Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

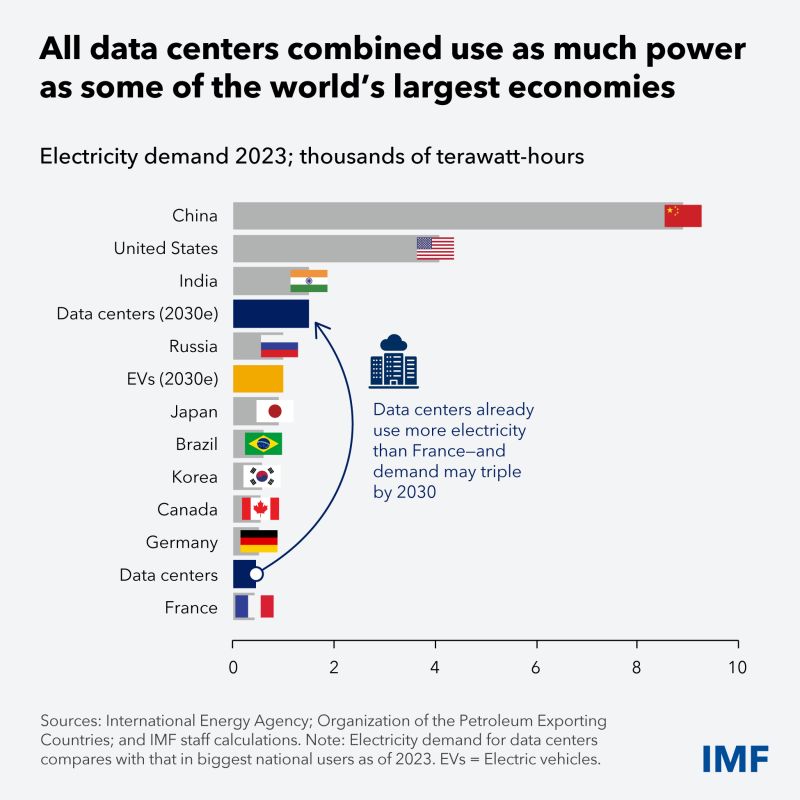

The @AI boom means the world’s datacenters use more electricity than almost every country.

As the chart below shows, electricity used by data centers alone, already as much as that of Germany or France, would by 2030 be comparable to that of India, the world's third-largest electricity user. This would also leapfrog over the projected consumption by electric vehicles, using 1.5 times as much power than EVs by the decade’s end. Data center energy consumption is growing fastest in the United States, home to the world’s largest concentration of centers. Power needed for US server farms is likely to more than triple, exceeding 600 terawatt-hours by 2030, according to a medium-demand scenario projection by McKinsey & Co. The boom in building new warehouses for data stored in the cloud and answering AI queries underscores the urgency for policymakers, who need effective energy strategies to ensure adequate supplies can meet surging demands. Increasing electricity demand from the technology sector will stimulate overall supply, which, if responsive enough, will lead to only a small increase in power prices. More sluggish supply responses, however, will spur much steeper cost increases that hurt consumers and businesses and possibly curb growth of the AI industry itself. Source: IMF

Stocks would plunge 10% and the U.S. Dollar would fall 5% if the foreign tax provision, known as Section 899, passes Congress, warns Allianz SE 🚨🚨

Source: Barchart

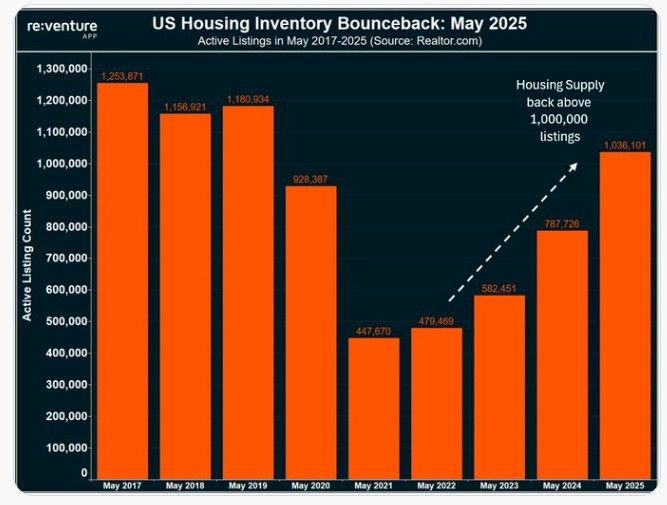

The U.S. housing market just broke 1,000,000 listings.

Excess inventory is piling up. Relative to buyer demand, we now have the highest inventory in close to a decade. Which is causing home prices to drop in over half the U.S. Source: Nick Gerli @nickgerli1

U.S. May. Nonfarm Payrolls: 139K, [Est. 130k, Prev. 177K]

May. Unemployment Rate: 4.2%, [Est. 4.2%, Prev. 4.2%] May. Average Hourly Earnings (MoM): 0.4%, [Est. 0.3%, Prev. 0.2%] May. Average Hourly Earnings (YoY): 3.9%, [Est. 3.7%, Prev. 3.8%] Source: Bloomberg

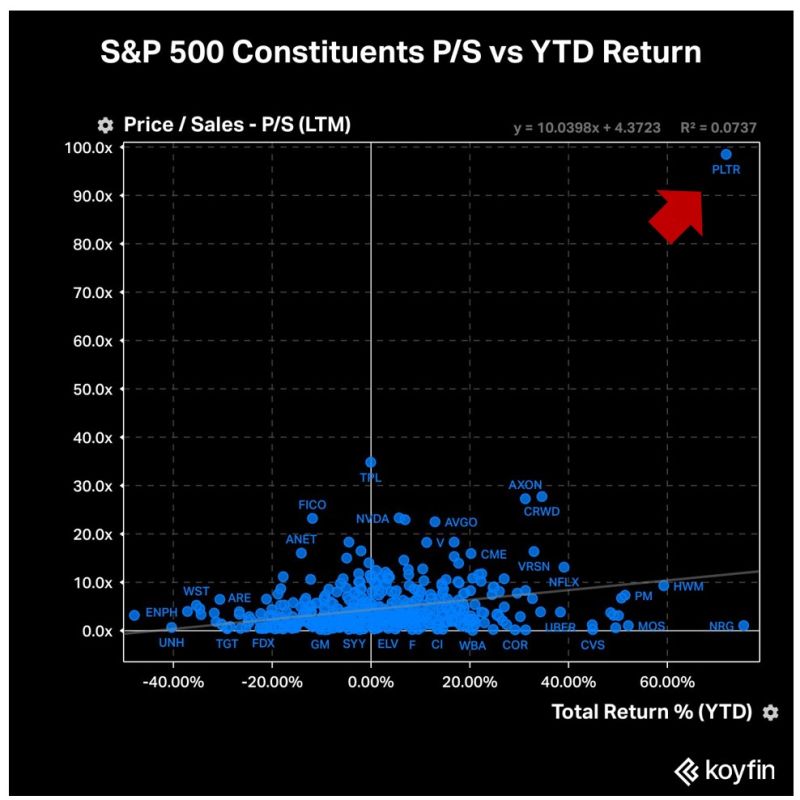

If you squint hard enough, you'll notice an outlier in the S&P 500 when it comes to Price/Sales vs YTD Return.

Source: Koyfin

Circle stock ($CRCL) surges 168% in blockbuster NYSE Debut as stablecoin giant goes public.

The stablecoin issuer's shares closed at $83.23, marking the crypto industry's second-largest public listing. The stablecoin giant's first day as a public company saw explosive trading activity, with 47.1 million shares changing hands as the stock swung between a daily high of $103.75 and low of $66.60. The dramatic price action pushed Circle's market capitalization to $16.7 billion by the closing bell, a remarkable turnaround for a company that had priced its IPO below its previous private market valuation. Circle's successful flotation represents the largest crypto-related public listing since Coinbase's 2021 debut and marks a watershed moment for the stablecoin sector. The Boston-based company raised $1.05 billion in an upsized offering that comes three years after a failed attempt to go public through a $9 billion SPAC transaction that collapsed in 2022. Source: www.blocklead.co

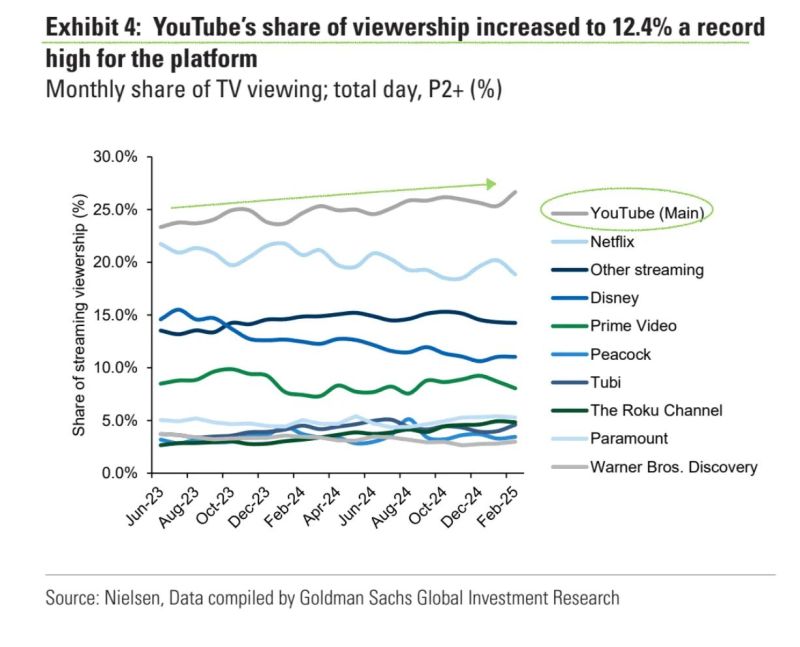

YouTube is now the No.1 platform on U.S. TVs, with a 12.4% share of total viewing and 25%+ among streamings.

Its ad + subscription revenue topped $50B last year. At Netflix's 12x sales multiple, YouTube alone could be worth $700B+. $GOOG $GOOGL $NFLX Source: Vlad Investment Bastion

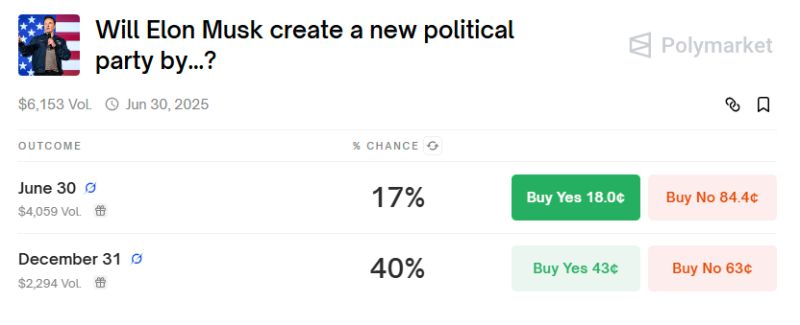

Will Musk create a new political party?

Source: www.zerohedge.com, Polymarkets

Investing with intelligence

Our latest research, commentary and market outlooks

![U.S. May. Nonfarm Payrolls: 139K, [Est. 130k, Prev. 177K]](https://blog.syzgroup.com/hubfs/10-Jun-06-2025-02-36-54-5263-PM.jpg)