Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

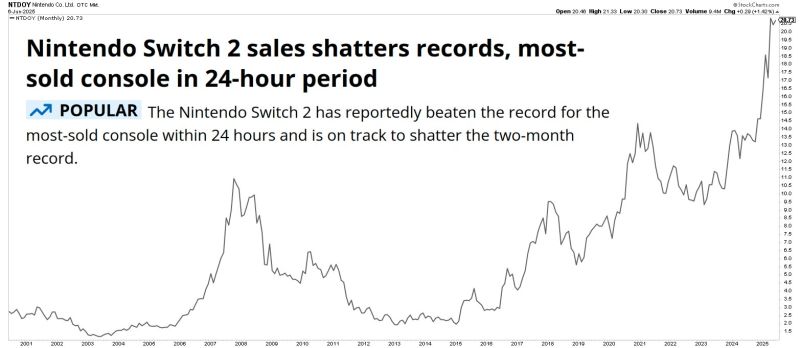

The Nintendo Switch 2 launch absolutely blew away expectations.

Below the monthly chart of Nintendo stock $NTDOY (7974.T-JP:Tokyo Stock Exchange) Source: Markets & Mayhem

Lesson of the week-end...

Always believe in yourself... till the very end

China’s exports growth missed expectations in May

dragged down by a sharp decline in shipments to the U.S., with analysts saying effects of a Beijing-Washington trade truce will be visible in June data. 🟥 Chinese exports to the U.S. plunged 34.5% from a year ago, marking the sharpest drop since February 2020, according to Wind Information, when the Covid-19 pandemic disrupted trade. Imports from the U.S. dropped over 18%, and China’s trade surplus with America shrank by 41.55% year on year to $18 billion. Overall exports rose 4.8% last month in U.S. dollar terms from a year earlier, customs data showed Monday, shy of Reuters’ poll estimates of a 5% jump. 🟥 Imports plunged 3.4% in May from a year earlier, a drastic drop compared to economists’ expectations of a 0.9% fall. Imports had been declining this year, largely owed to sluggish domestic demand. That was largely offset by its shipment to the Southeast Asian bloc, which jumped nearly 15% from a year, and those to European Union countries and Africa, which rose 12% and over 33%, respectively. Source: CNBC

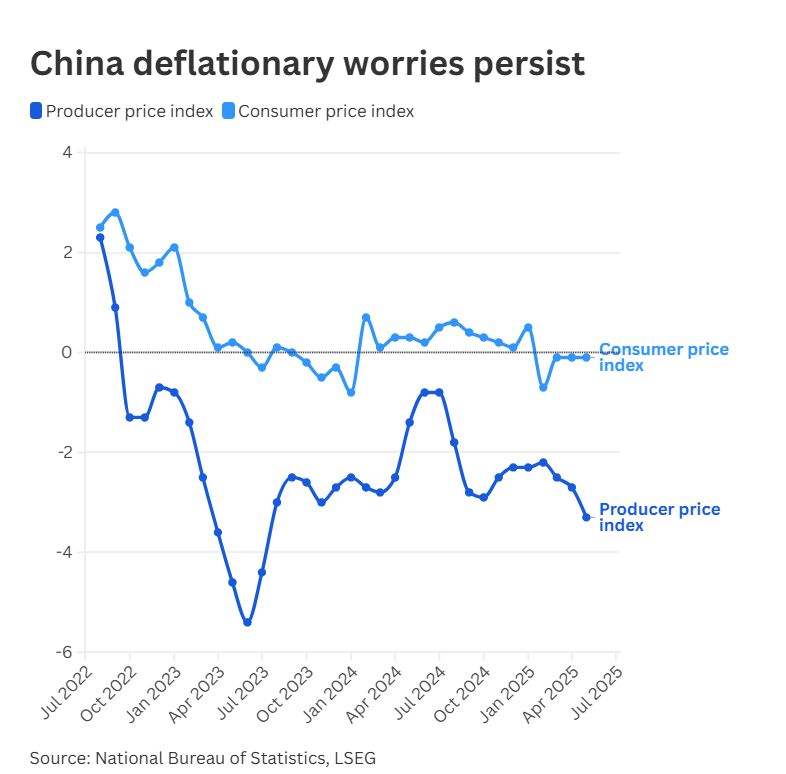

China’s consumer prices fell for a fourth consecutive month in May

Beijing’s stimulus measures appear insufficient to boost domestic consumption, with price wars in the auto sector adding to downward pressure. 🟥 The consumer price index fell 0.1% from a year earlier, according to data from the National Bureau of Statistics released Monday, compared with Reuters’ median estimate of a 0.2% decline. 🟥 CPI slipped into negative territory in February, falling 0.7% from a year ago, and has continued to post year-on-year declines of 0.1% in March, April, and now May. Core inflation, excluding food and energy prices, however, rose 0.6% in May — highest since January this year, according to Wind Information. Separately, deflation in the country’s factory-gate or producer prices deepened, falling 3.3% from a year earlier in May, marking the steepest decline since July 2023 and a sharper drop compared with analysts’ estimates of a 3.2% fall, according to LSEG data. Source: CNBC

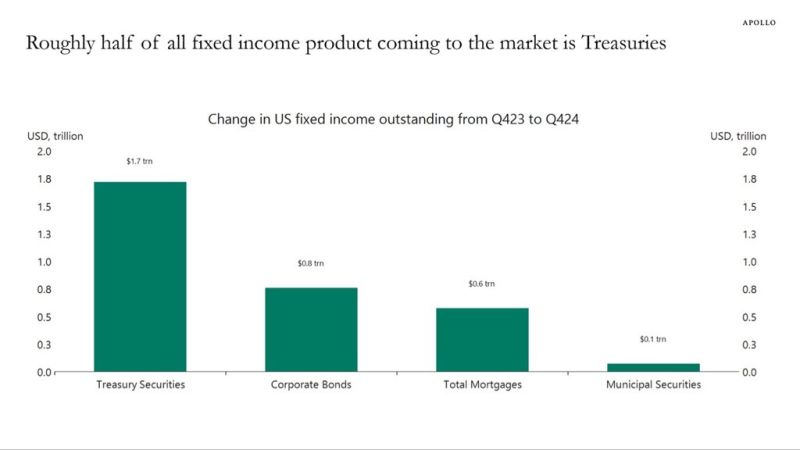

Apollo’s take on the treasury market and its implications:

👉 Over the past 12 months, roughly half of all fixed income product coming to the market has been Treasuries, see chart below. 👉 This is not healthy. Half of credit issued in the economy should not be going to the government. ➡️ The consequence is that investors need to allocate more and more dollars to finance the government rather than financing growth in the economy through loans to firms and consumers. Source: Peter Mallouk

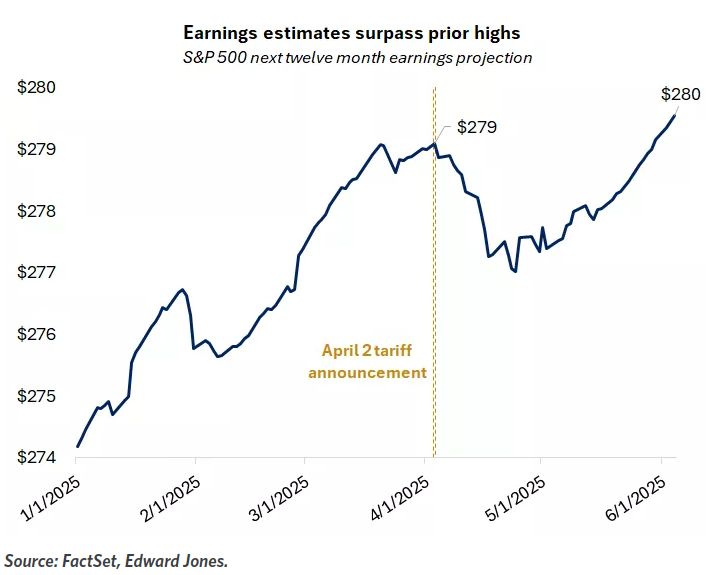

S&P 500 earnings estimates are now surpassing the prior high, which happened just before 'Liberation Day'.

First-quarter earnings season wraps up, underscoring corporate strength. S&P 500 companies grew profits 12.5% y-o-y, the third quarter of double-digit growth in the past four. While earnings growth estimates for 2025 have been revised down from 14% to 8.5%, the 2026 outlook remains steady, pointing to the potential for reacceleration. Notably, the forward 12-month earnings estimate has recently reached a new high, providing a fundamental anchor for rising equity markets. While valuations have undoubtedly contributed to the recent gains, earnings appear to have also played an important role as well. Source: Edward Jones

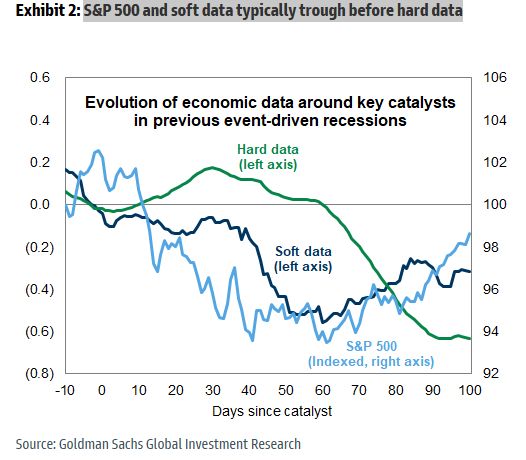

GS: S&P 500 and soft data typically trough before hard data

Source: Goldman Sachs, Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks