Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

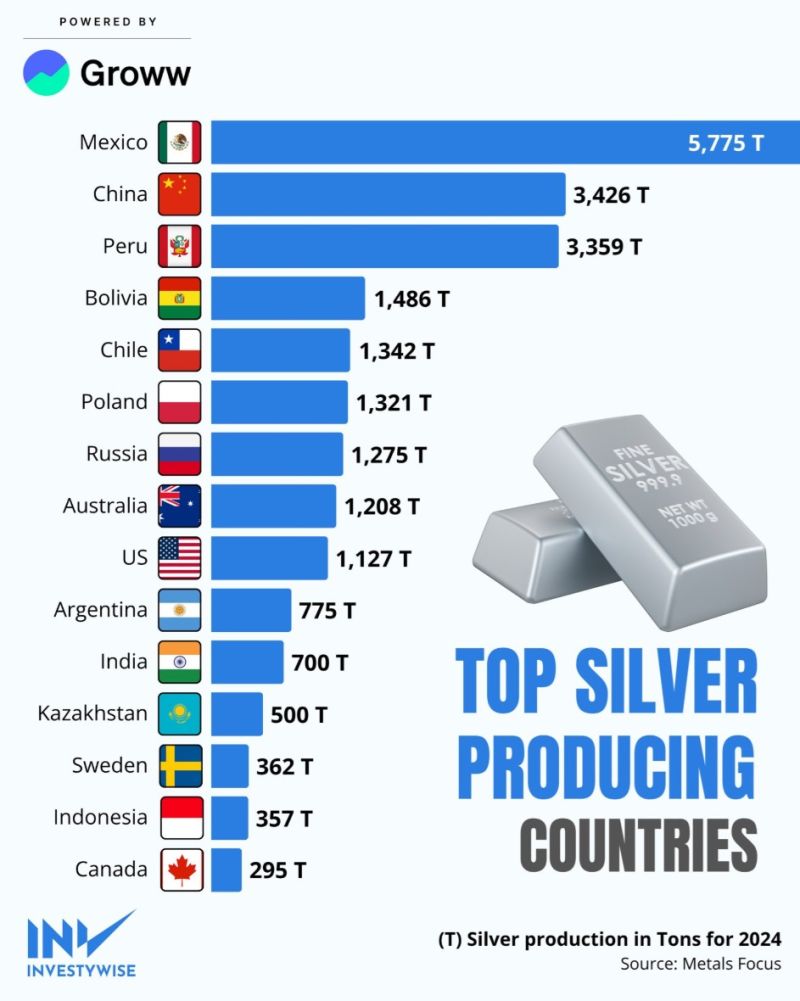

Mexico tops the list as the largest Silver Mine producer in 2024, followed by China and Peru.

Source: InvestyWise @Investywise

US funding market stress >>> Surging SOFR rates signaling a liquidity shortage

The most important indicator, as always, remains the SOFR rate: should the recent drift higher continue, the self-fulfilling cascade of a liquidity shortage will almost certainly be activated. And it did worsen... Source: zerohedge

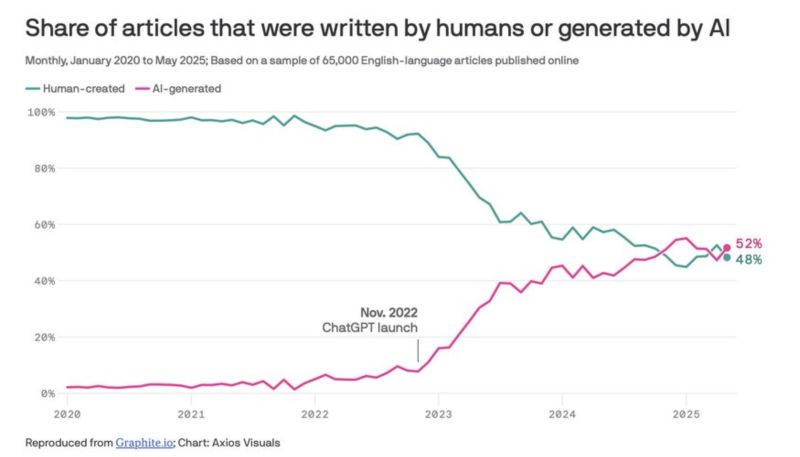

According to Oxford Researchers, the share of articles that are written by AI is now larger than the share of articles which are human created.

AI content went from ~5% in 2020 to 52% by May 2025. Projections say 90%+ by next year. Why? AI articles cost <$0.01. Human writers cost $10-100. The issue is the following: when AI trains on AI-generated content, quality degrades. Rare ideas disappear. Source: Ask Perplexity

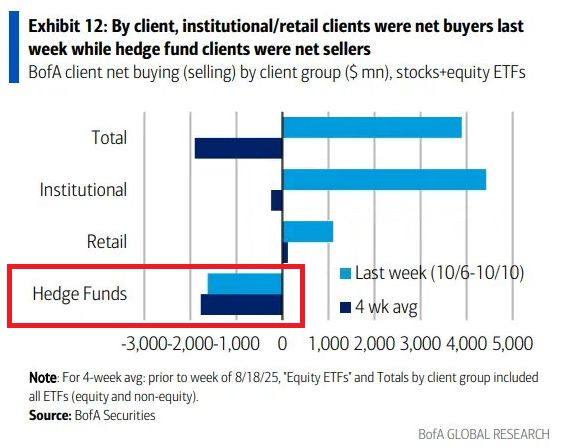

Hedge funds are SELLING massive amount of US equities:

Hedge funds sold $1.7 BILLION last week and $2.1 billion in the prior week, marking their 5th STRAIGHT week of selling. Retail and institutional investors turned to buyers. Nevertheless, the total 4-week selling was $1.9 billion. Source: BofA, Global Markets Investor

Airlines are facing cancellations and disruption as the US government shutdown enters its third full week

https://on.ft.com/492mNVZ Source: FT

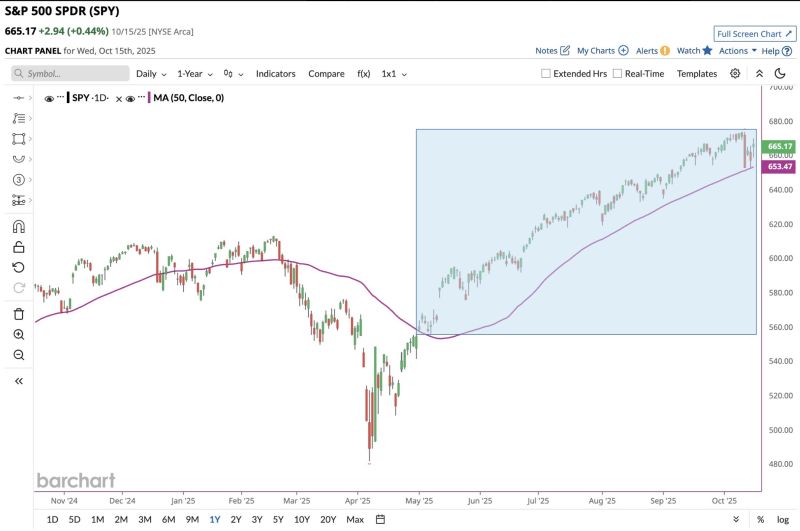

S&P 500 has now closed above its 50-day moving average for 116 consecutive trading days, the 3rd longest streak going back to 1990 (1995 and 2007 were longer)

Source: Barchart

Polymarket launches up/down equity markets, letting users bet on stock price movements with Wall Street Journal and Nasdaq as resolution sources.

Source: Cointelegraph @Cointelegraph

Steve Jobs literally explains why most people never succeed in life

Source: Hayes @neatprompts

Investing with intelligence

Our latest research, commentary and market outlooks