Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Elon Musk has said he “regrets some” of his posts about Donald Trump, after a spat between two of the world’s most powerful men resulted in a public split last week.

“I regret some of my posts about President @realDonaldTrump last week. They went too far,” the Tesla chief executive said in a post on his social media company X on Wednesday. The relationship between the pair had shown signs of strains in recent weeks, with Musk criticising parts of the White House agenda, including the US president’s signature tax bill, which he called a “disgusting abomination”. It then imploded last week as the two traded insults. In a series of posts on X, Musk called for Trump to be impeached, suggested his trade tariffs would cause a US recession, threatened to decommission SpaceX capsules used to transport Nasa astronauts and insinuated the president was associated with the late paedophile Jeffrey Epstein. Allies have since urged the US president and his billionaire backer to repair their relationship. The FT reported last week that senior figures in the tech industry had urged the two to reunite, amid concerns the damaging spat could impact the administration’s plans for tax cuts and deregulation. ➡️ https://lnkd.in/e9V7yJua

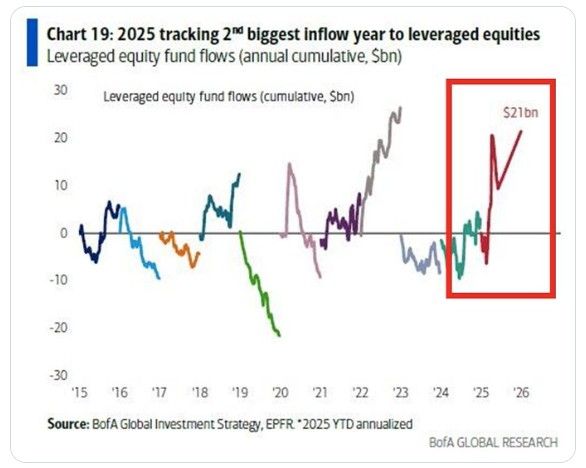

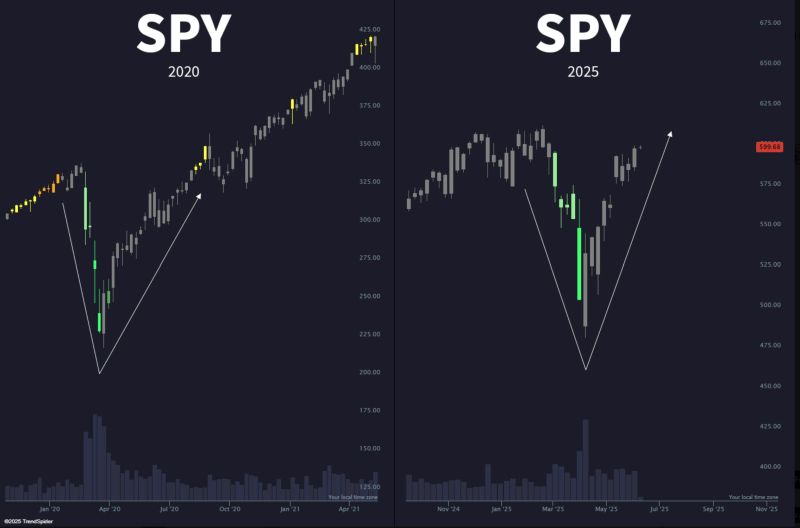

Market speculation is back with a vengeance...

Leveraged equity fund flows are on track for annual net inflows of $21 BILLION. This is almost in line with the 2022 record. Meanwhile, US leveraged equity ETFs currently hold near a RECORD $100BN in assets under management. Source: BofA, Global Markets Investor

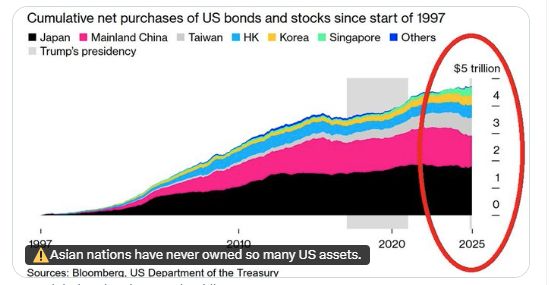

Asian nations have NEVER owned so many US assets:

The 11 largest Asian countries have accumulated $4.7 TRILLION of US stocks and bonds over the last 28 years. Their total investments in the US reached $7.5tn. ➡️ Will they bring the money back home? Source: Global Markets Investor, zerohedge, Bloomberg

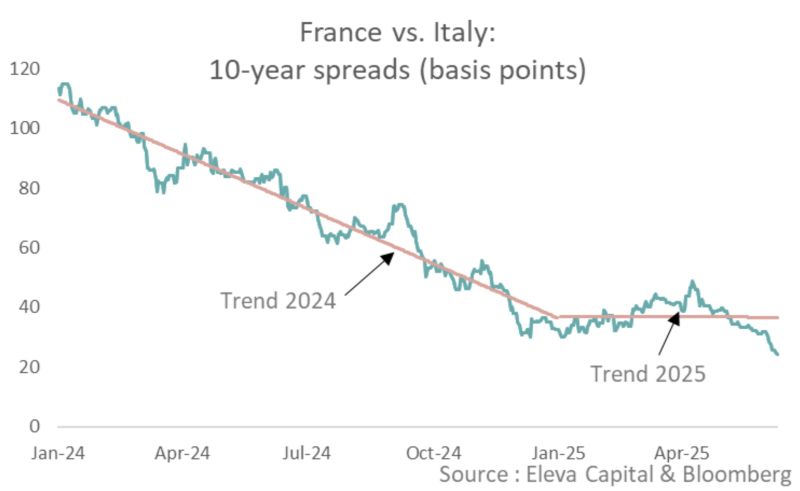

French-Italian 10y spread dropped below 25 bp this morning.

It was 115 bp at the start of last year… En route to zero? Source: Stephane Deo on X, Eleva Capital, Bloomberg

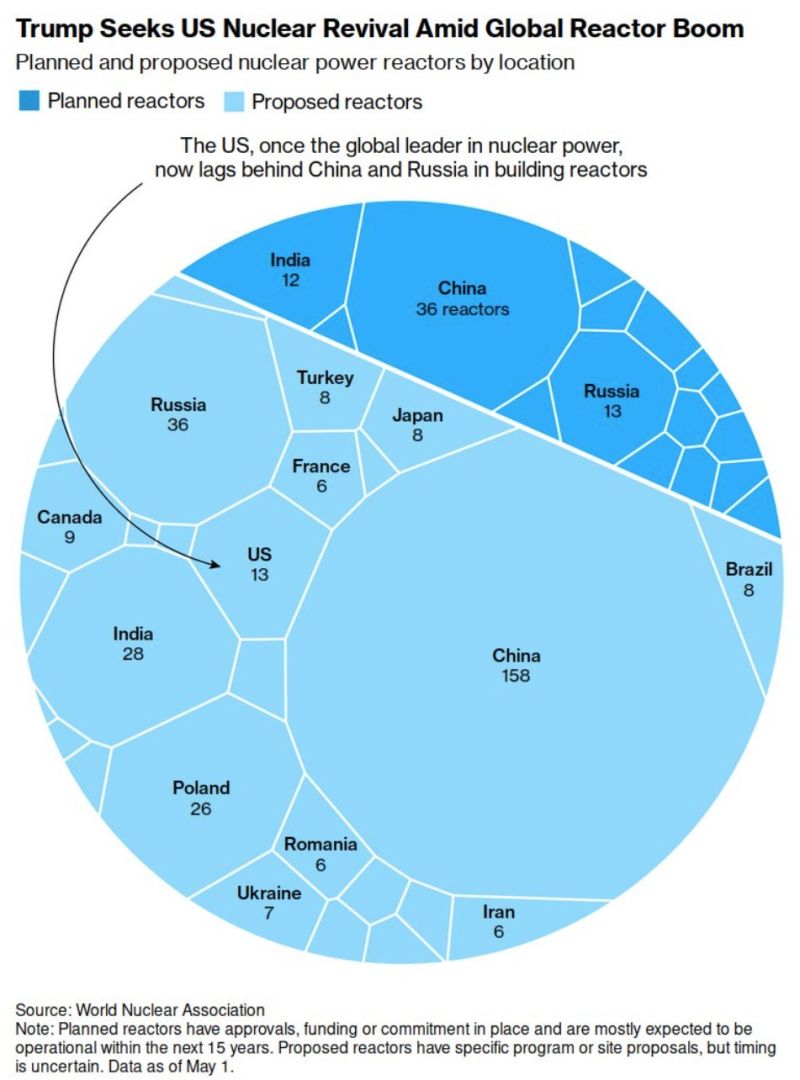

Bullish for the nuclear power sector and uranium producers

Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks