Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump said Wednesday that China’s President Xi Jinping was “extremely hard” to make a deal with

At a time when the White House has been suggesting the two leaders could talk this week amid a rise in trade tensions: “I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!,” the U.S. president wrote on Truth Social. That post on the social media platform came after a senior White House official told CNBC on Monday that Trump and Xi were likely to speak this week. Chinese Foreign Minister Wang Yi told the new U.S. Ambassador David Perdue during a meeting Tuesday that the recent string of “negative measures” by the Trump administration were based on “groundless reasons,” and undermined China’s legitimate rights and interests, according to the official English readout. Source: CNBC

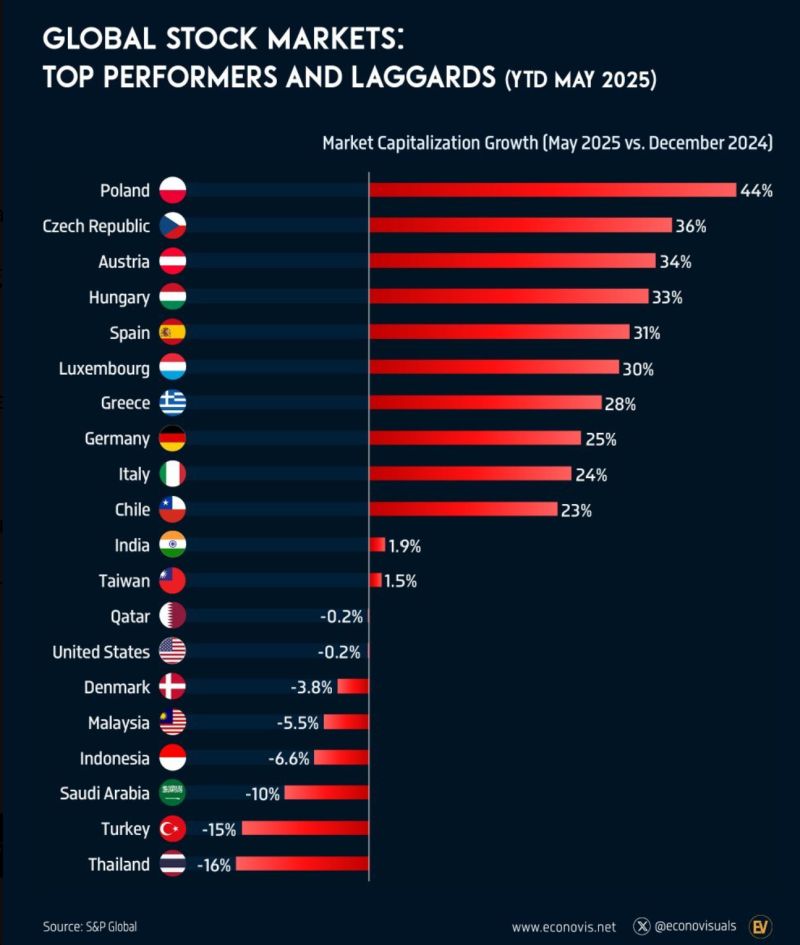

European markets have outperformed the US this year.

Poland, the Czech Republic, and Austria have grown their market capitalization by 44%, 36%, and 33%, respectively. Next are Hungary, Spain, Luxembourg, Greece, and Germany. The US has been flat. Source: Global Markets Investor

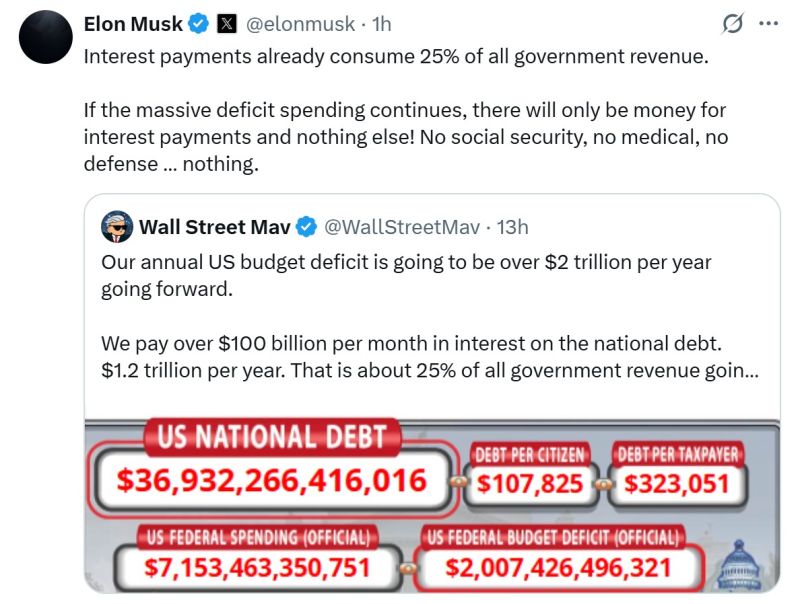

Elon keeps pounding the table on the fiscal & debt side...

He probably feels that D.O.G.E didn't go far enough...

China's manufacturing activity plunges to lowest level since September 2022 📉

Source: Barchart, LESG

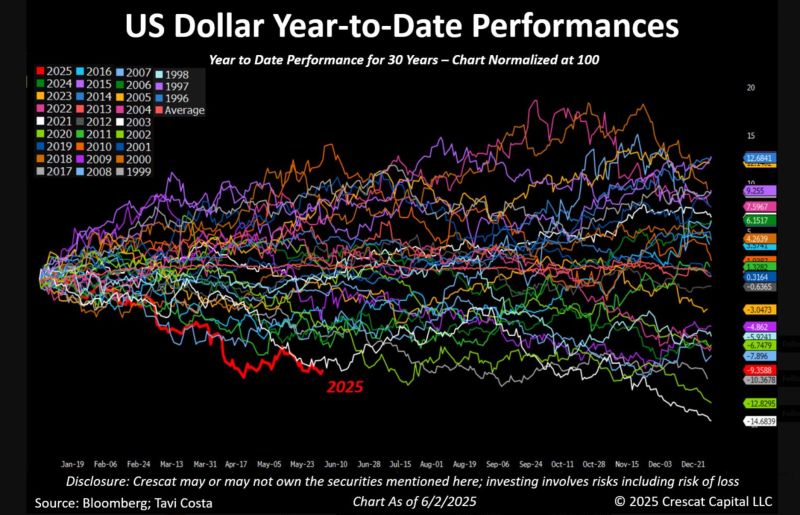

The US dollar is on track for its worst performance in three decades

Resource stocks, emerging and other developed markets, and foreign currencies are beginning to perform well. Source: Crescat Capital, Bloomberg

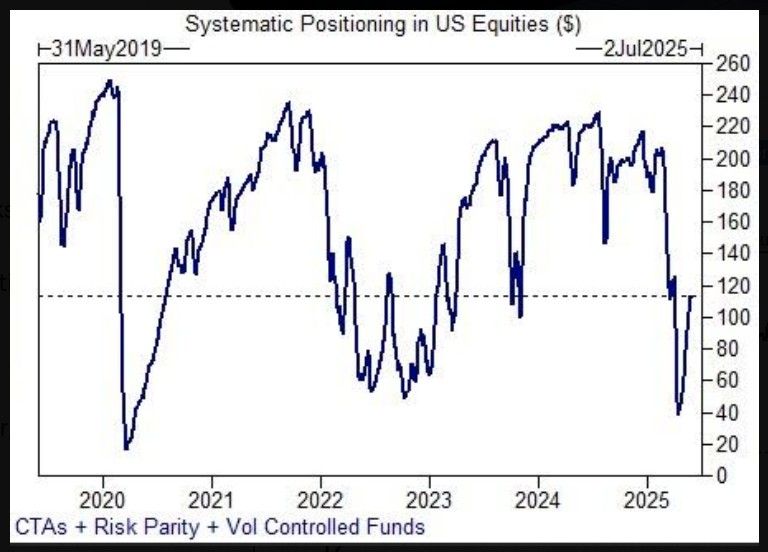

Systematic US equity exposure remains low, according to data from Goldman Sachs, i,.e they will be forced buyers if the rally continues 🚀

Source: Markets & Mayhem @Mayhem4Markets on X, Goldman Sachs

Novo Nordisk First Positive Sign in Bear Market

For the first time since June 2024, Novo Nordisk saw a positive close yesterday! While the long-term bearish trend hasn’t reversed yet, we’re seeing positive developments on the daily chart. The weekly chart remains bearish. The end of April rebound from the support zone between 365-380 is encouraging, but we’ll need more price action to confirm these first steps. Source: Bloomberg

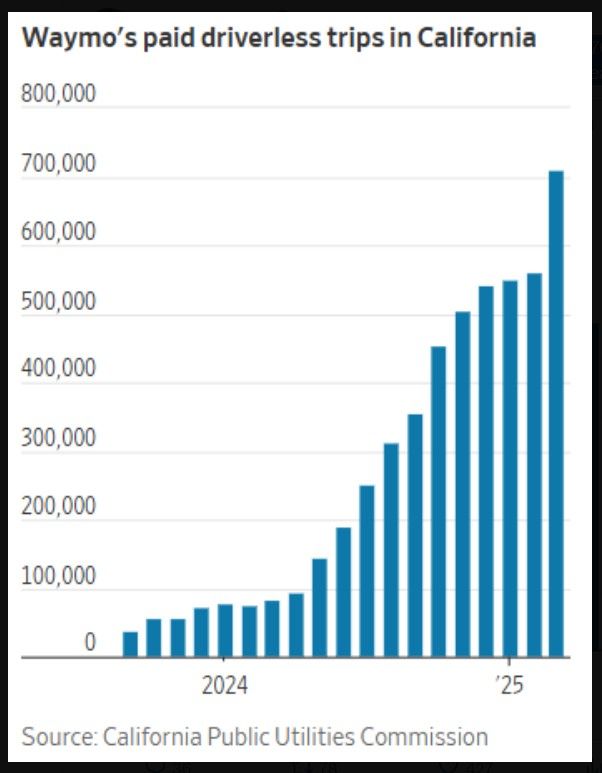

Autonomous vehicle is a reality

Self-driving taxi company Waymo is now doing over 700,000 rides per month in California, up from fewer than 100,000 a year ago. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks