17%, 1960s: 18%, 1970s: 21%, 1980s: 22%, 1990s: 21%, 2000s: 20%, 2010s: 23%, 2020s: 27%. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks