Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

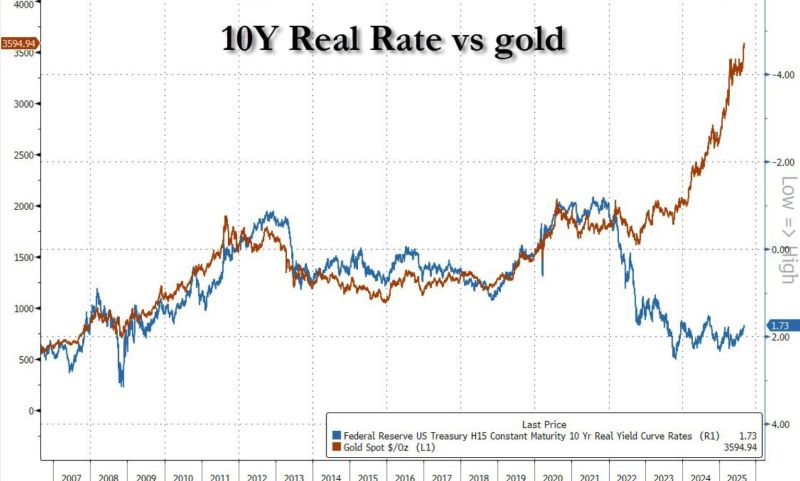

"The Ukraine war and the weaponization of the dollar was the straw that broke the camel's back"

Source: zerohedge

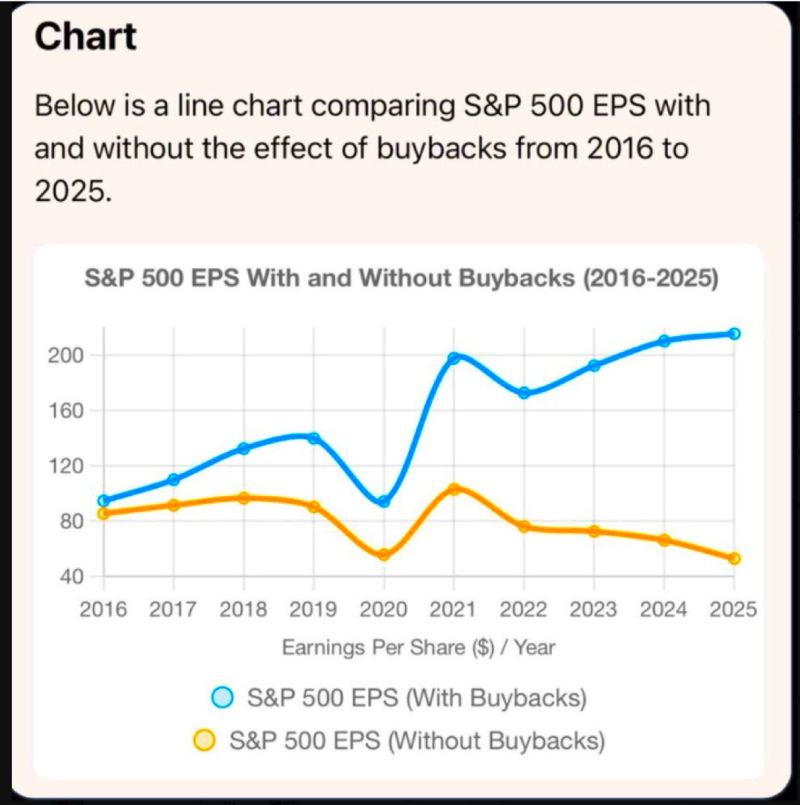

Buybacks are inflating earnings per share

By shrinking share counts, companies make profits look stronger on paper even when most firms show flat or declining growth. The top 10 companies are the only ones delivering real growth. Indexes keep climbing because of them, while the S&P 490 and the broader economy remain weak. This is one of the disconnect driving the market. Source: StockMarket.news

Treasury Secretary Scott Bessent said Sunday that he is “confident” that President Donald Trump’s tariff plan “will win” at the Supreme Court

But he warned his agency would be forced to issue massive refunds if the high court rules against it. If the tariffs are struck down, he said, “we would have to give a refund on about half the tariffs, which would be terrible for the Treasury,” according to an interview on NBC’s “Meet the Press.” He added, however, that “if the court says it, we’d have to do it.” Source: CNBC

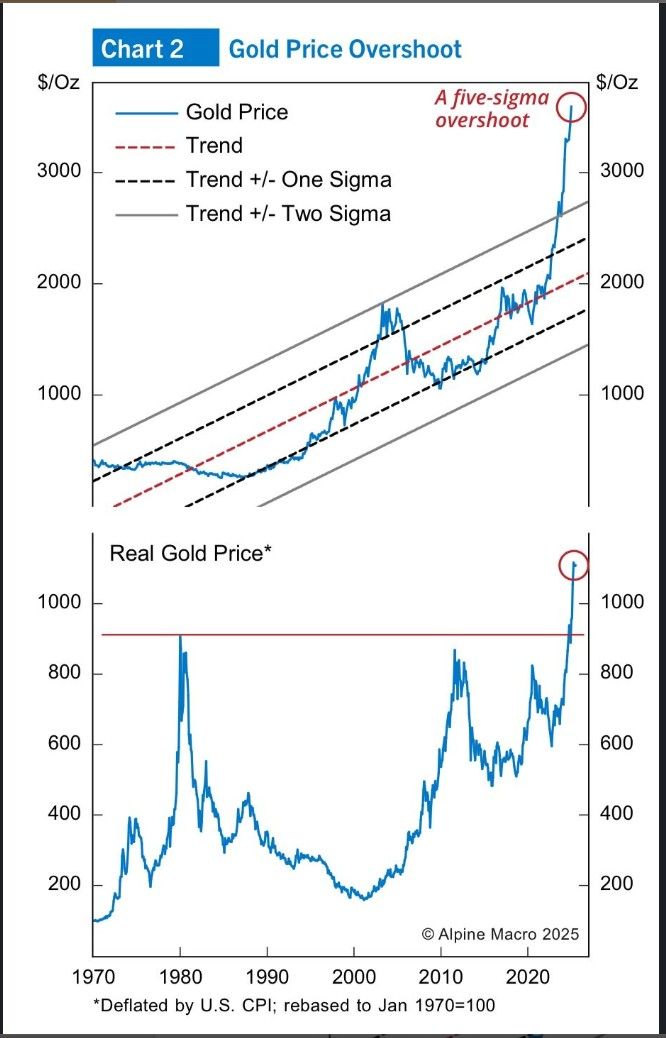

Gold is overshooting its time trend by 5 sigma

While the real gold price (after adjusted for U.S., CPI) is at the record highs, as this Alpine Macro chart shows. Source: Chen Zhao

China’s shipments to the U.S. plunged 33% in August

While overall exports growth slowed to its weakest level in six months, and President Donald Trump’s policy targeting trans-shipments weighed on exports and businesses, frontloading activity lost momentum. 👉Imports from the U.S. also dropped 16% from a year ago, customs data showed. 👉China’s total exports climbed 4.4% in August in U.S. dollar terms from a year earlier, customs data showed Monday, marking their lowest growth since February while missing Reuters-polled economists’ estimates for a 5.0% rise. That growth slowed from the prior two months, in part reflecting the statistical effect of a high base last year when China’s exports grew at their fastest pace in nearly one-and-a-half years. 👉Imports rose 1.3% last month from a year ago, missing Reuters estimates for a 3% growth. Imports rose for a third straight month after returning to growth in June, albeit still muted due to the persistent real estate slump, rising job insecurity, among other things. ➡️ China has increasingly relied on alternative markets, particularly Southeast Asia and European Union nations, Africa and Latin America, as U.S. President Donald Trump’s trade policy has pressured U.S.-bound shipments. Nonetheless, no one country has come close to the U.S. which remains China’s largest trading partner on a single-country basis, absorbing $283 billion of Chinese goods this year as of August. Exports to the EU stood at $541 billion over the same period. Beijing and Washington on Aug. 11 agreed to extend their tariff truce by another 90 days, locking in place U.S. tariffs of around 55% on Chinese imports and 30% Chinese duties on U.S. goods, according to Peterson Institute for International Economist. But bilateral talks appear to be struggling to reach a breakthrough, with a late-August visit to Washington by top Chinese trade negotiator Li Chenggang yielding little progress. Source: CNBC

The top 10 US stocks now have a combined market cap of 23 trn USD, bigger than China (16), the EU (13) or Japan (7)

If these 10 were a country, they’d be the world’s largest stock market (ex US). Source: Bergos AG, Econovis, Till Christian Budelmann

Scott Bessent now says the Biden-era jobs tally will be revised down by ~800,000 next week

Goldman Sachs is calling for a 550k–950k cut in the BLS benchmark revision. If it lands, the labor market narrative gets rewritten and it could swing the Fed between a 25bps trim and a 50bps shock in September. Source: StockMarket.News

Investing with intelligence

Our latest research, commentary and market outlooks