Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

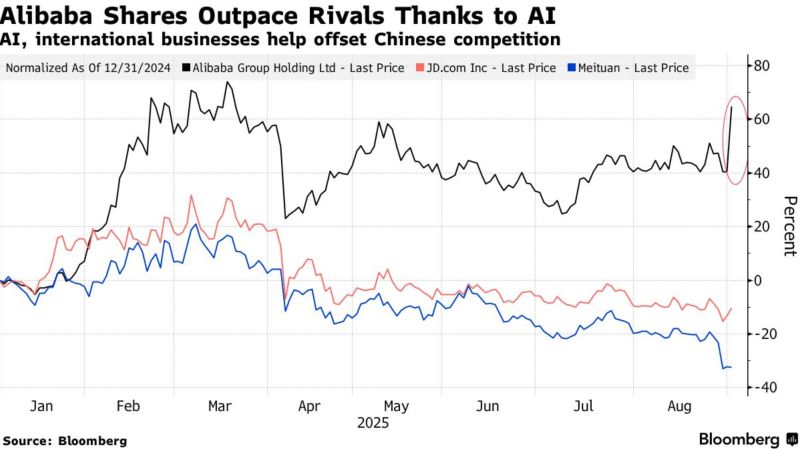

$BABA Alibaba shares are jumping +18%

The most since 2022, after China’s e-commerce leader posted a triple-digit percentage gain in AI-related product revenue as well as a better-than-anticipated 26% jump in sales from the cloud division. Alibaba’s rally also helped energize the broader AI sphere: Ernie developer Baidu gained as much as 5.8%, while Tencent Holdings also climbed. “Alibaba’s breakout reinforces a broader theme in Asia: while global tech remains preoccupied with geopolitics and valuations, parts of China tech are quietly REACCELERATING—driven not by hype, but by real revenue growth in AI and cloud,” said Charu Chanana, chief investment strategist at Saxo Markets. “This isn’t a broad-based rotation yet—but the divergence is real.” Source: Bloomberg, @neilksethi on X

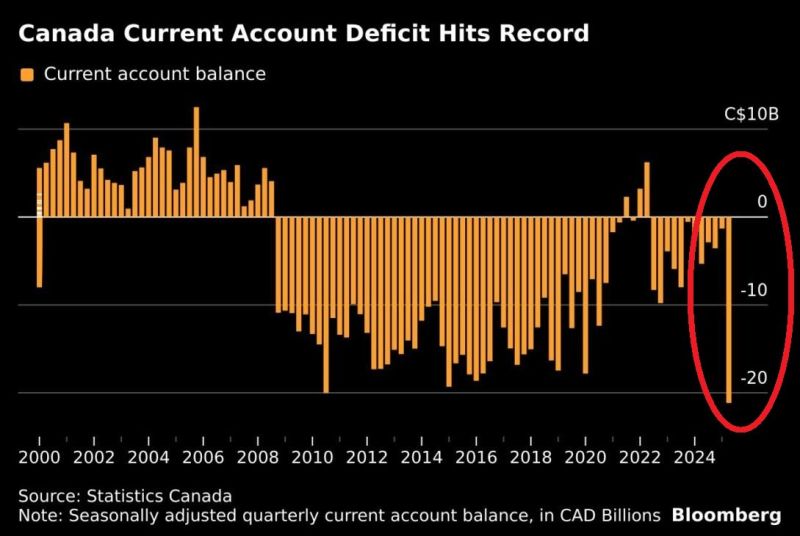

⚠️ Way more more money is flowing out of Canada than coming in

Canada’s current account deficit reached C$21.16 billion in Q2 2025, AN ALL-TIME HIGH. Additionally, trade deficit in goods widened to a record C$19.6 BILLION. US tariffs seem to be hurting Canada's economy. Source: Global Markets Investor, Bloomberg

Tariffs are forcing countries to make new partnerships

Do you remember the proverb? "The enemy of my enemy is my friend" Source: @krassenstein on X

Analysts have raised $NVDA estimate after Q2 earnings.

The stock is now trading at just ~27x on next year EPS estimate while growing at ~50% Source: The AI Investor @The_AI_Investor

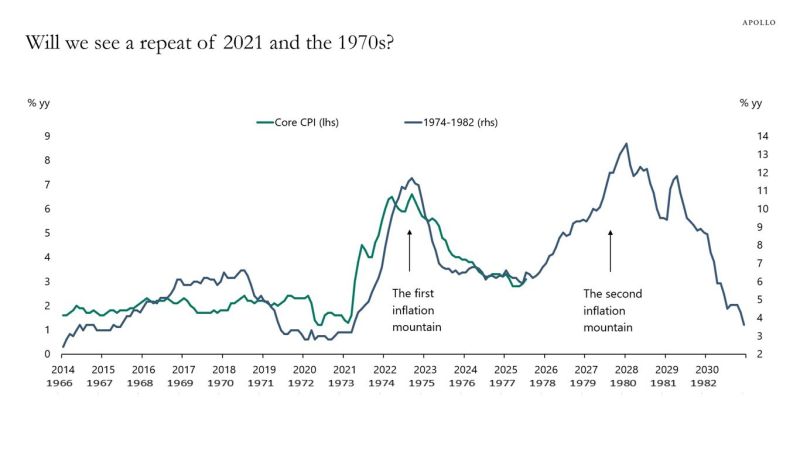

Apollo: "Yes tariffs are inflationary - so too is a US dollar depreciation - that results in a coming inflation mountain"

See chart below inflation 2021 cycle relative to 1970s. Source: Apollo, Samantha LaDuc on X

German stock market valuations have hit HISTORIC levels:

DAX index forward P/E ratio relative to the Euro Stoxx 600 P/E reached the highest level since the Financial Crisis. DAX P/E is 16x, above the average of 13x over the last 10 years. Source: Global Markets Investor, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks