Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

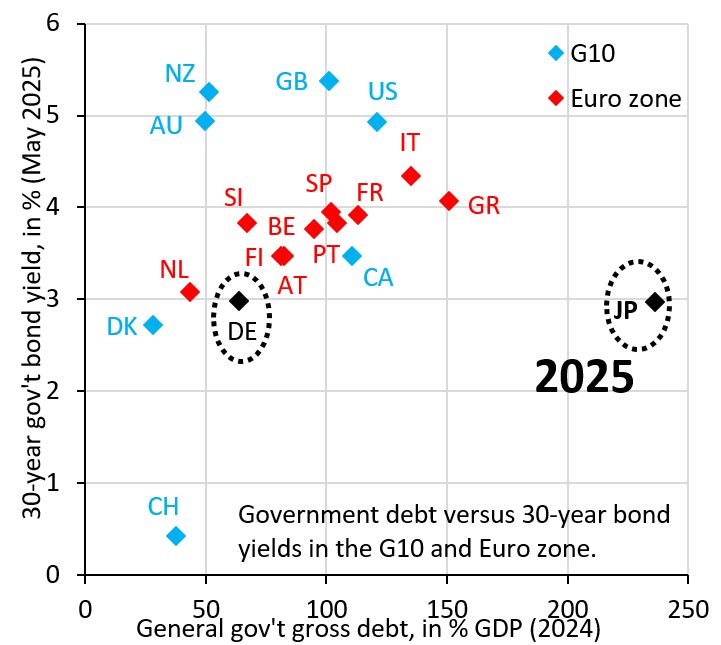

Japan's 30-year government bond yield has risen sharply in recent months and is now 3%.

That's the same yield level as Germany, but German government debt is 60% versus Japan's 240%. Japanese yields are still way too low given Japan's astronomically high level of government debt. Source: Robin Brooks @robin_j_brooks on X

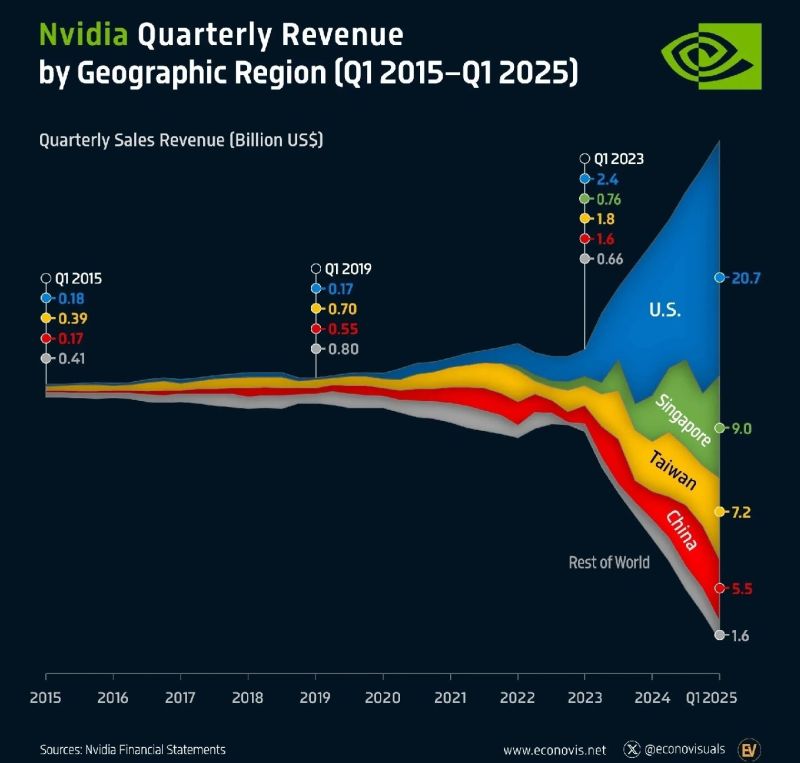

Nvidia quarterly revenues by regions over time...

Up to 20% of Nvidia’s revenue comes from Singapore a known gateway to China and when including direct sales to China and Hong Kong, roughly one-third of its total revenue ($15 billion) may be exposed to Chinese market risk. Source: econovisuals

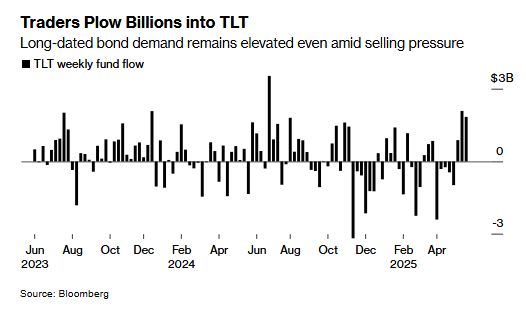

$TLT just saw a weekly inflow of $1.8 Billion, the highest inflow among all ETFs 🚨

Source: Bloomberg, Barchart

The German-US trade balance surplus keeps increasing...

In Germany, anticipation is building for the upcoming meeting between Chancellor Friedrich Merz and US President Donald Trump. The two leaders will meet at the White House on June 5 to discuss key issues including the war in Ukraine, the Middle East, and trade policy. Over the past 12 months, Germany has posted a trade surplus of >€70bn with the US, equal to 1.7% of its GDP... Source: HolgerZ, Bloomberg

If it is the case, that means the printer is coming

Source: Bloomberg

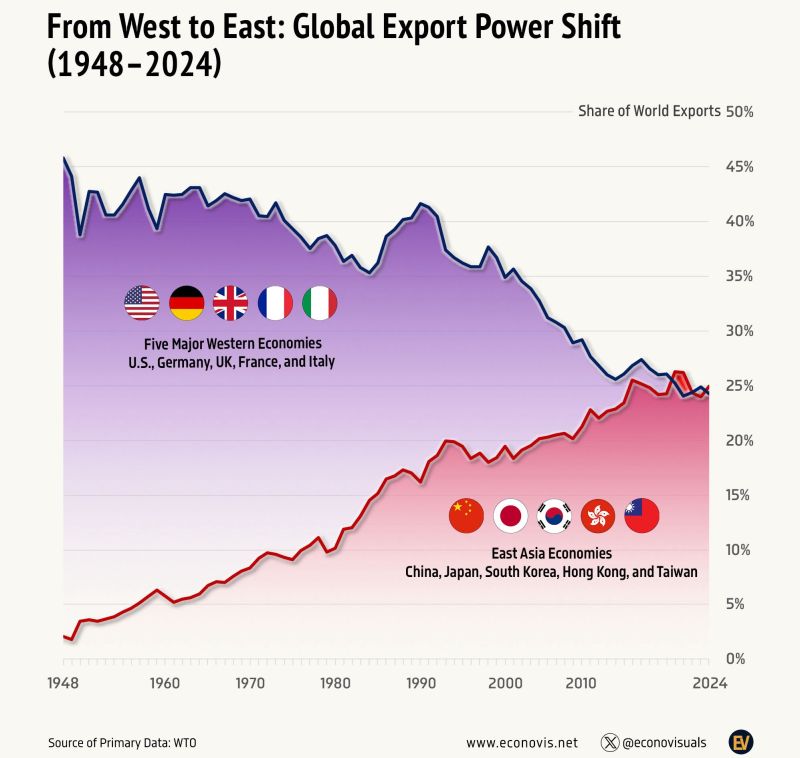

Is it time for the West to rethink its economic model?

Chart @econovisuals thru Michel A.Arouet

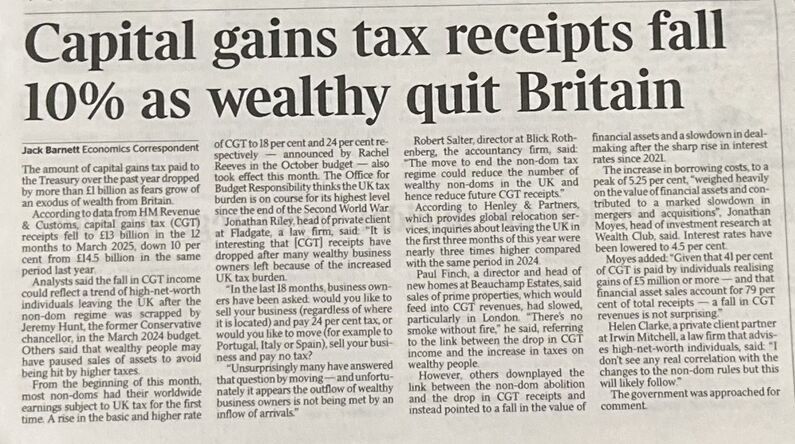

Too much tax kills the tax...

The saying "too much tax kills the tax" refers to the concept of the Laffer curve, which suggests that excessively high tax rates can actually lead to a decrease in tax revenue. This happens because high taxes can discourage economic activity, leading to less income and ultimately, less tax to be collected.

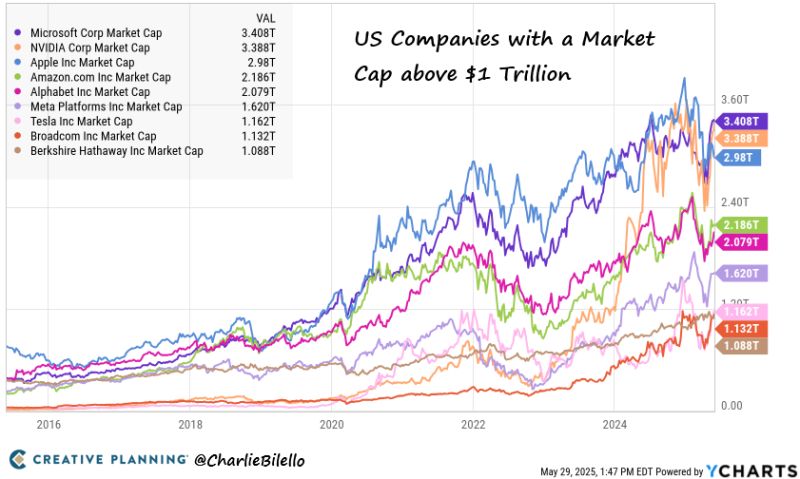

There are now 9 US companies with a market cap above $1 trillion:

Microsoft, Nvidia, Apple, Amazon, Google, Meta, Tesla, Broadcom, and Berkshire Hathaway. A decade ago, Apple was the largest company in the US with a market cap of $750 Billion. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks