Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

SP500 200-day reclaim. Clean retest. Strong bounce.

Shorts are sweating. $SPY 🥵 Source: Trend Spider

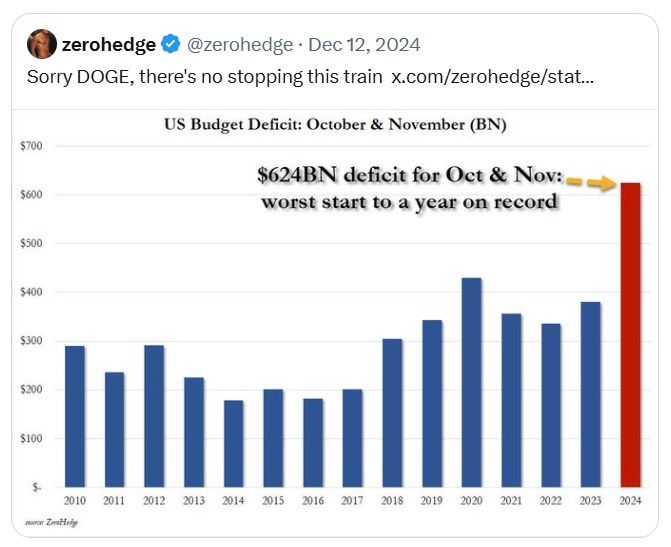

Elon Musk expressed dissatisfaction with President Donald Trump’s giant tax bill, which the US House narrowly passed last week, saying it undercut his efforts to slash government spending

Source: zerohedge, Bloomberg

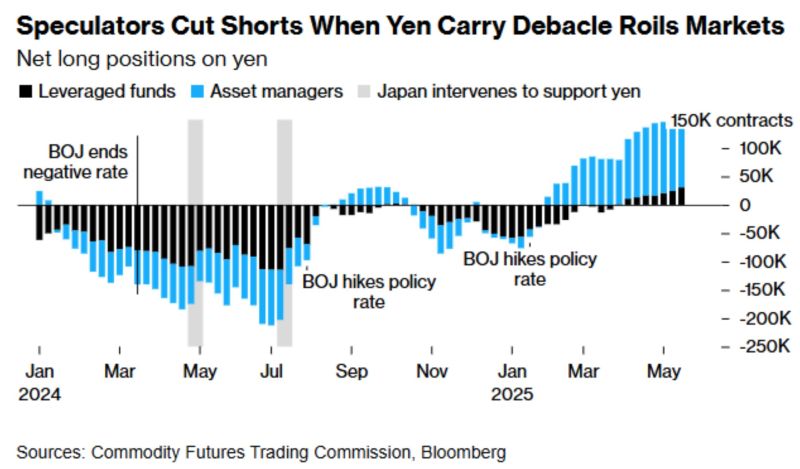

And now watch Japanese inflation tumble...

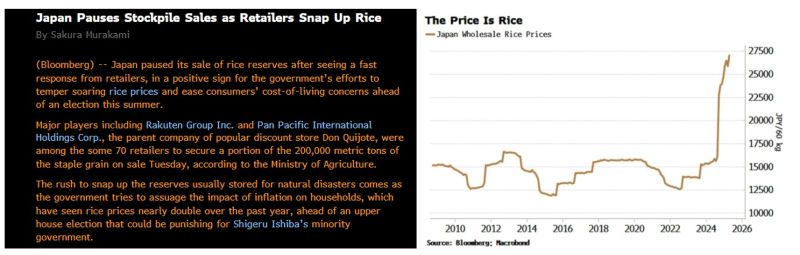

As highlighted by zerohedge, Japan does NOT actually have high CORE inflation; it does however have soaring rice prices which have skewed inflation expectations across the population as rice is a huge component of the overall CPI basket. Meanwhile the BOJ is scrambling to contain inflation - which has tumbled ex food with real wages near record lows - and is tightening conditions by raising rates even though it has zero control over food inflation. However, as a by product of its monetary policies and strong yen, the bond market is crashing every day now... This bond crash could eventually spread to Japan's banks and global markets, sparking a global crisis. They thus need to do something. Yesterday, Japan's Ministry of Finance (MOF) said they will consider tweaking the composition of its bond program for the current fiscal year, which could involve cuts to its super-long bond issuance... This was enough to trigger a big drop in bond yields and the yen, which both came as a relief for global markets. What is happening on rice (and its deflationary consequences) is anotehr positive development Source: zerohedge, Bloomberg, Macrobond

$TSLA vs. $BYD

Battle of EV giants Battle of valuations US vs. China The first 10 years of EV were all about a revolutionary company, Tesla, that basically created the market. Could the next 10 are all about the rise (and shine) of BYD? Source: Oraclum capital on X

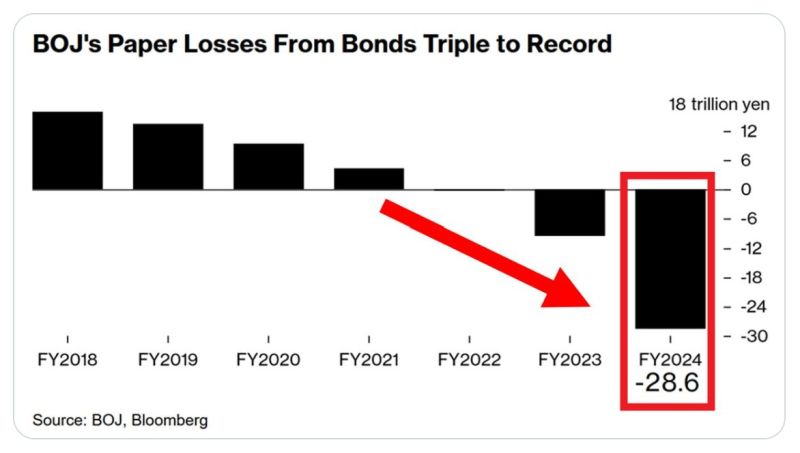

The Bank of Japan's unrealized losses hit a record ¥28.6 trillion ($198 billion) in Fiscal Year 2024 ending March 31, 2025.

Paper losses from Japanese government bonds TRIPLED from the last year. However, the BOJ's reported net income was ¥2.26 trillion ($16 billion). It can take years until these bonds mature. Source: Global Markets Investor, Bloomberg

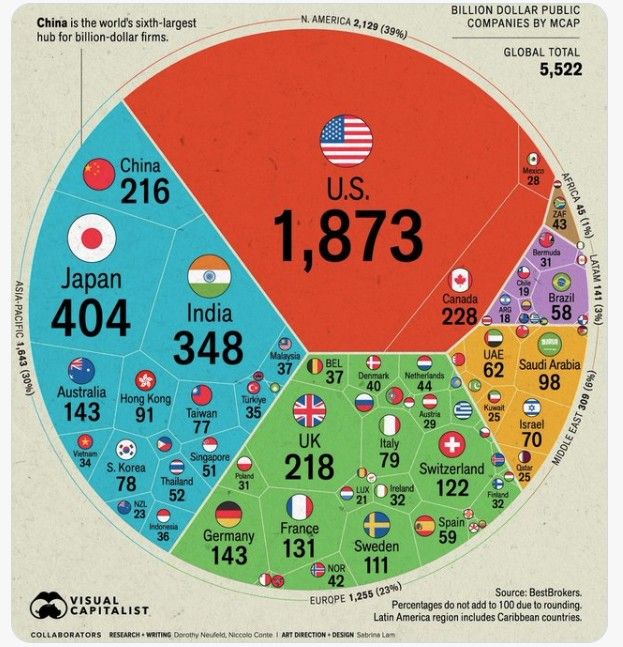

This is what American exceptionalism looks like.

There are 1,873 billion dollar companies in the US. Japan is a distant second with 404 billion dollar companies. Followed by India with 348. Source: Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks