Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Chocoladefabriken Lindt – Retesting Breakout Level

After a consolidation of more than 16% since the June highs, Lindt has now come back to retest the support zone at 11'090–11'750, which also coincides with the February breakout level. We’re seeing constructive price action on the shorter timeframes, suggesting that this level is attracting buyers and could act as a solid base. Source: Bloomberg

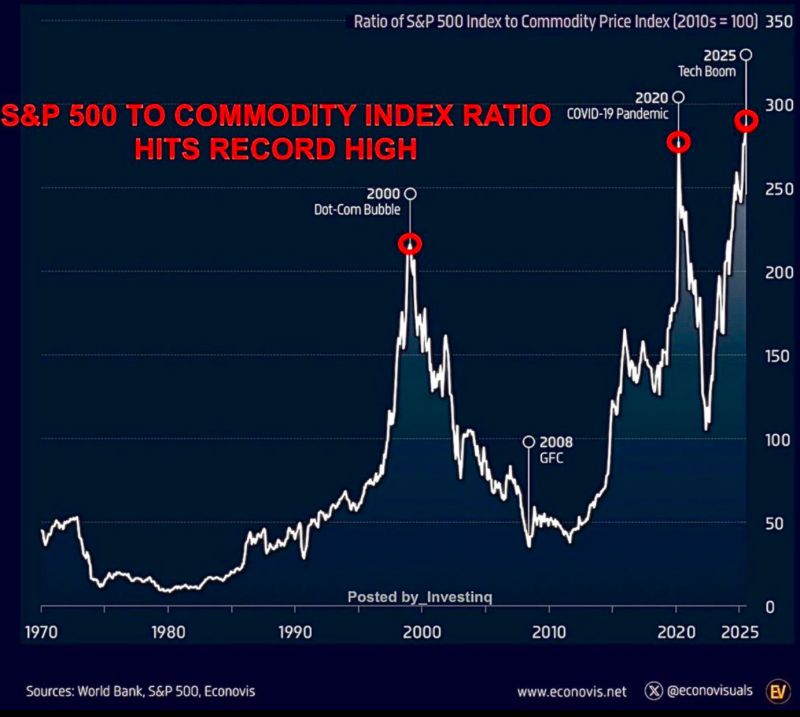

A new all-time-high for sp500 to commodities ratio

Source: Worldbank, Econovis

😨 New European car registrations of Tesla vehicles totaled 8,837 in July, down 40% year-on-year, according to the European Automobile Manufacturers Association, or ACEA.

🏆 BYD recorded 13,503 new registrations in July, up 225% annually. 🚨 Elon Musk’s automaker faces a number of challenges in Europe, including intense ongoing competition and reputational damage to the brand. Source: CNBC

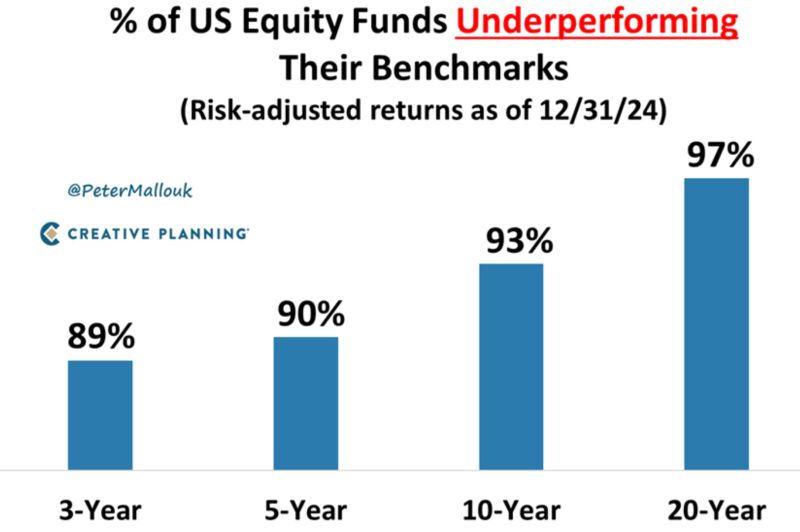

"Don't look for the needle in the haystack. Just buy the haystack!" - Jack Bogle

Source: Peter Mallouk @PeterMallouk

Analysts are raising their Nvidia $NVDA targets across the board

• JPMorgan: $170 → $215 • Rosenblatt: $200 → $215 • Benchmark: $190 → $220 • BofA Securities: $220 → $235 • Citi: $170 → $215 • Jefferies: $200 → $205 • KeyBanc: $215 → $230 • DA Davidson: $135 → $195 • Trust Securities: $210 → $228 Source: Stocktwits

🚨Hedge funds are dumping US stocks

Hedge funds sold $2.0 billion in single stocks and ETFs last week, bringing the 4-week average of selling to $0.5 billion. Interestingly, retail sold $0.9 billion, the 1st time in 8 weeks. Institutional investors bought $1.6 billion. Source: Global Markets Investors , BofA

The measure of intelligence is the ability to change

Source: Limitless Life @LimitlessLif3

Investing with intelligence

Our latest research, commentary and market outlooks