Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

‼️Hedge funds are shorting the S&P 500 futures at nearly a RECORD pace

Hedgefunds short exposure to the S&P 500 futures hit $180 BILLION, an all-time high. As a share of open interest, shorts hit ~27%, the highest in 2.5 years, only below March 2023 and September 2022. Source: Global Markets Investor

Breaking news

Tesla’s board has proposed a new pay package for chief executive Elon Musk worth $1tn over the next decade if he is able to hit a series of formidable targets. Musk will receive no salary or bonus under the plan unveiled on Friday, but would collect shares in instalments unlocked by increases in Tesla’s market value, combined with milestones including a huge increase in earnings and selling millions of cars, robotaxis and AI-powered robots. “Retaining and incentivising Elon is fundamental to Tesla . . . becoming the most valuable company in history,” chair Robyn Denholm said in a letter to investors. The package is “designed to align extraordinary long-term shareholder value with incentives that will drive peak performance from our visionary leader”. The board stressed that Musk’s incentives were aligned with investors’ interests and he will receive nothing if Tesla’s growth stalls. However, the sheer scale of the deal is likely to revive a fierce debate over the earnings of the world’s richest man. Source: FT

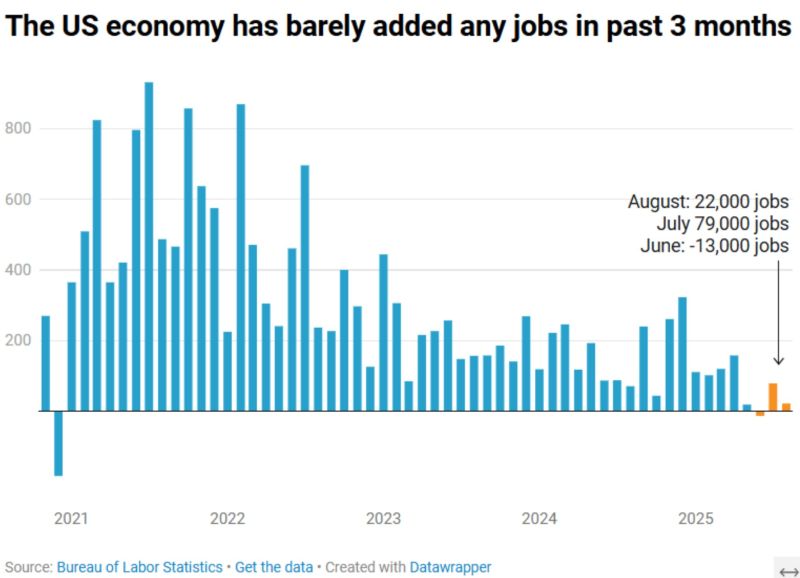

‼️ JUST IN: Another WEAK jobs report

The US economy added only 22,000 jobs in August ➡️ That’s much weaker than expected. 1) The unemployment rate rose to 4.3% --> Highest since October 2021. 2) June job growth was revised down to -13,000 (!). July was revised up slightly to 79k (from 73k). 🌈 Wages grew 3.7% in the past year (above 2.7% inflation). Source: Heather Long @byHeatherLong on X

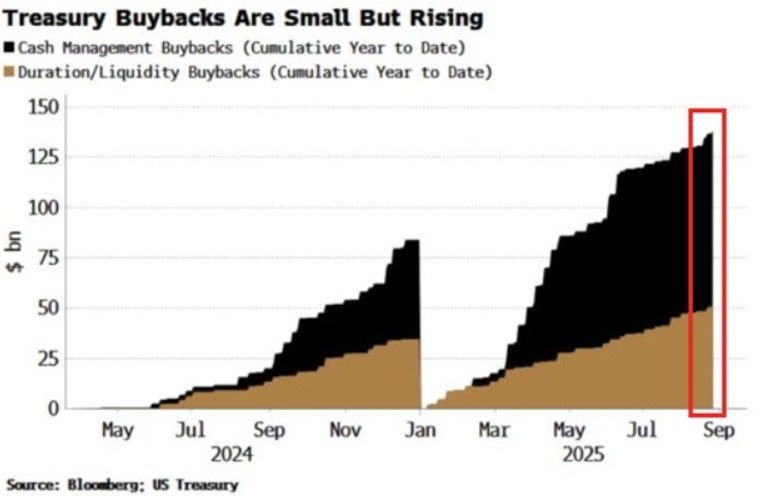

Treasury buybacks are accelerating

As highlighted by The Kobeissi Letter on X: " The US Treasury has bought back a record $138 billion in bonds YTD. This significantly surpasses the $79 billion repurchased during the entire 2024. This buyback program aims to boost liquidity and manage cash, as deficit spending continues to surge. In July, the Treasury said it would buy back 10- to 30-year Treasuries TWICE as often. As a result, Bloomberg’s measure of Treasury liquidity has materially improved over the last year. The world’s largest bond market can no longer function without intervention". Source: The Kobeissi letter, Bloomberg

Debt in the U.S. is spiraling faster than ever

On July 2nd, the national debt was $36.2 trillion. By September 4th, it hit $37.4 trillion. That’s $1.2 trillion in just two months over $21 billion added every day. At the same time, government spending is running at levels we used to only see during wars or crises like 2008 and Covid. The difference? Today’s economy is still called “strong.” Source: stockmarket.news on X

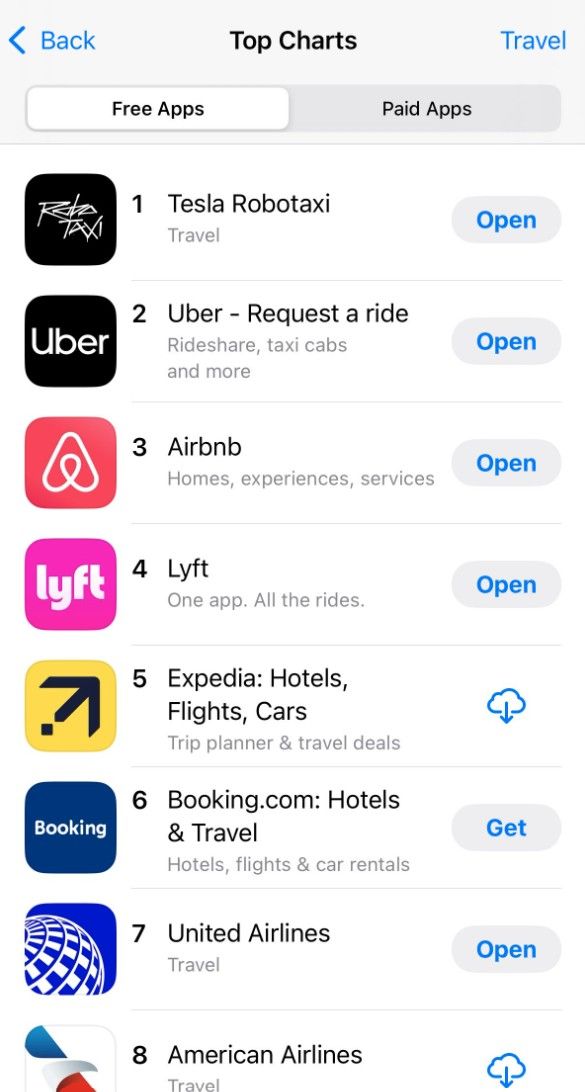

Tesla Robotaxi has already surpassed Uber on the App Store, ranking #1 in the Travel category

99%+ of these users can’t even use the app yet. Source: Ali Mirzaei @AliMirzaei0 on X

American Eagle $AEO shares just had their best day in history (+37.9%)

What a chart! And thank you Sydney Sweeney...📈📈 Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks