Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

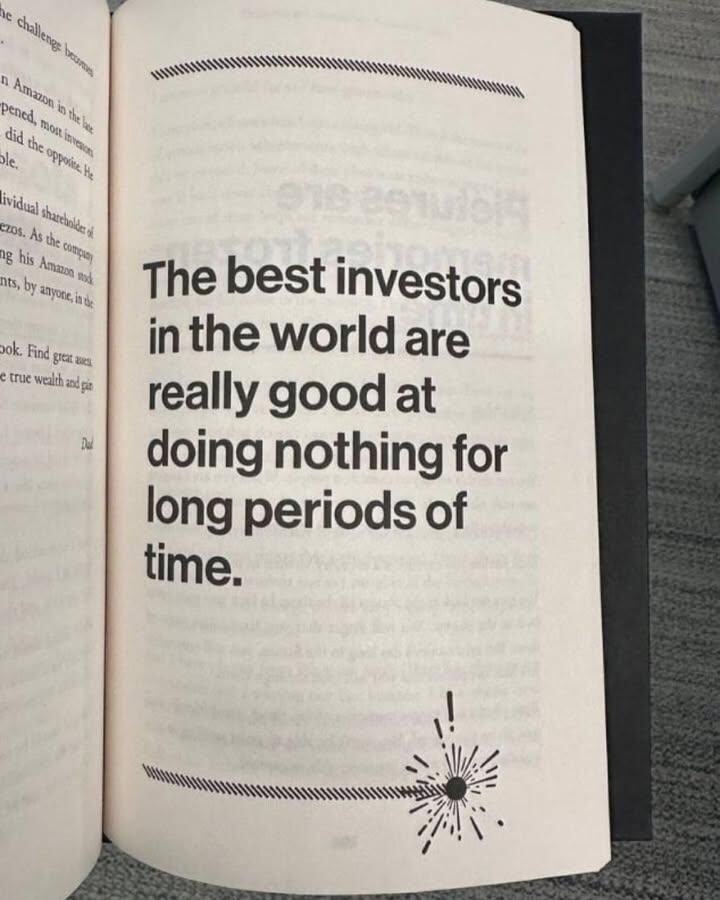

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Is it a memecoin?

- 36 trillion supply - No supply cap - 1 node - 25% of supply minted in the last 6 months - 1% of holders own 30% - Backed by the U.S. government Source: Not Jerome Powell on X

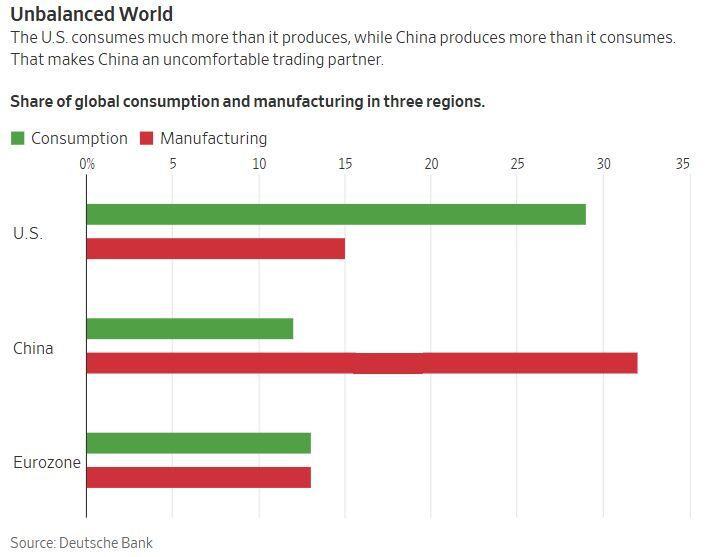

An unbalanced world...

▶️ Share of Global Consumption... US: 29% Eurozone: 13% China: 12% ▶️Share of Global Manufacturing... China: 32% US: 15% Eurozone: 13% Source: Charlie Bilello, Deutsche Bank

Hermes $RMS Q1 2025

"Despite a high comparison basis in the first quarter, the group achieved solid growth in sales, thanks to the trust of its customers and the commitment of the teams, whom I thank warmly." – Axel Dumas, CEO Revenue growth by business line: Source: Quartr

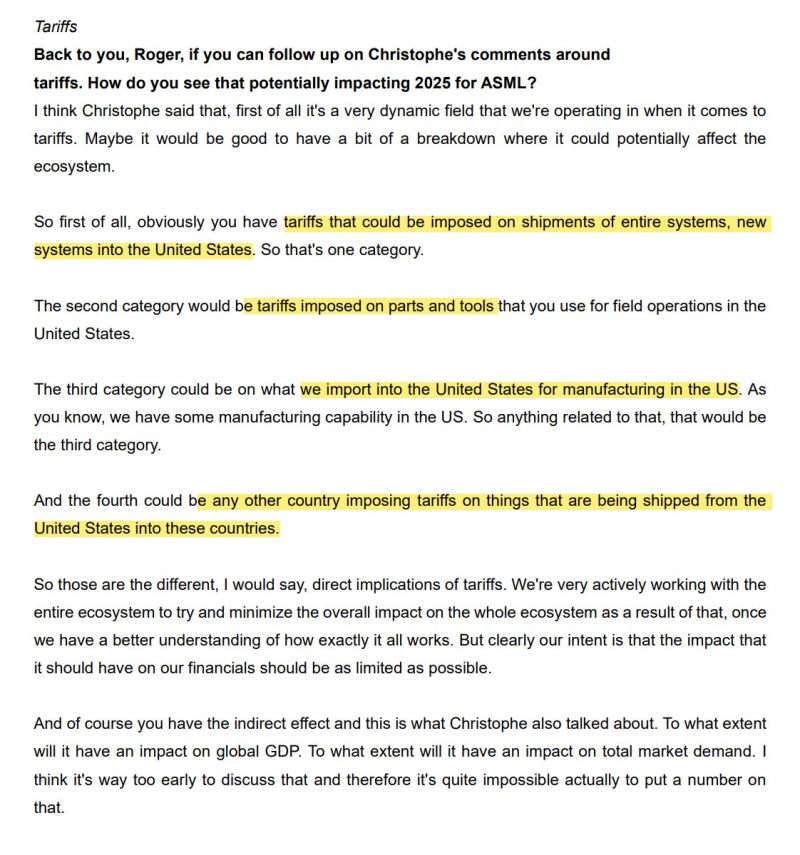

$ASML CFO on the potential impact of tariffs:

—Tariffs could impact ASML across 4 critical supply chain categories —Actively working to mitigate tariff-related risks across its ecosystem —Timing & magnitude of Tariff-induced demand shocks are still too early to quantify Source: The Transcript @TheTranscript

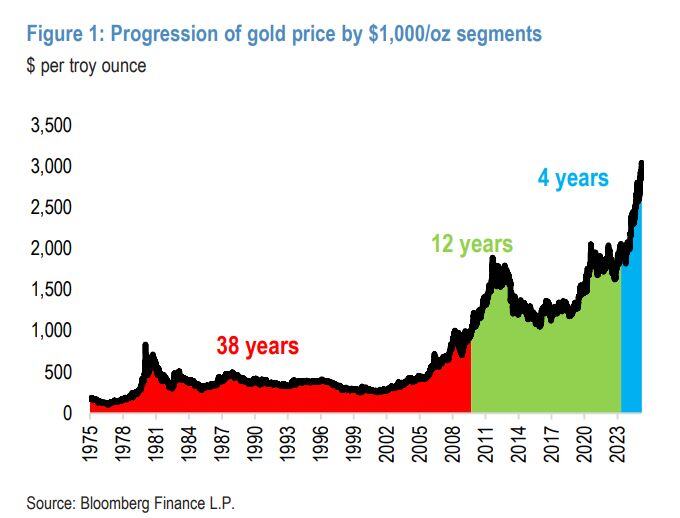

It took 38 years for gold to rise from $35/oz to $1,000/oz. Then it took 12 years to rise from $1,000/oz to $2,000/oz in 2020.

It only took 4 years to go from $2,000 ~~~> $3,000 Source: CEO Technician, Bloomberg

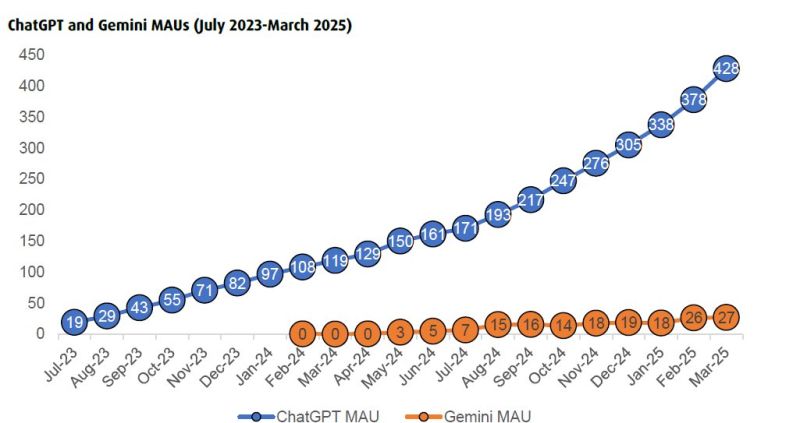

Absolutely brutal chart for Alphabet $GOOGL MAU = Monthly Active Users

Source: Pythia Capital, No Brainer @PythiaR

Investing with intelligence

Our latest research, commentary and market outlooks