Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The US just sold $70 billion of 5-year Treasuries.

The Bid-to-Cover ratio was 2.36. Foreign buyers pulled back but US buyers stepped up in record size. Here's the breakdown: • Foreign accounts (called “Indirects”) bought 60.5%. • Domestic institutions (called “Directs”) bought a record 30.7%. • Dealers (big banks) bought only 8.8%, the lowest ever. Now here’s the twist: even though the auction was definitely a poor one, the bond market rallied afterwards. 10-year Treasury yields actually dropped. Why? Because traders were braced for worse. “Not awful” was good enough to spark a rally. Source: StockMarket.news

Despite ballooning debt, scare of Fed independence, tariffs, etc. the market's perception of USA sovereign risk is back at pre-Trump lows.

Source: zerohedge

$UBER announces the launch of Uber Trains

From 2029, 10 high-speed trains could connect Stratford Intl to Brussels, Paris, Lille & more via the Channel Tunnel. Partnering with Gemini Trains, tickets may be booked directly in the app alongside cabs, bikes and more. ➡️ Transport multinational Uber, known for its ride-hailing app, has announced it is launching a new train service between the UK, France and Belgium. ➡️ Uber Trains aims to run 10 high-speed trains from London to Paris, Lille and Brussels using the Channel Tunnel. ➡️ The trains will depart from Stratford International Station in East London and are expected to initially focus on the London to Paris route. Passengers would be able to book tickets via the Uber app. ➡️ Uber will partner with start-up Gemini Trains to launch the new service, which could be operational as soon as 2029, subject to receiving the necessary permits.

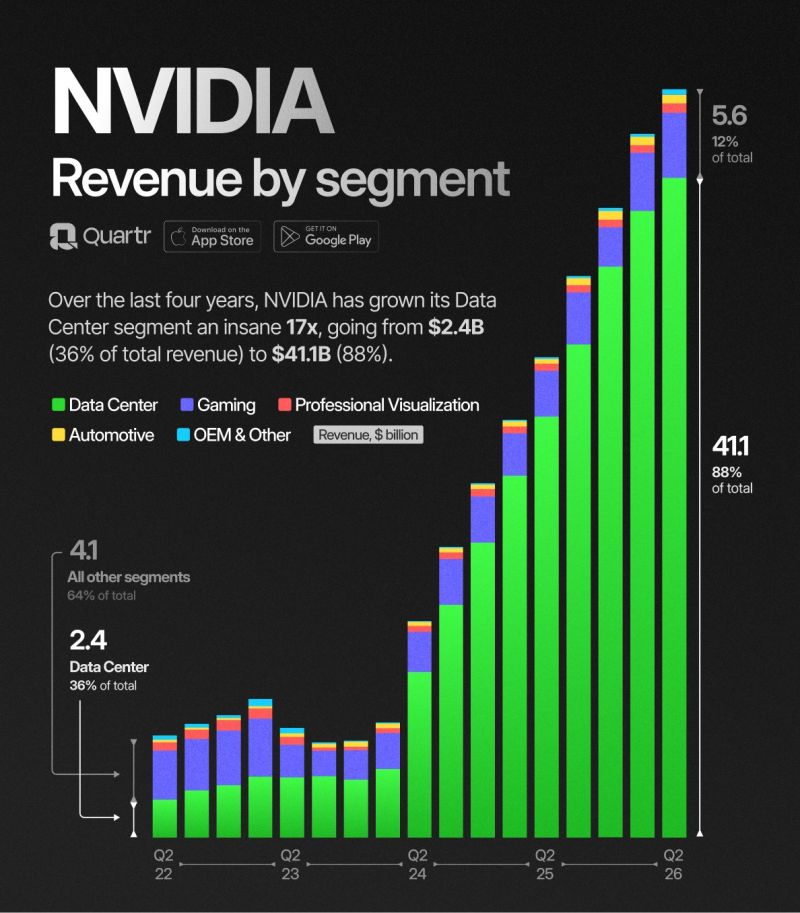

🔥 NVIDIA (NASDAQ: $NVDA) earnings are in! Another DOUBLE beat from the world’s most valuable company! 🚀

EPS: $1.05 vs. $1.01 est. (+4.17%) YoY EPS growth: +54.41% ($0.68 last year) Revenue: $46.743B vs. $46.018B est. (+1.58%) YoY Revenue growth: +55.60% ($30.04B last year) Q2 FY26 Highlights: 🤖 Data Center: $41.1B 🧠 Blackwell AI surge: +17% seq 💰 New $60B buyback approved Q3 guide: $54B revenue 😤Note that the outlook does NOT include any shipments of H20 chips to China. Nvidia is excluding China data center revenue from future projections to give Wall Street a clearer baseline in an otherwise volatile environment. Bottom-line: Nvidia beat on revenue and earnings but didn't raise guidance. The result? It's down after market, but no crash (-2% to -3%). Source: Quant Data @QuantData, Day Trading News

$NVDA Q2 2026

"Production of Blackwell Ultra is ramping at full speed, and demand is extraordinary." - Jensen Huang Revenue growth by segment: *Data Center +56% *Gaming +49% *Professional Vis. +32% *Automotive +69% Source: Quartr

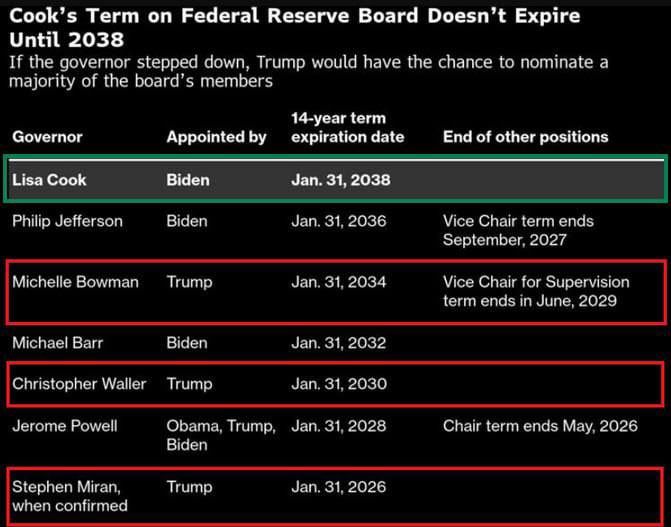

Trumps Fed power shift in play

➡️ Trump’s push to remove Fed Governor Lisa Cook, could flip the balance of power inside the Fed. If Cook is out, Trump-appointed Governors would hold 4 of 7 seats (excluding Powell). That would give Trump the majority on the board for the first time in history. This shift could open the door to aggressive easing. Cook’s term runs until 2038, making this challenge unprecedented. The Fed has never faced a political reshuffle like this, and the outcome could define the next chapter for US rates and markets. Source: MartyParty @martypartymusic

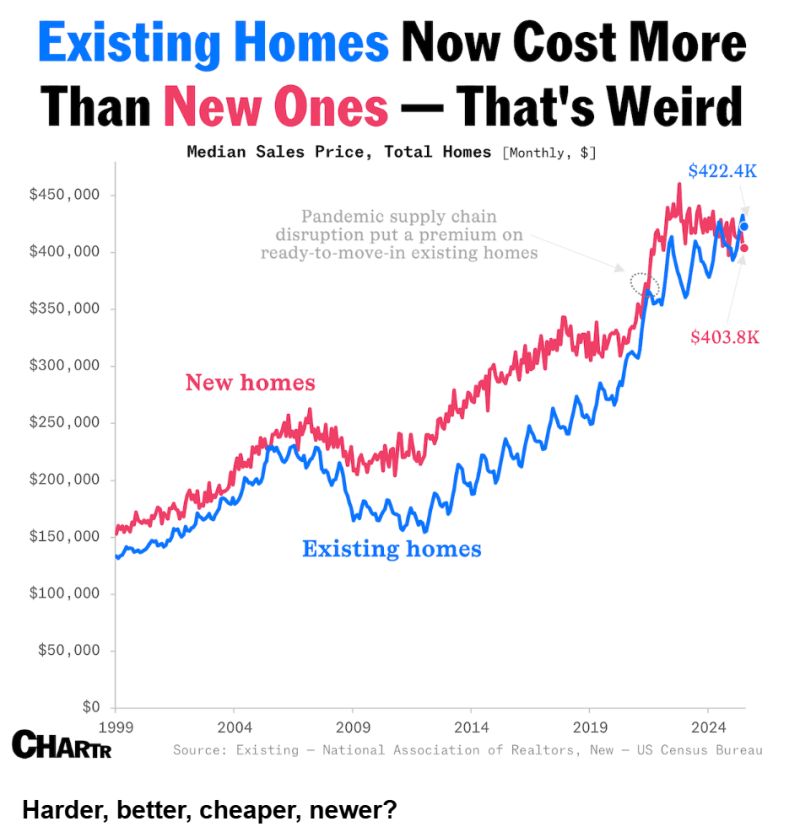

Marrying two datasets from the Census Bureau and the National Association of Realtors.

This reveals that the median $403,800 sales price of new homes was lower than the $422,400 median price of existing homes nationally as of July. The reason? There’s simply way too many newly completed homes. As of July, the inventory of unsold new homes on the market would take more than nine months to clear, the highest level in 15 years excluding the pandemic, compared to the 4.6-month supply of existing homes. To attract buyers and trim their overflowing inventories, homebuilders are adding discounts to new home deals, like mortgage rate “buydowns” of about 5% on average — even if it hurts their margins. In fact, a record 38% of builders said they cut home prices in July, per the National Association of Home Builders. Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks