Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

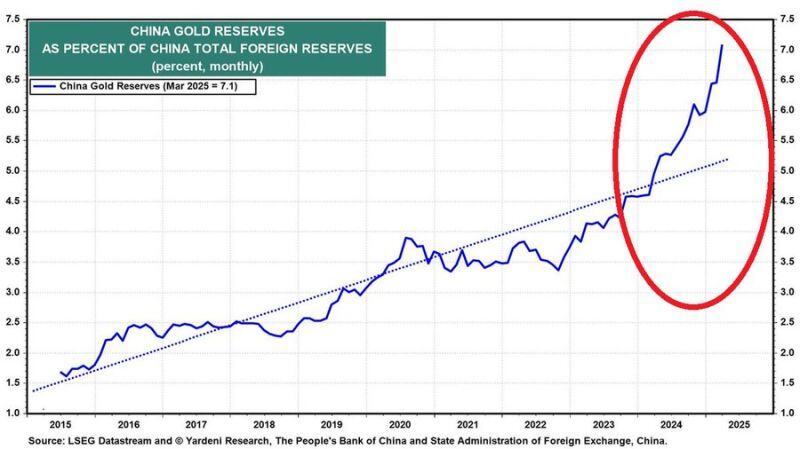

Global Markets Investor @GlobalMktObserv ‼️

China's gold buying has been truly historic: China's gold reserves hit a RECORD 73.5 million troy ounces. China has bought a whopping 10 MILLION troy ounces of gold over the last 30 months. In effect, gold's share of China's total foreign reserves hit 7.1%, an all-time high. Source: Global Markets Investor

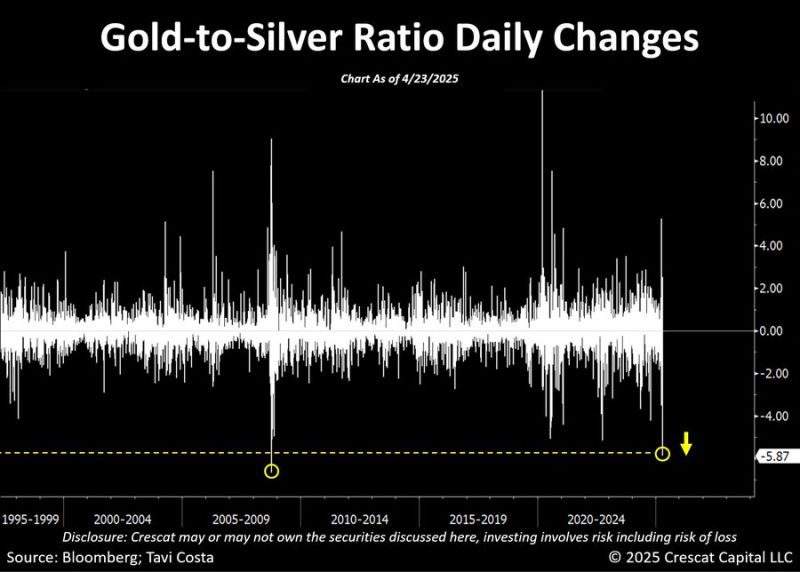

As highlighted by Otavio (Tavi) Costa, we're currently seeing the biggest drop in the gold-to-silver ratio since 2008.

That move back then marked the start of a long downtrend that eventually took the ratio all the way to 31 over the next three years. Are we heading into a similar setup now? (except we're starting from an even more extreme level). We’ve just dipped below 100; in 2008, the peak was 85. Just to put it in perspective: If the ratio drops to 30 today, silver would be trading around $110 an ounce. Source: Bloomberg, Crescat Capital

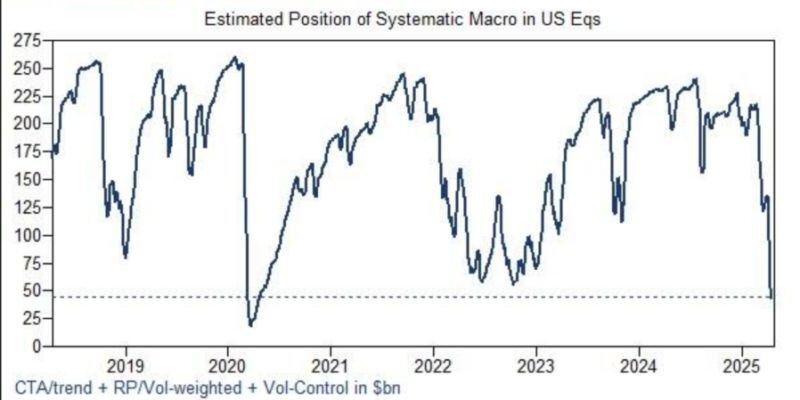

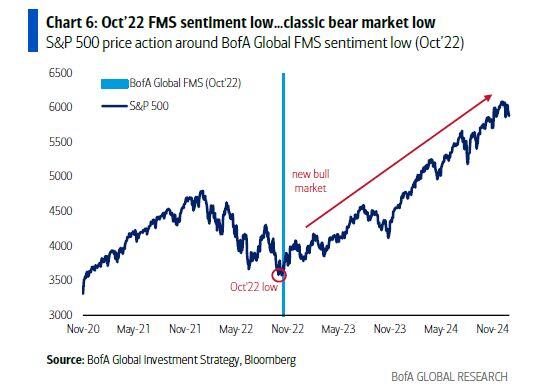

Wow. Systematic macro hedge funds have reduced exposure to US equities to levels not seen since the COVID crash.

They sure have a lot of buying to do if the market stays bid. Chart: Goldman Sachs thru Markets & Mayhem

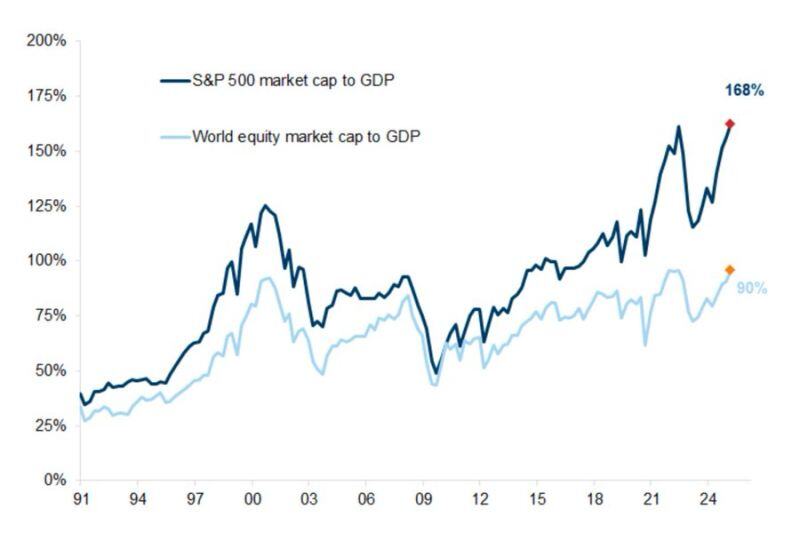

Warren Buffett looks at market cap-to-GDP as one indicator for how frothy or cheap the markets may be.

The S&P 500 recently traded around 168% market cap-to-GDP vs the global equity markets at around 90%. That suggests US stocks are .. exceptionally expensive. Chart: Goldman, Markets & Mayhem

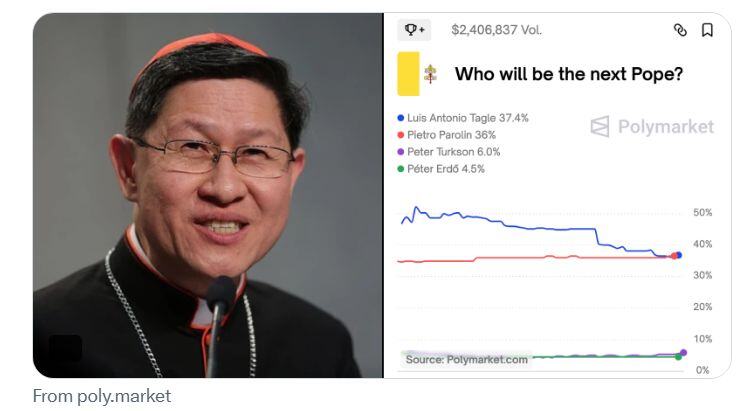

BREAKING: Luis Antonio Tagle overtakes Pietro Parolin as the likely successor to Pope Francis.

If elected, Cardinal Tagle would be the first Filipino Pope in history. Source; Stocktwits

GOLD IS OUTPERFORMING THE STOCK MARKET BY A WHOPPING 42.5% SO FAR THIS YEAR 😮

Source: GURGAVIN @gurgavin on X

Investing with intelligence

Our latest research, commentary and market outlooks