Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

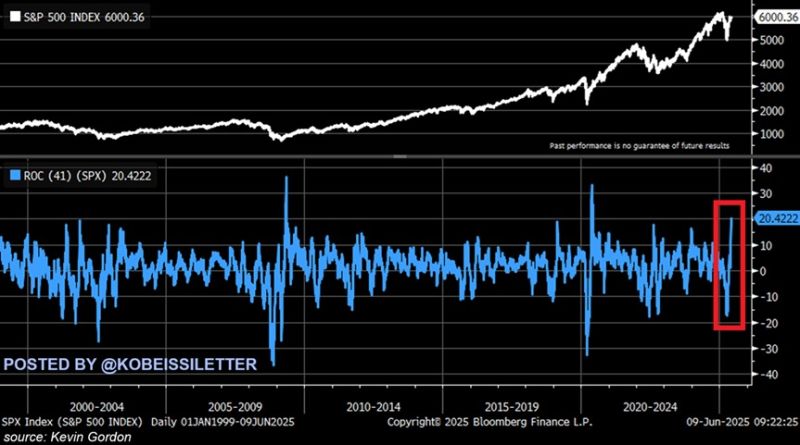

What do you notice on the picture below?

Source: Michel A.Arouet

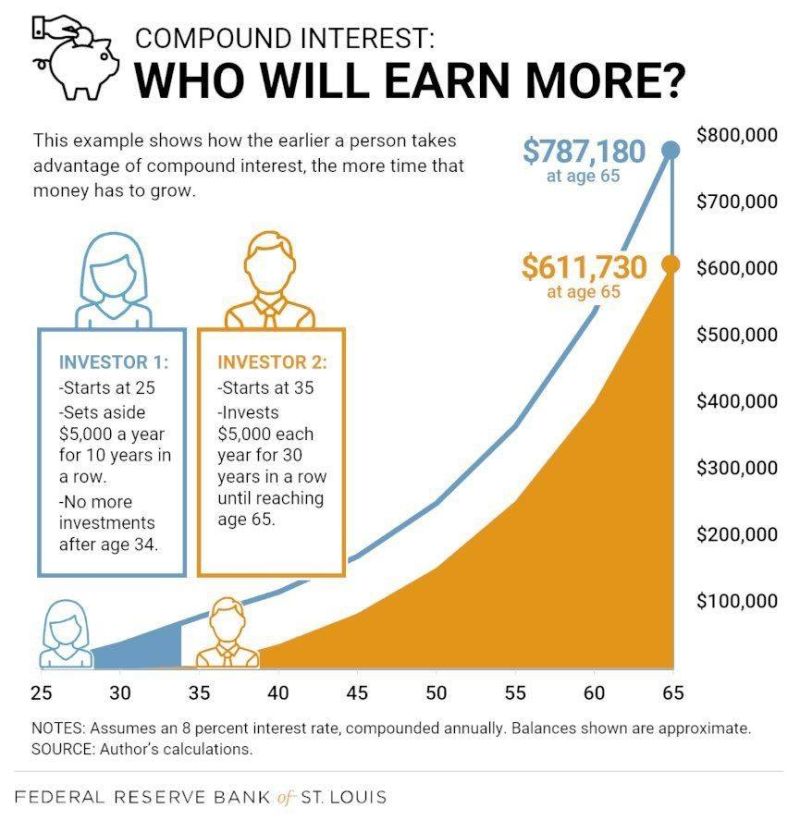

The Importance of Starting Your Investing Journey As Early As Possible

Source: Dividend Growth Investor

Bloomberg reports that US Treasury Secretary Scott Bessent is a possible contender to succeed Fed Chair Powell.

Last week, Trump said his pick for the next Fed Chair is “coming out very soon.” Source: The Kobeissi Letter

The SEC has asked Solana ETF issuers to submit amended S-1 forms within a week, potentially putting approval on track for July.

Source: cointelegraph

China, U.S. officials reach agreement for allowing rare-earth, tech trade.

The negotiators will now seek approval on the framework from the U.S. and Chinese presidents, before implementing it. The U.S. and China have reached an agreement on trade, representatives from both sides said after a second day of high-level talks in London, with the deal now awaiting a nod from the leaders of the two countries. “We have reached a framework to implement the Geneva consensus and the call between the two presidents,” U.S. Commerce Secretary Howard Lutnick told reporters. That echoed comments to reporters from Li Chenggang, China’s international trade representative and a vice minister at China’s Commerce Ministry. U.S. President Donald Trump and Chinese President Xi Jinping spoke by phone late last week, stabilizing what had become a fraught relationship with both countries accusing each other of violating the Geneva trade agreement. At a meeting in Switzerland in mid-May, the world’s two largest economies had agreed to a 90-day suspension of tariffs added in April, and a rollback of certain other measures. Lutnick said he and U.S. Trade Representative Jamieson Greer will head back to Washington, D.C., to “make sure President Trump approves” the deal outline. If Xi also agrees, then “we will implement the framework,” Lutnick said. Chinese restrictions on rare-earth exports to the U.S. are a “fundamental part” of the latest agreement and the U.S. expects the issue “will be resolved in this framework implementation,” Lutnick said. He indicated U.S. restrictions on sales of advanced tech to China in recent weeks would be rolled back as Beijing approves rare-earth exports. While Chinese state media had been quick to announce Xi’s call with Trump last week, Beijing’s official mouthpieces were conspicuously silent more than one hour after Lutnick’s comments, except for a lower-profile mention citing Vice Commerce Minister Li as saying that the talks helped build bilateral trust. On Tuesday local time in London, U.S. Treasury Secretary Scott Bessent told reporters he was headed back to the U.S. in order to testify before Congress. Chinese Vice Premier He Lifeng, the lead negotiator on trade talks with the U.S., and Chinese Minister of Commerce Wang Wentao also participated in this week’s discussions. China’s CSI 300 index was trading slightly higher, while U.S. stock futures were down as investors awaited details on the trade framework. First take >>> The fact that the two sides will now brief their leaders could be a sign that some disagreements or unresolved details still require internal discussion. The framework agreement signals a commitment to de-escalate and continue the dialogue process, but whether it will lead to concrete agreements or substantive breakthroughs continues to be uncertain. Source: Bloomberg, CNBC

The market's recovery has been truly historic:

The S&P 500 has rallied +20.4% over the last 41 trading sessions, its third-best run this century. During the same period, the Nasdaq 100 has risen +27.3%, its third-biggest rally since 2002. Only 2020 and 2008 haven seen such sharp recoveries over the last two decades. As a result, the S&P 500 and the Nasdaq 100 are now trading just 2.1% and 1.8% from their all-time highs. We have gone from a historically weak to a historically strong market in a matter of days. Source: The Kobeissi Letter, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks