Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Apple $AAPL gets a downgrade from Needham which warns that investors shouldn't enter a position until the price hits $170-$180

Source: Barchart

“Early signs indicate that many businesses are quickly raising prices for shoppers, to cover most of the higher costs from sweeping U.S. tariffs on imported goods.”

Source: Kalani o Māui on X

TRUMP TAPS PALANTIR: A DATABASE FOR ALL AMERICANS….

Trump is moving ahead with a plan to create a sweeping national citizen database using Palantir Technologies. The collaboration, has Palantir’s Foundry platform pulling data from across federal agencies, including health records, bank details, and social services, into one central hub. Critics say it’s a “surveillance nightmare,” with fears it could be misused for political ends. Source: Yahoo Finance, Benzinga, NewsNation thru Mario Nawfal on X

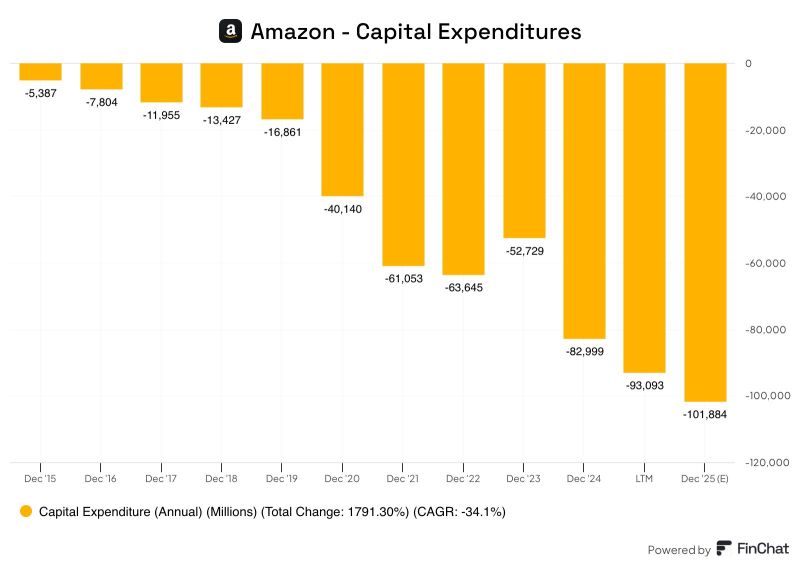

Amazon will be the first company ever to spend more than $100 billion on capital expenditures in a single year.

More than 50% of that CapEx will be spent on tech infrastructure. How much more runway does AWS have to grow? $AMZN Source: finchat

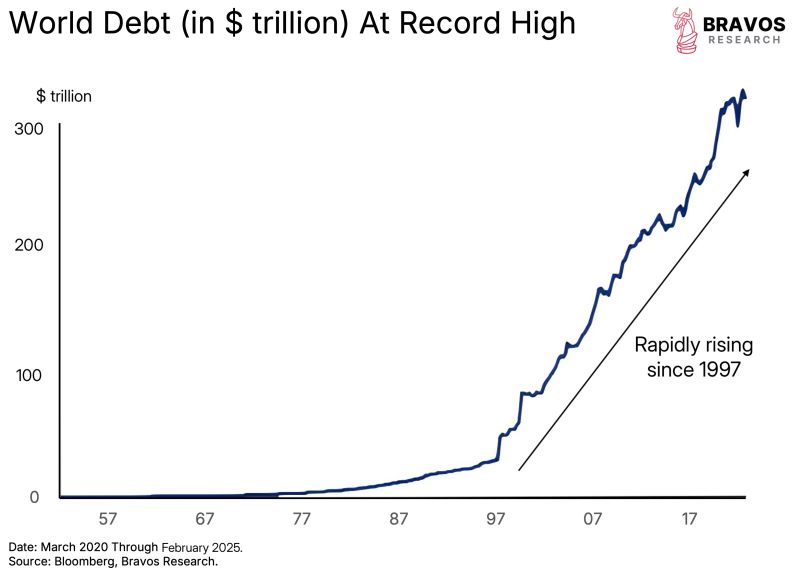

World debt has now officially crossed $300 trillion

And still continues to climb aggressively Source: Bravos Research

Investing with intelligence

Our latest research, commentary and market outlooks