Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

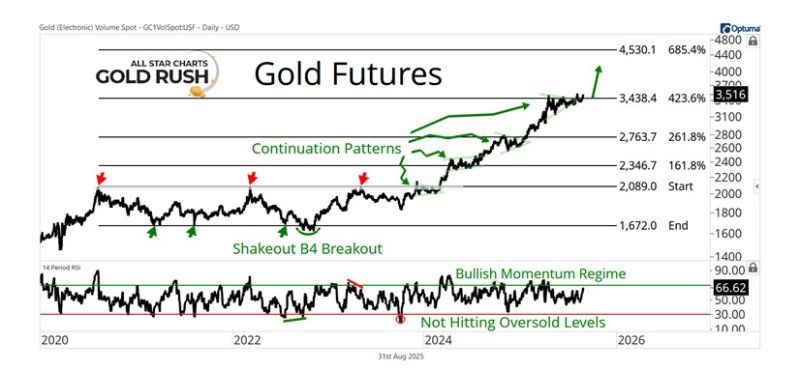

What's next for gold?

Here's the technical analysis view from J-C Parets: "After spending months coiling beneath the 423.6% Fibonacci extension, Gold futures are now resolving higher. This has been the pattern time and time again. Gold pauses at an extension level, builds energy, then launches to the next target. Every one of those continuation patterns has marked the beginning of another leg higher, and this one looks no different. As long as this breakout sticks, we think 4,500 is next". Source: All Star Charts team

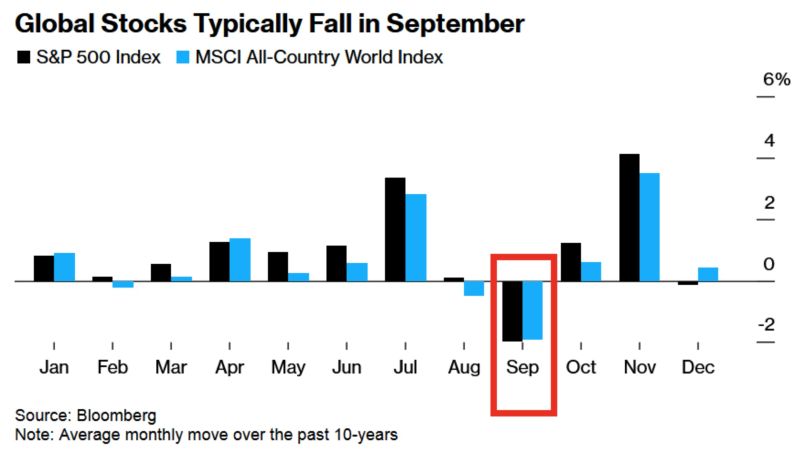

September is historically the WORST month for US and global stocks

The S&P 500 and MSCI All-Country World Index have averaged a –2% return in September over the past decade. Stocks fell in 4 out of the last 5 Septembers, with the steepest drop in 2022 — exceeding 9%. Source: Global Markets Investor @GlobalMktObserv, Bloomberg

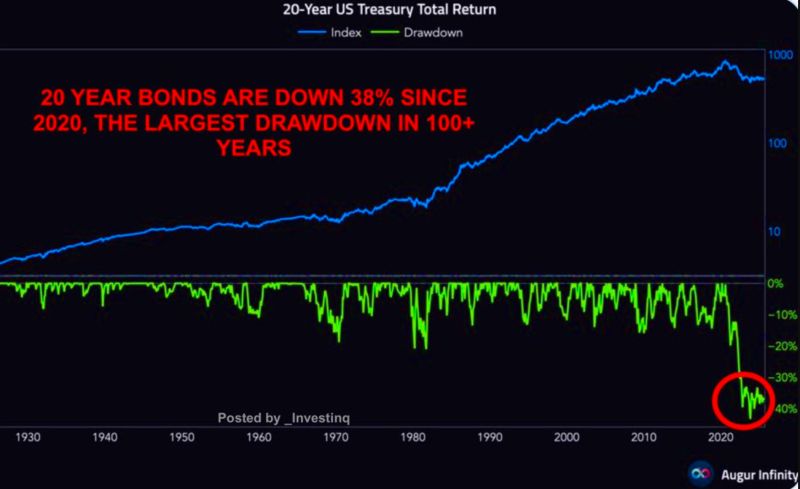

20-year US Treasuries are down ~38% since 2020, the worst drawdown in over a century

What was once seen as the world’s “safest” asset has instead delivered stock-like volatility. Deficits, inflation, and weak demand are forcing long yields higher. Source: stockmarket.news on X

Gold just hit all-time highs, 100 times the $35 it was in 1971 when Nixon closed the gold window

"The metal itself hasn’t changed; it’s still atomic number 79, the same as thousands of years ago. What changed is the dollar. Once it was tied to gold, now it floats, weakened by inflation and endless deficits. That’s why it takes over 100x more dollars to buy the same ounce". Source: StockMarket.News @_Investinq on X

Revolut employees are in line for big windfalls as the UK’s most valuable fintech allows staff to sell down their holdings in the company at a $75bn valuation

Revolut told staff on Monday that they would be allowed to sell up to 20 per cent of their shares to make way for other investors, according to people with knowledge of the matter and a document seen by the Financial Times. Source: FT https://lnkd.in/eRpjTMad

Investing with intelligence

Our latest research, commentary and market outlooks