Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

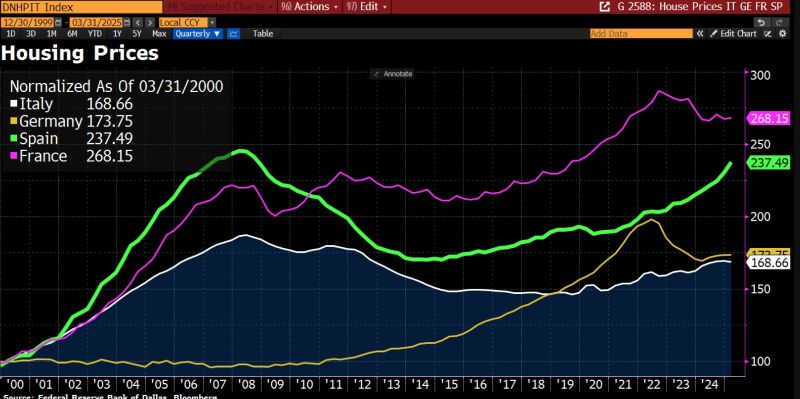

Housing market in Spain is booming.

Home sales and prices are closing in on the record highs set before the 2008 financial crash. The strong momentum is supported by a classic supply / demand imbalance. On the supply side, only about 100,000 new apartments are built each year – roughly a third of what’s needed. On the demand side: strong economic growth, a surge in tourism, and rising migration The house price index now sits just 3.2% below its 2008 peak. Source: Bloomberg, HolgerZ

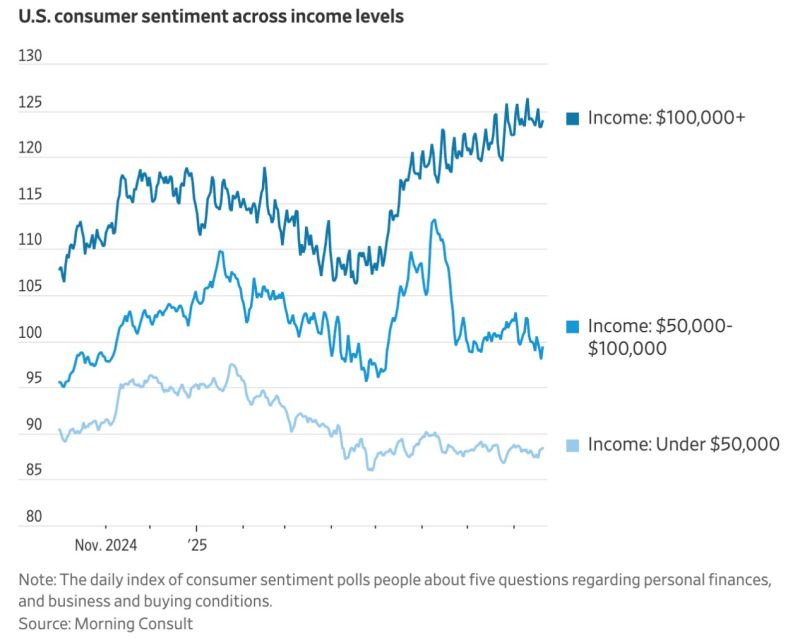

US consumer sentiment across income levels

An interesting perspective by Morning Consult. Source: Barchart

A suspected Russian interference attack targeting the president of the European Commission, Ursula von der Leyen

The Russian interference disabled GPS navigation services at a Bulgarian airport and forced the commission president’s plane to land using paper maps. Source: FT

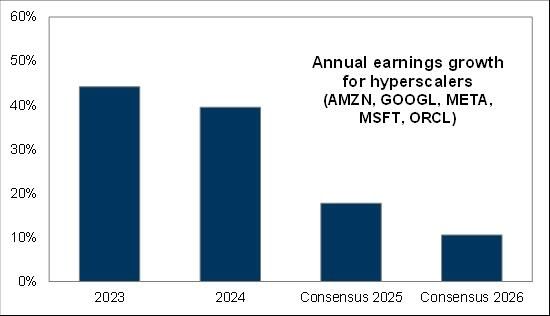

Hyperscaler growth is set to slow meaningfully over the next year

Will AI CapEx follow? Chart: Goldman Sachs thru Markets & Mayhem

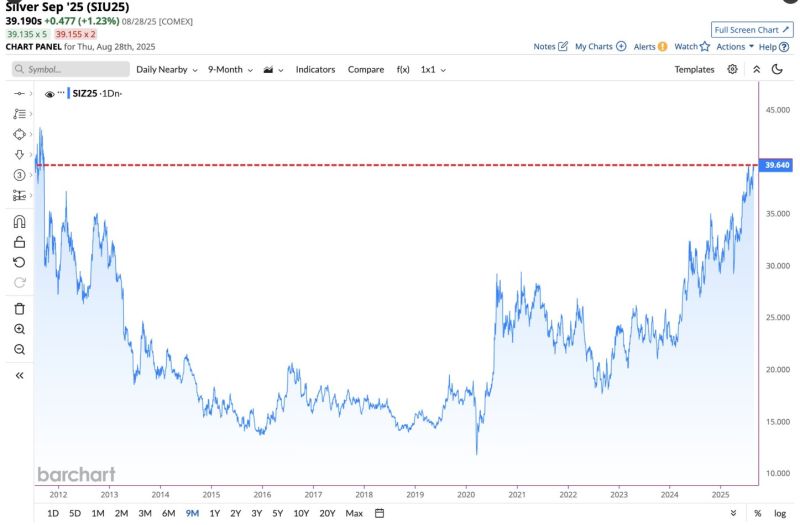

In case you missed it... silver hits highest closing price in almost 14 years 📈📈

Source: Barchart

Credit spreads have rarely been this tight.

So why are investors in corporate bonds undeterred despite the significant tightening in risk spreads (chart below)? Two reasons: 1) Higher yields ("risk free" component + spreads 2) More and more investors see corporate bonds as less risky than sovereign bonds Source chart: Bloomberg

JPMorgan analysts believe Bitcoin ($BTC) is trading below its fair value as its price volatility falls to historic lows, narrowing the asset's risk-adjusted gap with gold.

Volatility in Bitcoin has slid from nearly 60% earlier this year to roughly 30%, the lowest level on record. Analysts led by Nikolaos Panigirtzoglou said this dynamic implies a fair value near $126,000, a target they expect could be reached by year-end, according to The Block. A major driver of the decline in volatility has been corporate treasuries, which now hold over 6% of Bitcoin's total supply. JPMorgan compared the phenomenon to the post-2008 bond market, where central bank quantitative easing dampened swings by locking assets into balance sheets. Source: Yahoo Finance, Coindesk

Investing with intelligence

Our latest research, commentary and market outlooks