Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

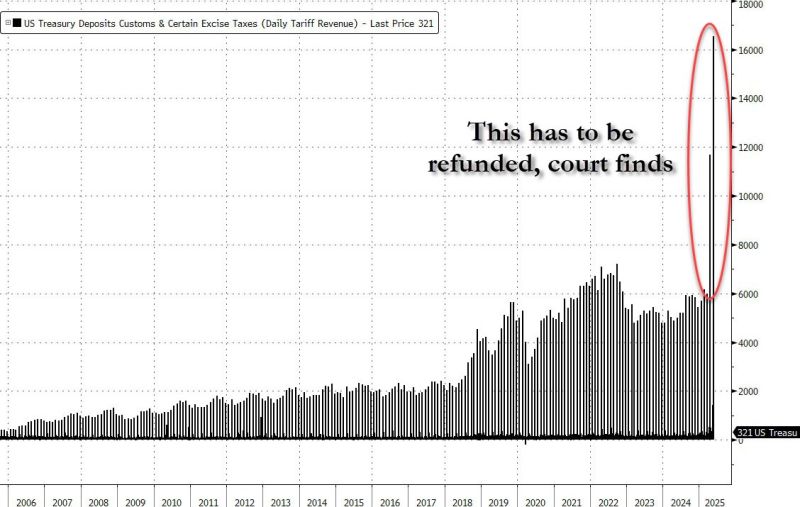

So tariffs - which have already been spent on Congressional grift and corruption - somehow now have to be refunded...

Source: zerohedge

WHAT ARE THE TOOLS AT THE TRUMP ADMINISTRATION? DISPOSAL AFTER A U.S COURT BLOCKS TARIFFS?

The U.S. Court of International Trade struck down President Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs. The court ruled that IEEPA does not authorize tariffs, and trade deficits aren't a valid "unusual and extraordinary threat" required under the act. ➡️ Response Options for the Trump Administration 👇 1. Appeal the Ruling - Already filed; may reach the Supreme Court. - A stay could allow tariffs to continue during litigation. - Outcome uncertain, depending on how courts view executive power. 2. Use Alternative Legal Authorities - Section 122 of the Trade Act (15% tariffs for 150 days). - Section 232 (national security rationale). - Section 301 (unfair trade practices). - Currency manipulation designations. Pros: Based on existing law. Cons: Some are limited or slow to implement. 3. Seek Congressional Authorization - Could pass new legislation to restore or expand tariff authority. - Mixed outlook due to bipartisan skepticism. 4. Adjust Tariff Strategy Within Legal Bounds - Use industry-specific or targeted tariffs under Sections 232 or 301. - Avoids IEEPA issues but may lack desired economic impact. 5. Negotiate Trade Deals During Appeal - Use paused tariffs as leverage. - Some deals (e.g., with China) already in motion. - Less effective now due to weakened legal position. 6. Declare New or Reframed National Emergencies - Possible but unlikely to succeed legally. - Courts already skeptical of broad use of IEEPA. 7. Use Non-Tariff Executive Actions - Sanctions, export controls, and financial restrictions. - Legally safer under IEEPA but less direct in addressing trade goals. 8. Request Emergency Stay - Would pause the court ruling, preserving tariffs temporarily. - Moderate chance of success; would delay impact while appeals proceed. ➡️ Most Viable Temporary Measures👇 : - Requesting a stay and appealing the ruling (keeps tariffs in place during litigation). - Using Section 122 for short-term, limited tariffs. - Expanding Section 232 or 301 actions for longer-term solutions. ➡️ Conclusion: The court ruling challenges executive power over tariffs. The Trump administration’s best short-term path is to appeal with a request for a stay, while Section 122 offers a fast, legal workaround. Longer-term strategies like Section 232/301 or new legislation face political and procedural hurdles.

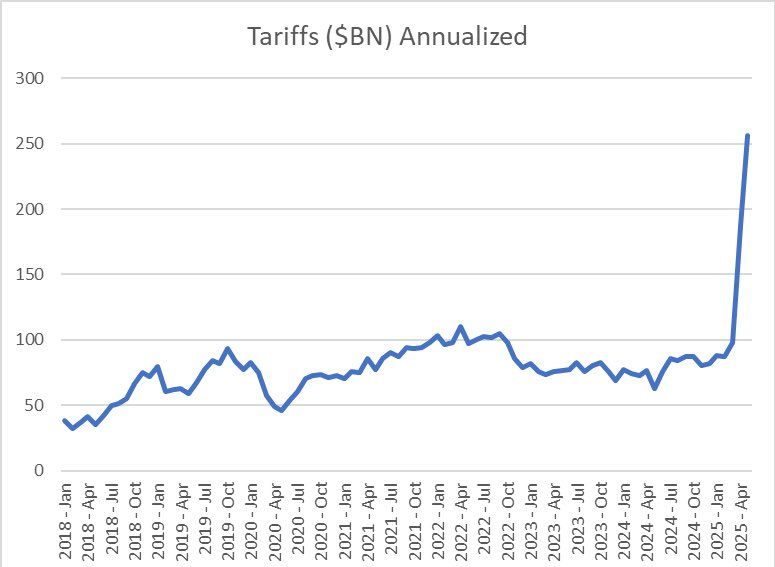

The US is now collecting ~$255 Billion in annualized revenue from Trump’s tariffs

Source: Geiger Capital @Geiger_Capital

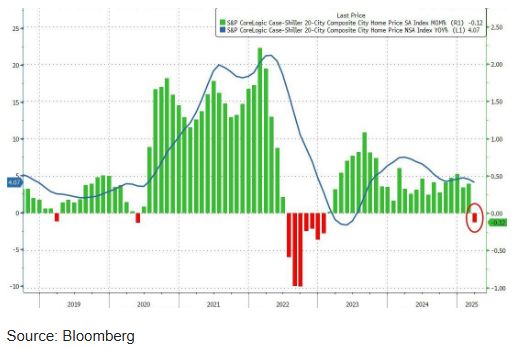

For the first time in more than 2 years, home prices saw a monthly decline (March)

Source: zerohedge

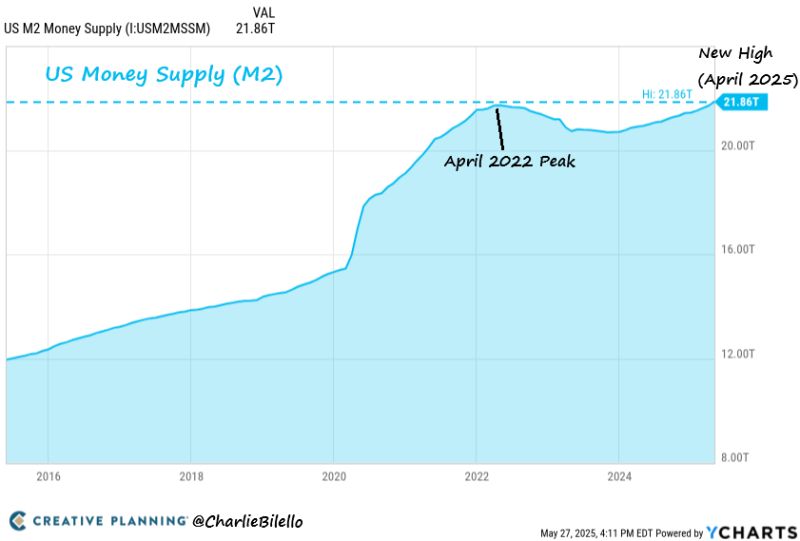

The US MoneySupply hit an all-time high in April for the first time in three years.

After a brief hiatus, money printing is back. Invest accordingly. Source: Charlie Bilello

Gold and JGBs 30y yield...

Wonder why gold was down yesterday? Japanese bond yields tumbled, as according to Reuters, Japan's Ministry of Finance (MOF) will consider tweaking the composition of its bond program for the current fiscal year, which could involve cuts to its super-long bond issuance... This was enough to fuel some profit taking on the yellow metal Source. The Market Ear

Four of Europe’s oldest industrial groups have added more than €150bn to their market caps on the back of soaring demand for data centres driven by the boom in artificial intelligence.

European makers of everything from switches to smart meters are providing the servers and infrastructure that power data centres for large language models and cloud computing, with traditional makers of electric equipment such as Legrand doubling their revenues thanks to data centres in recent years. Link to article 👉 https://lnkd.in/d8wsidBb Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks