Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

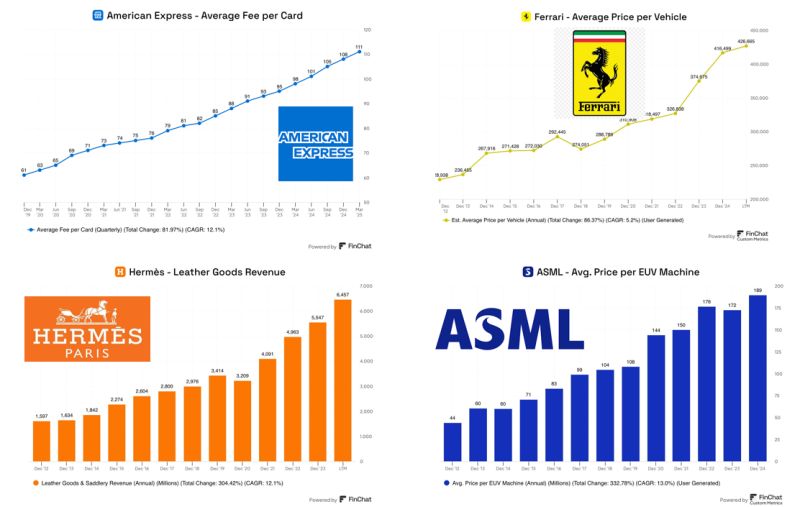

Companies with major pricing power

NB: These are NOT investment recommendations

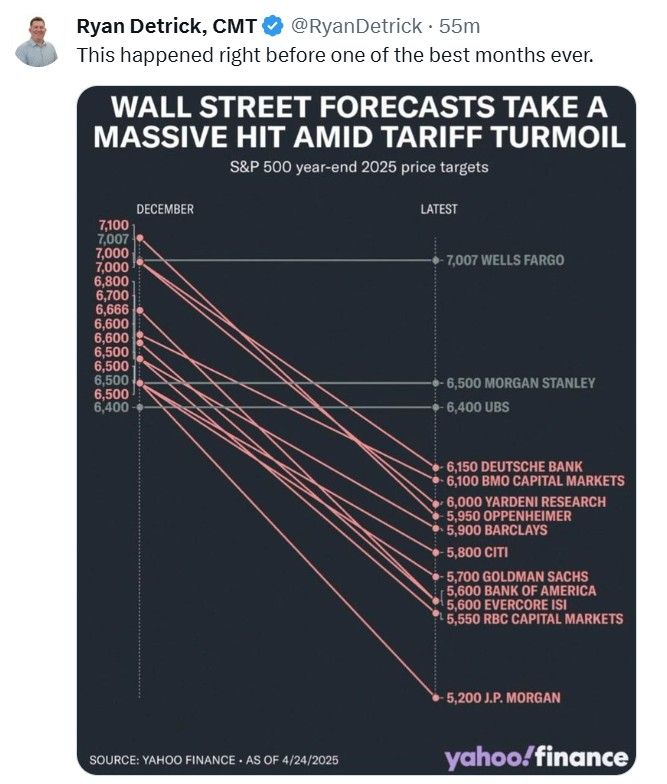

Do you remember when the vast majority of investment banks cut aggressively their year-end target on the S&P500?

This was right BEFORE one of the best month ever for the S&P 500...

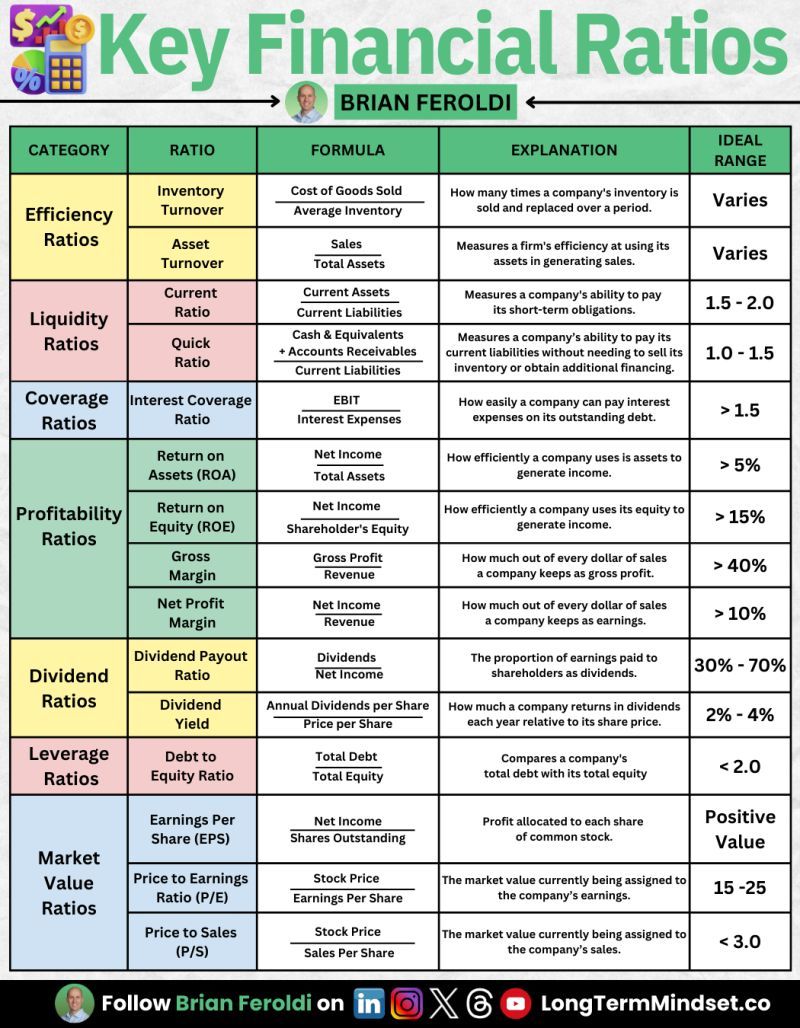

How to analyze a company in less than 5 minutes - study these ratios:

Source: Brian Feroldi @BrianFeroldi

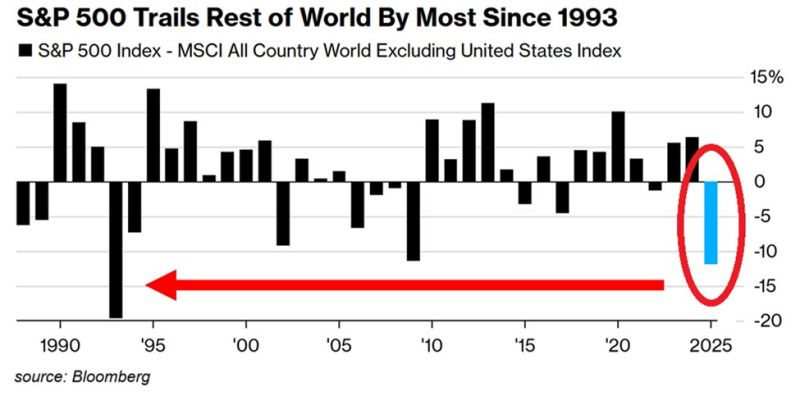

⚠️Despite US stocks outperformance in May, this is one of the WORST years for the US stock market in history:

The S&P 500 has UNDERPERFORMED World stocks excluding the US by 12 percentage points year-to-date, the most in 32 YEARS. Source: Bloomberg, Global Markets Investor

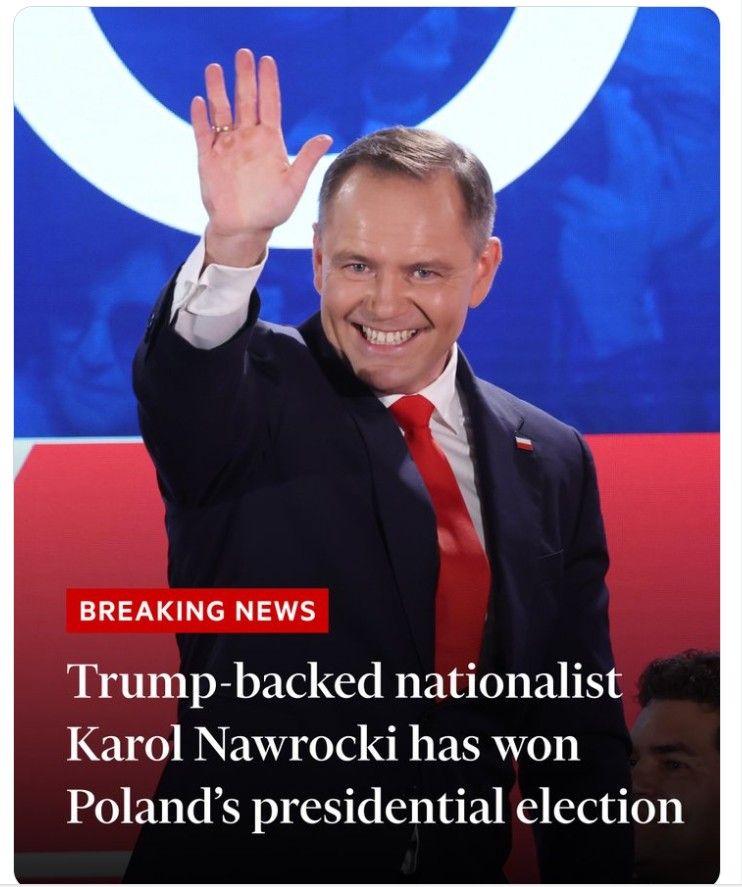

Breaking news:

