Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Portugal might bring back enhanced tax incentives, just for Golden Visa investors.

A 20% flat tax on local income. 0% on foreign income. Basically NHR 1.0… but gated behind a Golden Visa. If this passes, will demand explode? Source: Alessandro Palombo, Forbes

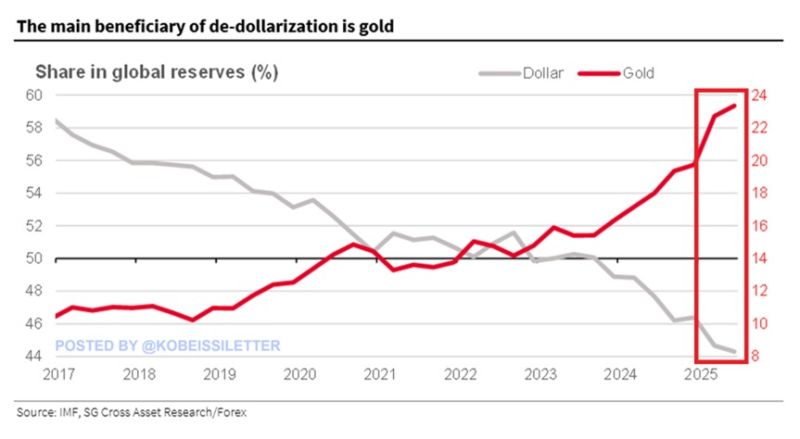

Gold's share of global reserves reached 23% in Q2 2025, the highest level in 30 years.

Over the last 6 years, the percentage has DOUBLED. At the same time, the US Dollar's share of international reserves has declined 10 percentage points, to 44%, the lowest since 1993 (dee left-hand scale). By comparison, the Euro's share has decreased 2 percentage points, to 16%, the lowest in 22 years. Gold is quickly replacing fiat currencies as a reserve currency. Keep watching gold.

BREAKING: Volatility

CBOE Volatility Index has plummeted 63% over the last 9 weeks, the largest volatility crush in history Source: Barchart

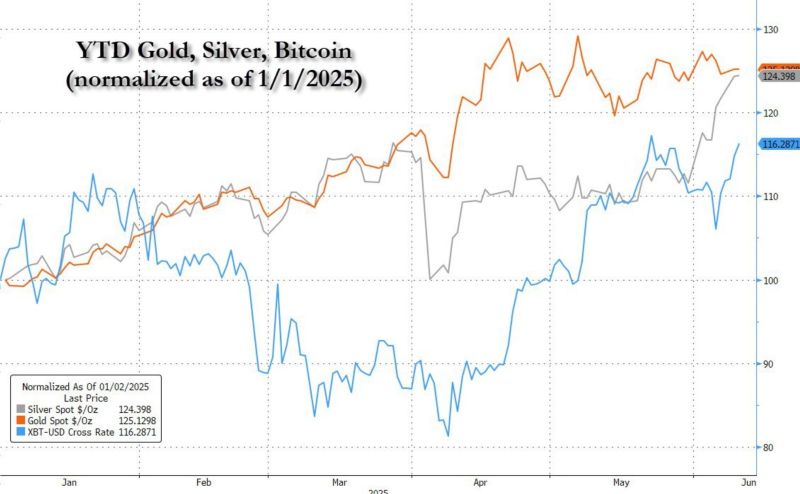

Silver about to surpass gold as best performing asset YTD

Source: zerohedge

Tesla stock $TSLA, surges over +5% as President Trump says he is not getting rid of his Tesla.

Trump also called Starlink a “good service” and say he wishes Elon well. Global Pulse on X: “Despite rising tensions, the Trump Vs Musk conflict will cool down in the coming days till next election. Both are high-stakes players, and neither wants to risk their empires”. Source image: Not Jerome Powell on X

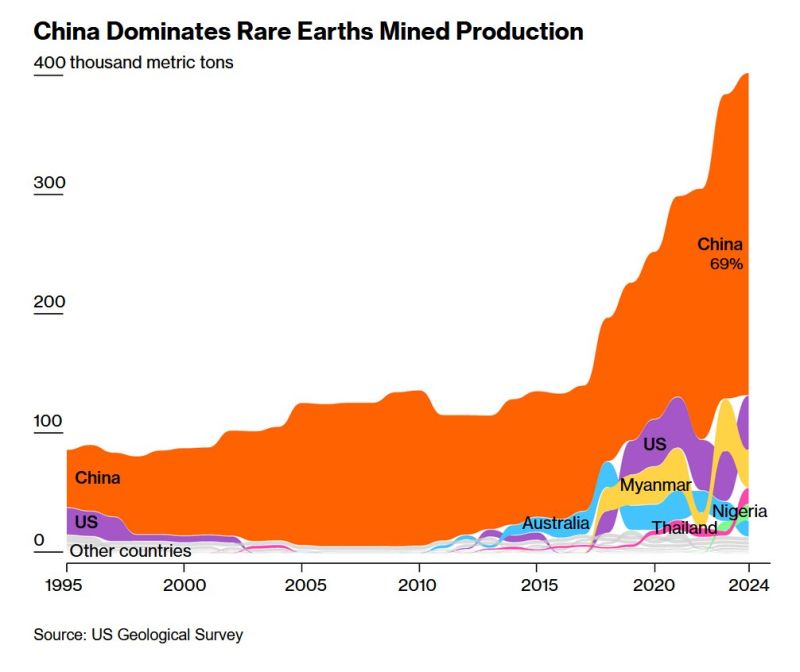

China dominates global rare earths production:

China now produces nearly 400,000 metric tons of rare earths a year. This is a massive 69% of the global output, per the US Geological Survey. The US is seeking to restore flows of critical minerals in today's trade talks. Source: Global Markets Investor

I know, it does not mean anything... still, this is a really big number...

Source: ₿TCHEL2025

Investing with intelligence

Our latest research, commentary and market outlooks