Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

$TLT jumps to highest price since April 📈📈📈 Ready to breakout?

Source: Barchart

Key dates for France sovereign rating

Macron still needs to find a new PM who then needs to form a government who should submit its budget bill to parliament by the first Tuesday of October, which this year is October 7. Good luck... Source: French Debt Agency

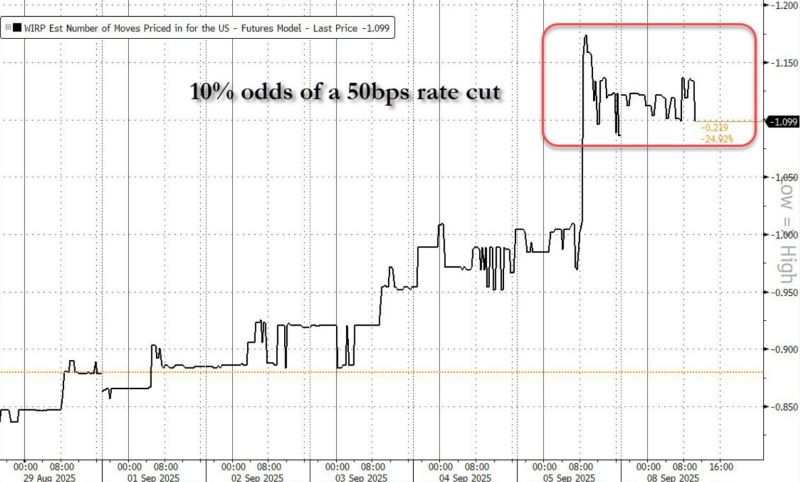

Odds of 50bps rate cut just hit 10%

Standard Chartered now predicts the Fed will cut TWICE at September FOMC. Source: zerohedge

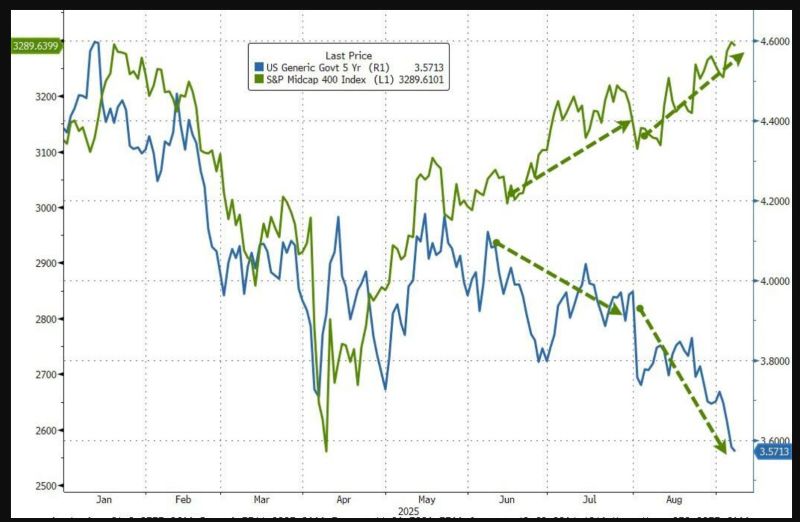

As Fed rate cuts odds increase, stocks and bonds continue to be bid together...

Source: www.zerohedge.com, Bloomberg

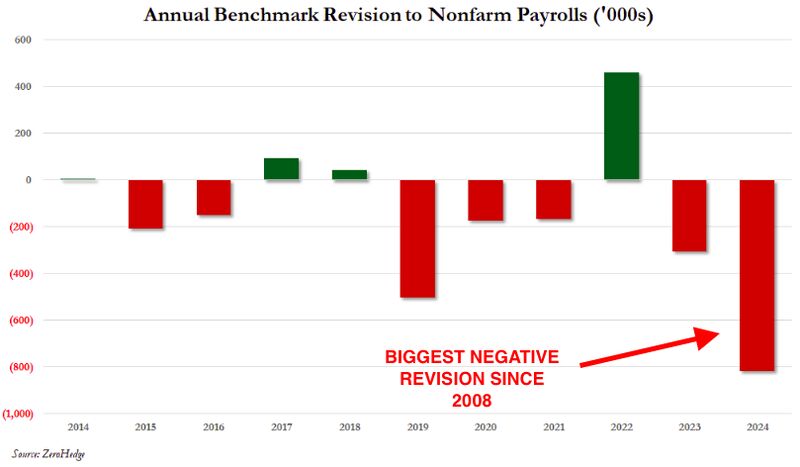

⚠️ The United States (US) Bureau of Labor Statistics (BLS) will publish the 2025 preliminary benchmark revision to the Establishment Survey Data on Tuesday, September 9

The preliminary revision will cover the 12-month period through March 2025 before the final benchmark revision is reported within the employment report of February 2026. The chart below puts the revisions in perspective: ➡️ 2024 just delivered the biggest downward benchmark revision since 2008 nearly -800k jobs erased. ➡️ That’s exactly why the BLS revision matters: if 2025 takes another -550k to -950k hit, it won’t just mark back-to-back historic revisions. ➡️ It will prove the labor market was overstated for years, not months. Source: StockMarket.News, zerohedge

What a year for ETFs ‼️

ETFs crack $800b in YTD flows, that's a $5b/day pace. That puts them on pace to hit about $1.2T this year, a new record. Source: Bloomberg, www.zerohedge.com

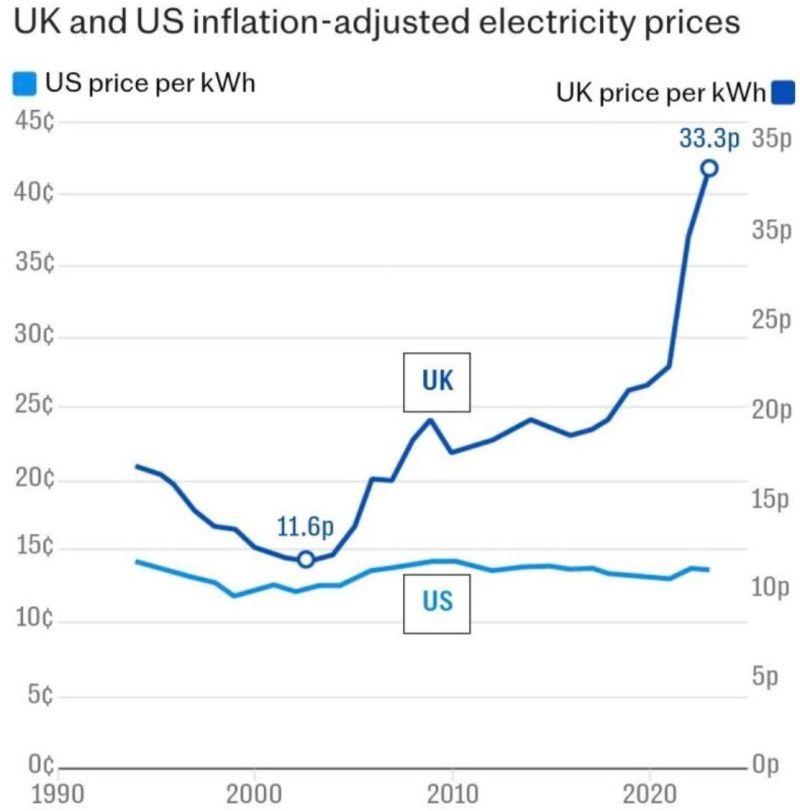

If you are in the manufacturing industry, do you produce in the U.S. or in the U.K.?

Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks