Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

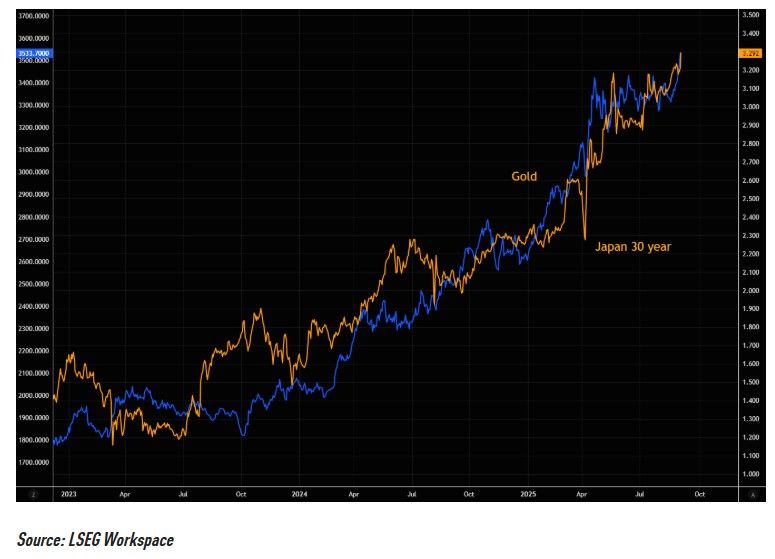

Gold knows

Gold is following the Japanese 30 year, pricing in "spillover" risks... Source: TME, LSEG workspace

U.S. Top 10 Tech Giants Reach $22 Trillion Market Cap in August 2025

As of August 29, 2025, the combined market capitalization of ten leading U.S. tech companies: Alphabet, Amazon, Apple, Broadcom, Meta, Microsoft, Netflix, Nvidia, Oracle, and Tesla, hit a record $21.95 trillion, representing roughly one-third of the U.S. equity market. From 2012 to 2025, their market cap grew at a 23% compound annual growth rate (CAGR), underscoring their dominant role in shaping market performance. Source: Econovis

In the AI race between Alphabet $GOOGL and Microsoft $MSFT, Alphabet is once again clearly ahead

Since the launch of ChatGPT, Alphabet stock has risen nearly 128%, while Microsoft's share price has only increased 98%. Source: HolgerZ, Bloomberg

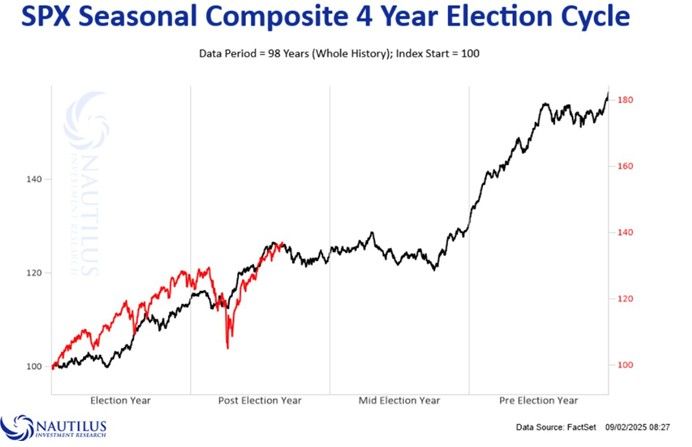

Lots of talks about seasonality these days...

If you believe in election cycle, we are in for a stretch of sideways at best. Source: Nautilus thru RBC

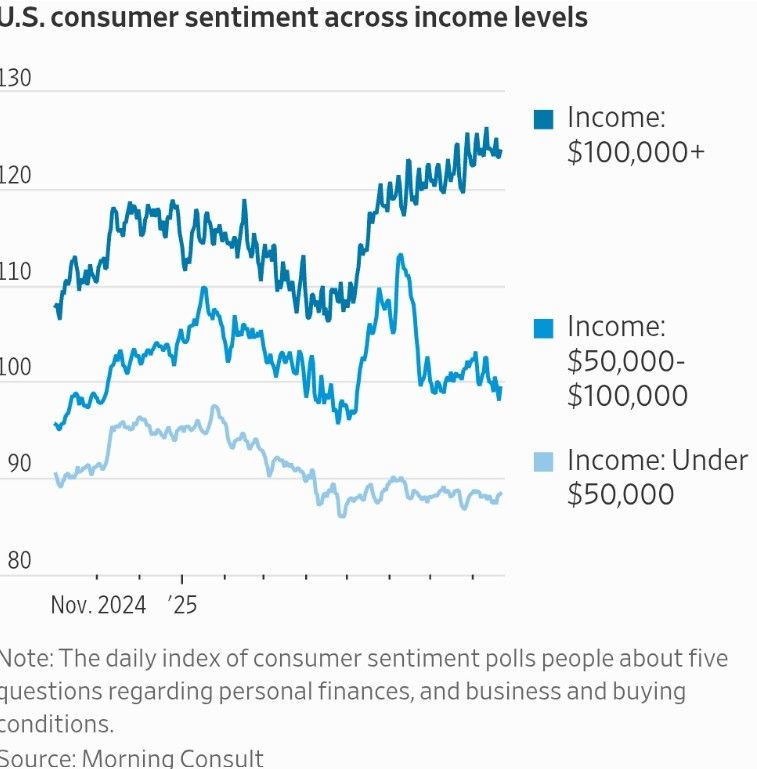

The gap in 🇺🇸 consumer confidence is widening.

Wealthier households remain upbeat, while middle-income sentiment has slumped sharply since June — now looking closer to lower-income pessimism. It’s the middle class that’s starting to feel the squeeze.

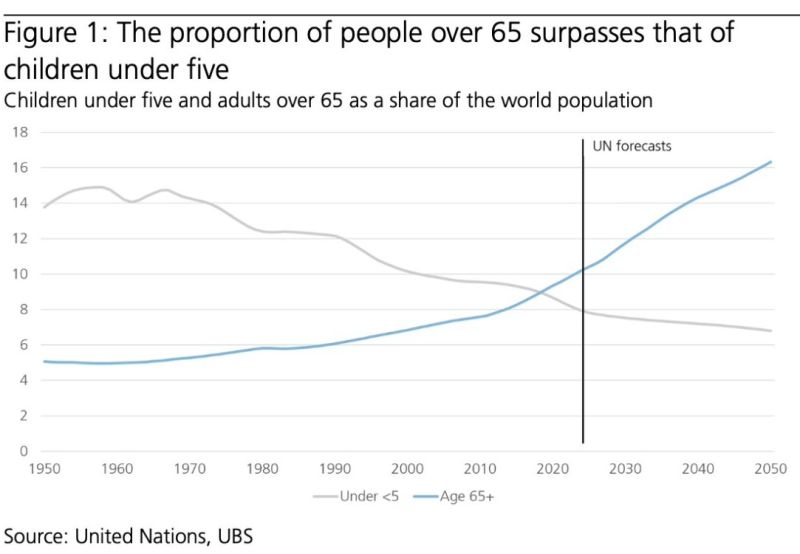

More seniors than toddlers — a turning point in demographics

Slow, steady, and unstoppable—like a glacier—demographic shifts are quietly transforming economies and societies. UBS highlights how changing age structures, migration, and longevity are not just slow-moving backdrops but fundamental forces that will define markets, growth models, and policy choices for decades to come. A reminder that some of the most profound transformations happen quietly, in plain sight. source : ubs

With the Fed’s reverse repo facility nearly drained, the system now leans on reserves as the main buffer.

Right now, they sit at ~$3.2T, which the Fed still calls “ample.” Governor Waller has suggested ~$2.7T is a safe floor, while Barclays sees end-September reserves sliding closer to that line. The problem? Treasury bill issuance and QT are still pulling cash out each month. With no RRP cushion left, every dollar matters more and once reserves fall into the danger zone, stress tends to show up fast in repo markets, auctions, and short-term funding. Source: StockMarket.News @_Investinq on X

Tariffs, Courts & Treasuries

A U.S. federal appeals court has ruled that the Trump administration misused emergency powers to impose tariffs that have been bringing in roughly $30 billion per month. If upheld, the decision could force Washington to repay importers and remove the steepest trade taxes in a century. The case is now on an expedited track to the Supreme Court, with a key October 14 deadline looming. What’s at stake? - Congress relied on these tariff revenues to help offset this year’s tax cuts. A rollback could leave a deeper fiscal hole, unsettling Treasury buyers. - Importers say nothing changes until the court outcome, but market uncertainty is rising. - Steel and aluminum duties (1962 Act) and other tariffs (1974 Trade Act) are not affected — the dispute centers on the 1977 emergency powers. Trade policy and fiscal stability are deeply intertwined.

Investing with intelligence

Our latest research, commentary and market outlooks