Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

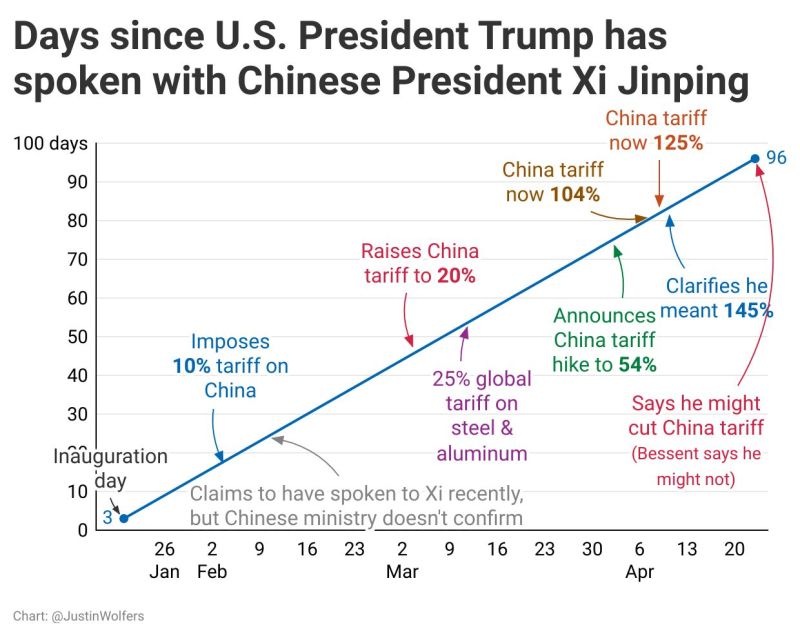

Trump - Xi Jinping summarized in one chart

Source: Justin Wolfers @JustinWolfers on X

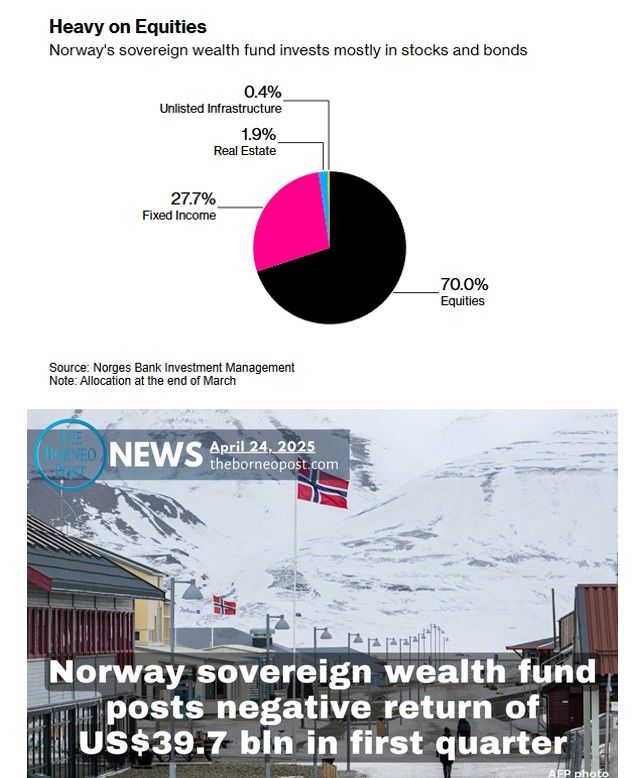

NORWAY’S $1.7T SOVEREIGN WEALTH FUND JUST POSTED A $40B LOSS IN Q1, ITS WORST DROP IN 6 QUARTERS.

The fund, run by Norges Bank Investment Management, pointed to a pullback in tech stocks as the main drag, with equity returns down 1.6%. Holdings like $AAPL, $NVDA, and $TSLA all took a hit. Fixed income helped a bit, returning 1.6%, but it wasn’t enough to offset the slump. CEO Nicolai Tangen said the recent market turmoil, especially after Trump’s tariff hikes, isn’t even fully reflected yet. That early-April tariff spike alone knocked off another $200M. Despite the loss, the fund still outperformed its benchmark by 0.16%. They’ve already started trimming some tech exposure to reduce risk. CFO also confirmed they didn’t make any moves in U.S. Treasuries in April—no buying or selling. The fund's performance is mostly tied to global indexes, so there's limited room for active moves. And while it’s staying out of nuclear weapons makers like Lockheed due to ethical guidelines, there's growing political pressure in Norway to rethink that stance. Source: Wall St Engine, The Borneo Post

Buffett with $334.2 BILLION in cash

Source: Warren Buffett Stock Tracker

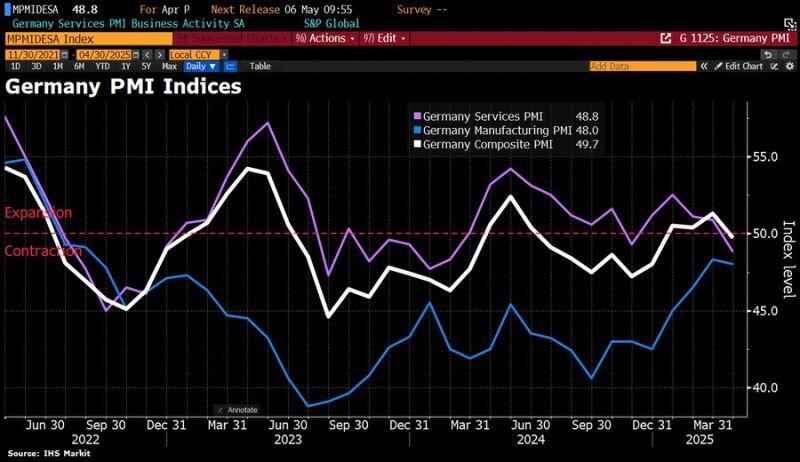

In Germany, the private sector just shrank for 1st time in 4 months.

According to S&P Global, the Composite PMI (a key economic indicator) fell to 49.7 in April, dropping below the critical 50 mark that separates growth from contraction. The services sector was hit especially hard, with its index tumbling to 48.8 – the lowest in 14 months. This drop reflects growing worries about tariffs, as well as broader concerns around Germany’s economic and political future. This unexpected decline adds to an already grim outlook for the German economy, which is considered particularly exposed to global trade tensions. The IMF is now forecasting stagnation for Germany this year. Source: HolgerZ, Bloomberg

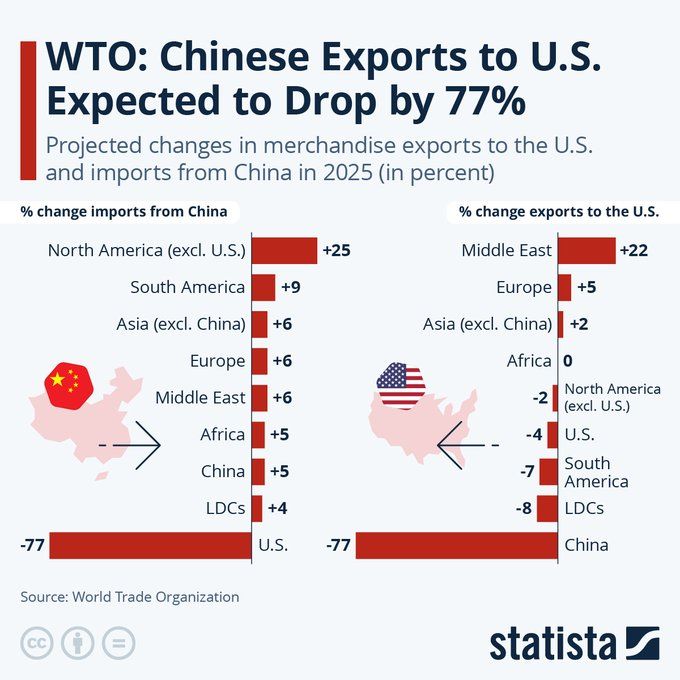

Chinese exports to the United States are expected to fall by 77 percent in 2025, according to World Trade Organization forecasts.

Meanwhile, Chinese imports are expected to increase to every other market, with the rest of North America predicted to see growth of 25 percent. Source: Statista @StatistaCharts

BREAKING: Cantor Fitzgerald, SoftBank, Tether, and Bitfinex are pooling $3 billion to create 21 Capital, a Bitcoin investment firm.

The initiative mirrors Strategy's Bitcoin plan, with contributions from Tether ($1.5 billion), SoftBank ($900 million), and Bitfinex ($600 million). Brandon Lutnick, current chair and CEO of Cantor Fitzgerald and son of former CEO Howard Lutnick, is at the helm of this venture. The initiative will utilize funds from Cantor Equity Partners, a special purpose acquisition company (SPAC) that raised $200 million earlier this year. The investment contributions to 21 Capital are substantial, with Tether expected to provide $1.5 billion in Bitcoin. SoftBank will contribute $900 million, while Bitfinex plans to supply $600 million worth of the crypto. This collaboration aims to mirror the investment approach pioneered by Michael Saylor's Strategy, which has seen significant success in the Bitcoin market🔥 The report highlights that the Bitcoin holdings from these companies will eventually be converted into shares of 21 Capital, valued at $10 per share, suggesting a valuation of $85,000 per Bitcoin. Additionally, Cantor's vehicle plans to raise $350 million through a convertible bond and an additional $200 million via private equity placements for further Bitcoin acquisitions. The Financial Times notes that an official announcement regarding this venture is expected in the coming weeks, although details may still be subject to changes or cancellation. Source: The Bitcoin Historian @pete_rizzo_

Investing with intelligence

Our latest research, commentary and market outlooks