Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 A HUGE WEEK AHEAD FOR EARNINGS

👉 Monday: $WM $DPZ 👉Tuesday: $KO $V $SBUX $SNAP $SOFI $SPOT $PFE $UPS $MO $GM $HON 👉Wednesday: $MSFT $META $HOOD $QCOM $CAT $ETSY 👉 Thursday: $AAPL $AMZN $LLY $MA $ABNB $MSTR $RBLX $MRNA $RDDT $XYZ 👉 Friday: $XOM $CVX (Source for the Earnings Calendar - @EarningsHubHQ) thru Evan on X

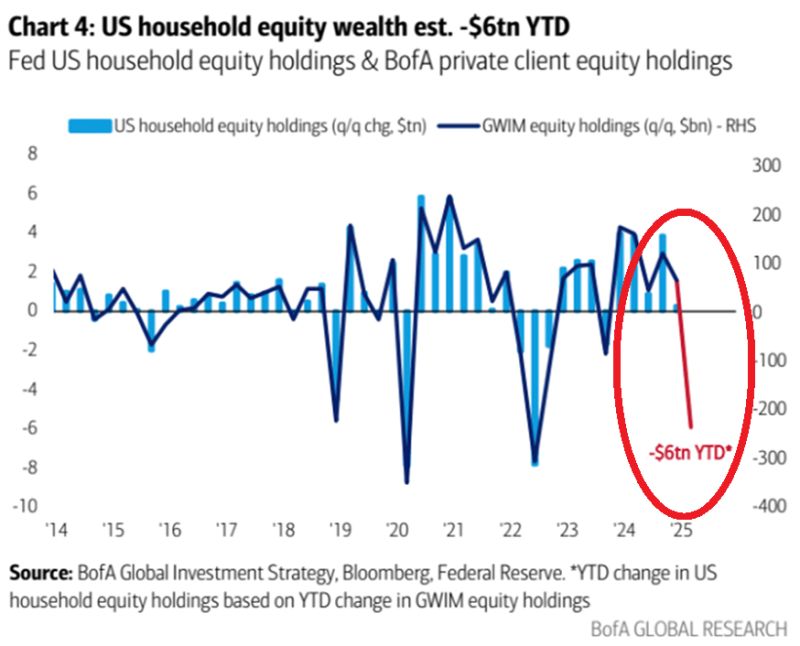

⚠️MASSIVE amount of US household wealth has been lost:

US household equity wealth has likely dropped by $ TRILLION year-to-date, the most in 3 YEARS. This may lead to further pullback in consumer spending as the top 10% account for 50% of total consumer expenditures. Source: BofA

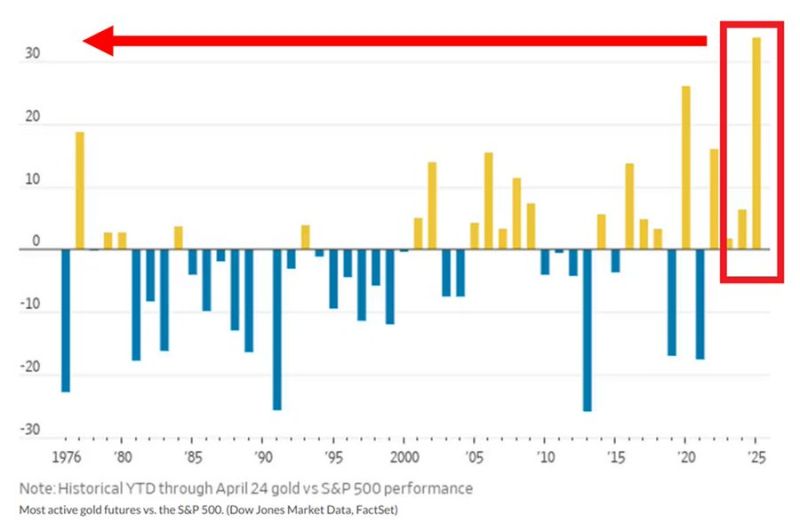

Gold prices have OUTPERFORMED the S&P 500 by 33% so far this year, the most since at least 50 YEARS.

Since the start of 2023, gold has rallied 82% while the S&P 500 44%, despite 2023 and 2024 being the best years for stocks since the Dot-Com BUBBLE. Source: Global Markets Investor

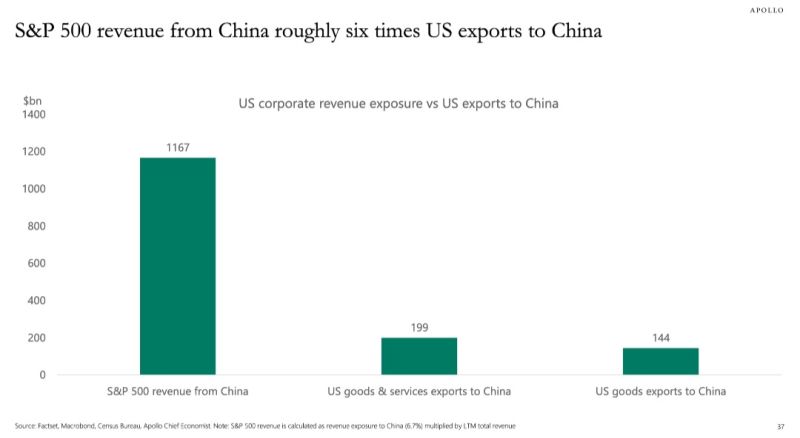

SP500 revenue from China are roughly six times US exports to China

From Torsten Slok, Apollo

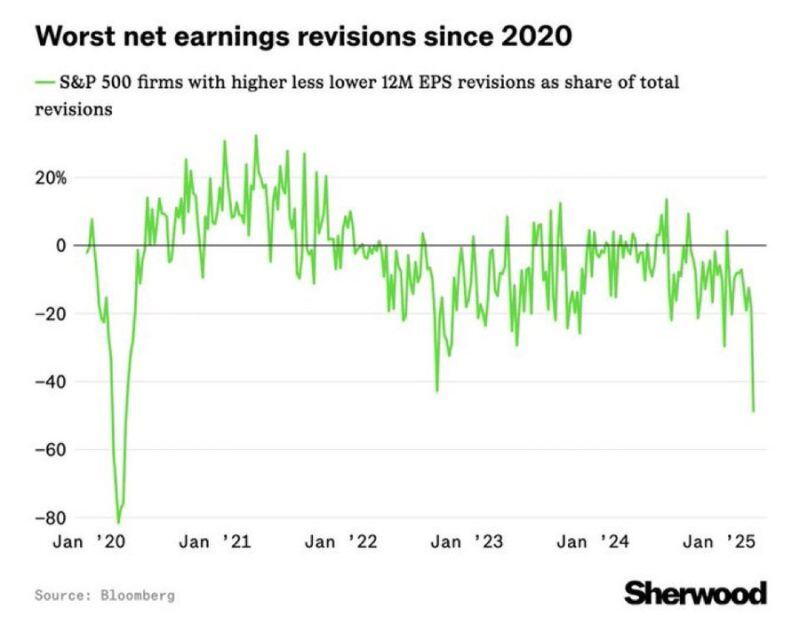

Worst net US earnings revisions since 2020!

Source: Win Smart, CFA @WinfieldSmart

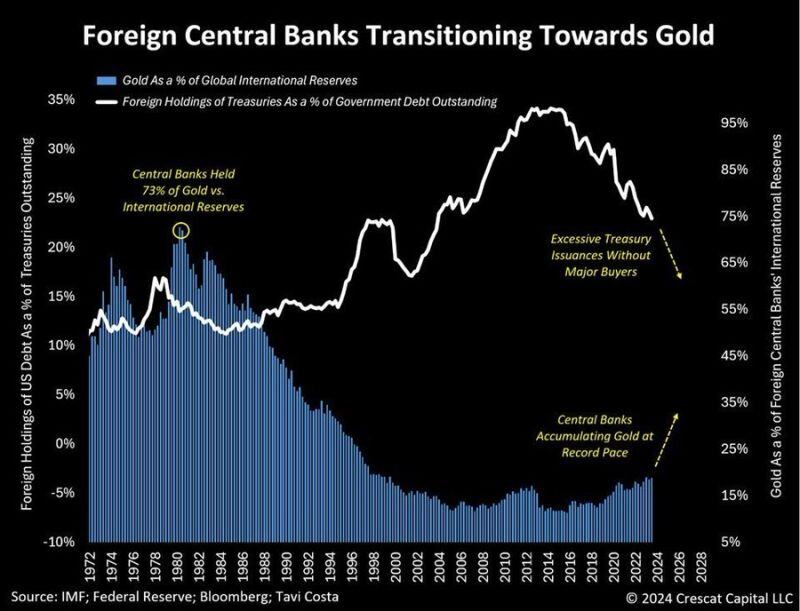

Should investors look at overbought signals on gold or focus on the long-term perspective?

Tavi Costa believes that when it comes to the yellow metal this as one of those key moments when traditional technical analysis like overbought conditions become largely irrelevant. We are likely in the midst of a monetary realignment, and attempting to time short-term corrections based on extreme RSI levels misses the forest for the trees, in his view. "This perspective underestimates the structural macro imbalances that continue to compel governments to accumulate gold" he added. He might be right...

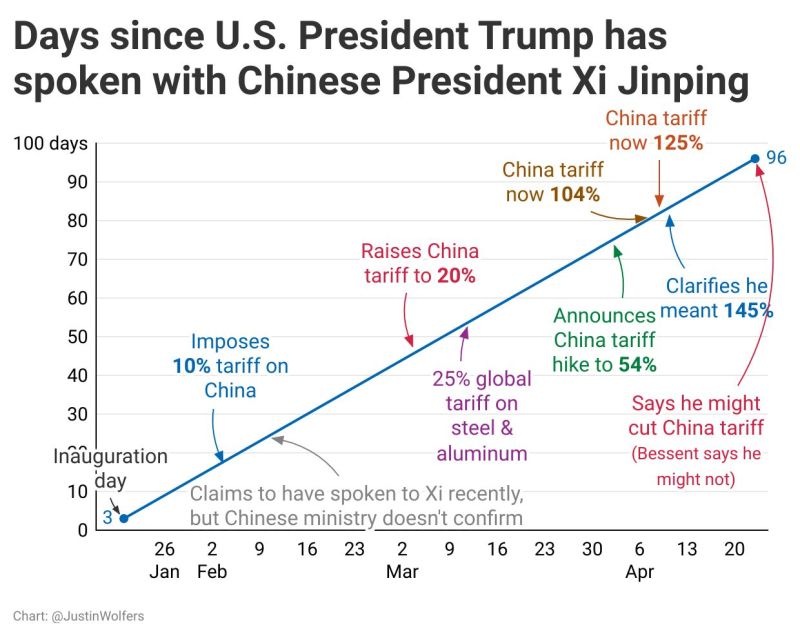

Trump - Xi Jinping summarized in one chart

Source: Justin Wolfers @JustinWolfers on X

Investing with intelligence

Our latest research, commentary and market outlooks