Karol Nawrocki has won Poland’s presidential election, the country’s electoral commission said, after a tight run-off vote against pro-EU rival Rafał Trzaskowski Source: FT

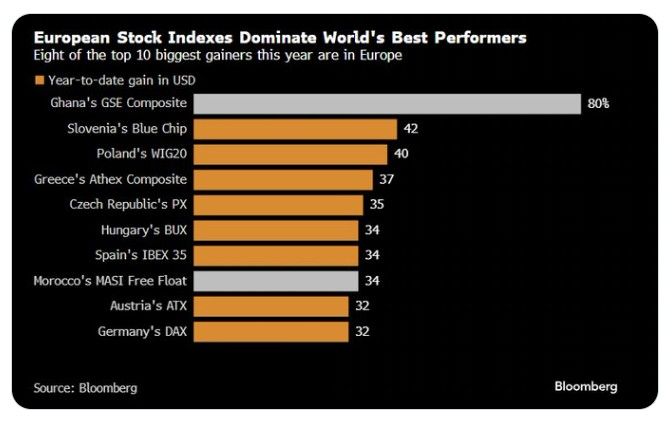

Europe stocks stage world-beating rally as trade war backfires.

8 of the world's 10 best-performing stock markets are in Europe this year, w/Germany's Dax rallying >30% in Dollar terms: Peripheral markets such as Slovenia, Poland, Greece, and Hungary also performing well. Source: HolgerZ, Bloomberg

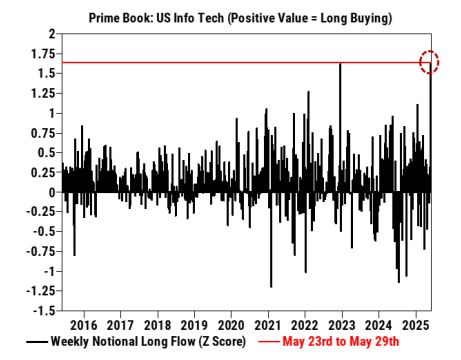

Goldman: Hedge funds net bought US Info Tech stocks for a 3rd straight week and every day this week, driven by risk-on flows with long buys outpacing short sales (1.6 to 1)

It’s worth nothing that (1) the recent streak of buying in US Info Tech came after the sector was net sold in 10 of the previous 12 weeks, and (2) this week’s notional long buying in the sector was the largest in more than 10 years (+1.6 z score), pointing to a positive turn in sentiment. Source: Goldman, Neil Sethi @neilksethi

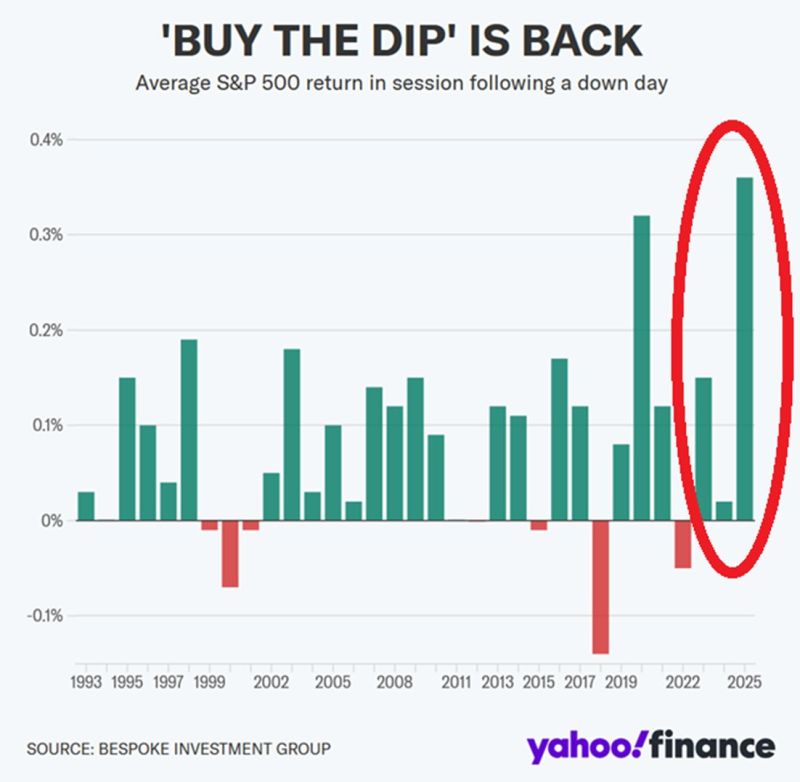

🚨Retail investors have bought every dip this year

The S&P 500 has returned 0.36% on average following a down day, the most ever recorded. By comparison, last year it was just 0.02%. Retail investors purchased over $50 billion in US equities since the April low. Source: Yahoo Finance, Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks