Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

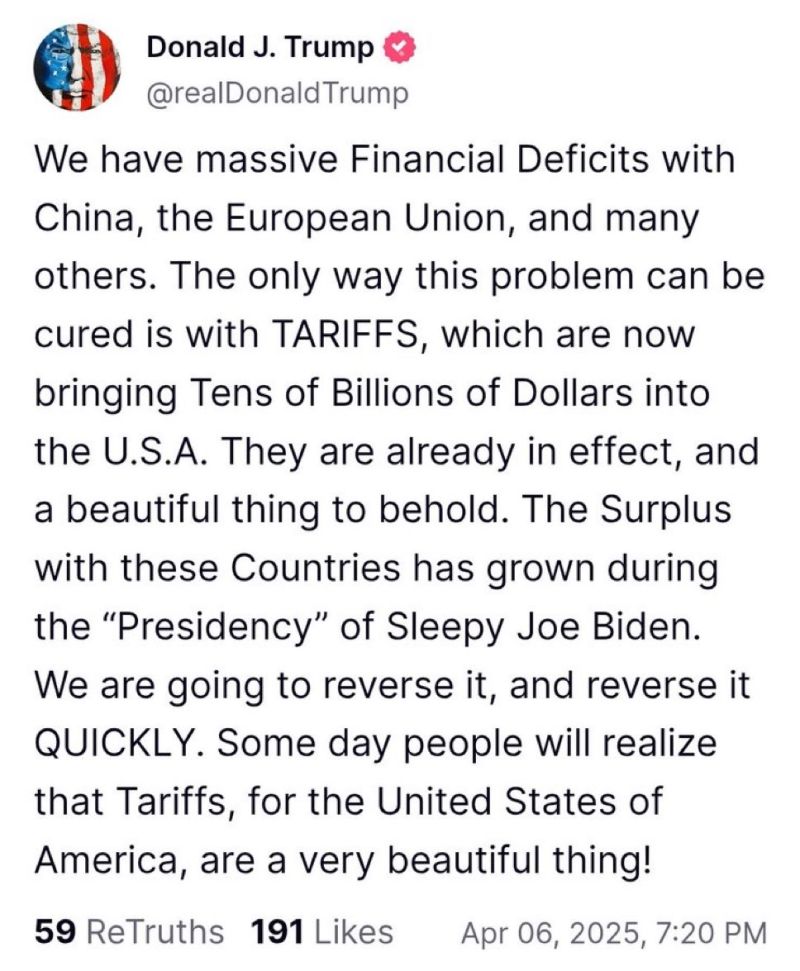

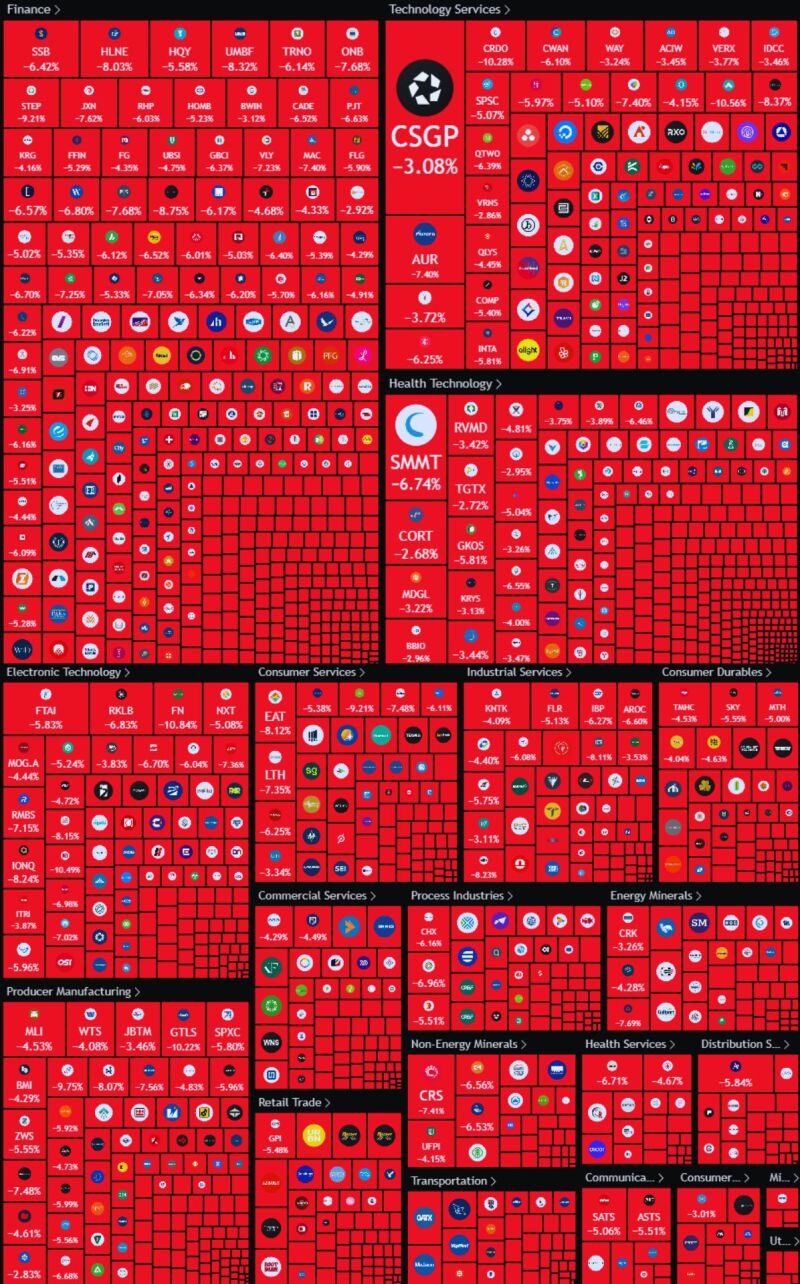

He seems to be going all-in...

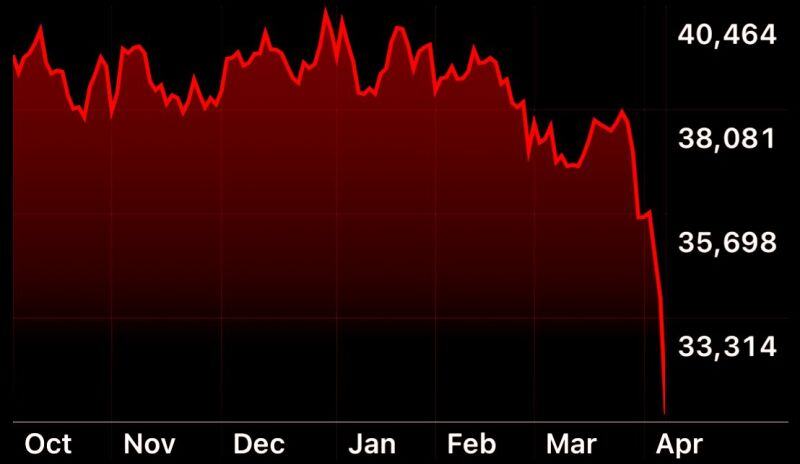

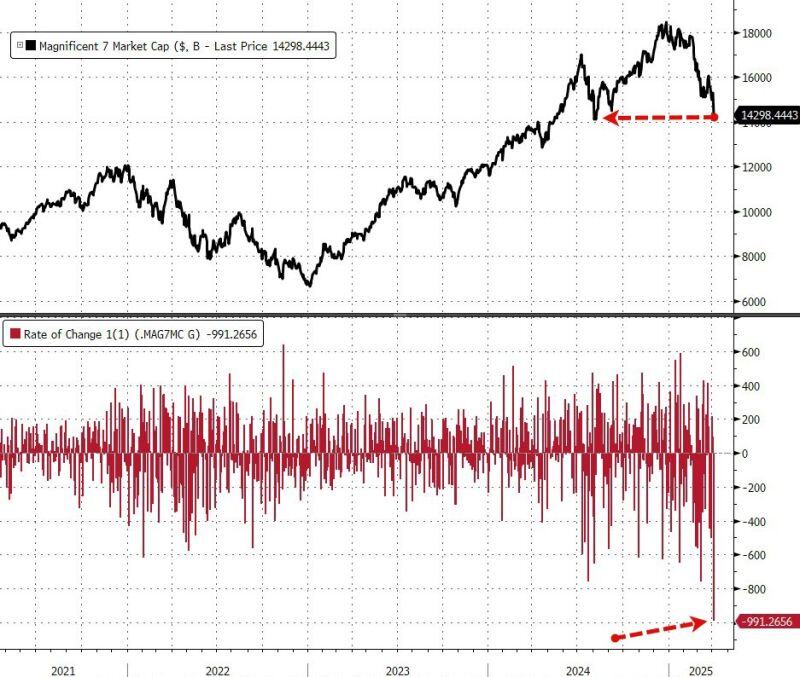

And the market doesn't like it 😨 🔴 Dow Futures are down 1,000 points and Asia, Cryptos are a bloodbath

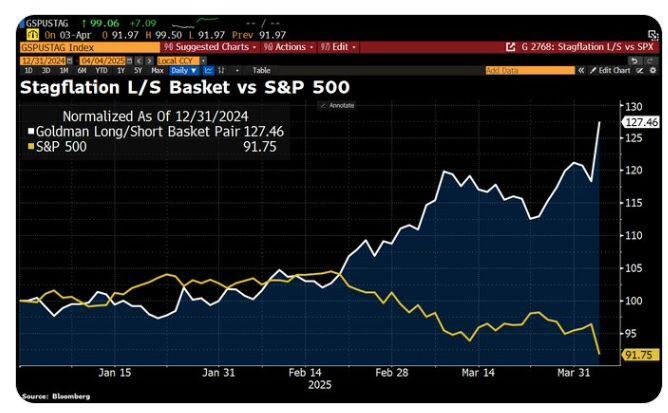

Markets are flashing a stagflation warning.

Goldman's long/short stagflation basket is up 27.5% YTD, while the SP500 has dropped nearly 10% over the same period. Source: Bloomberg, HolgerZ

🔴 Breaking news:

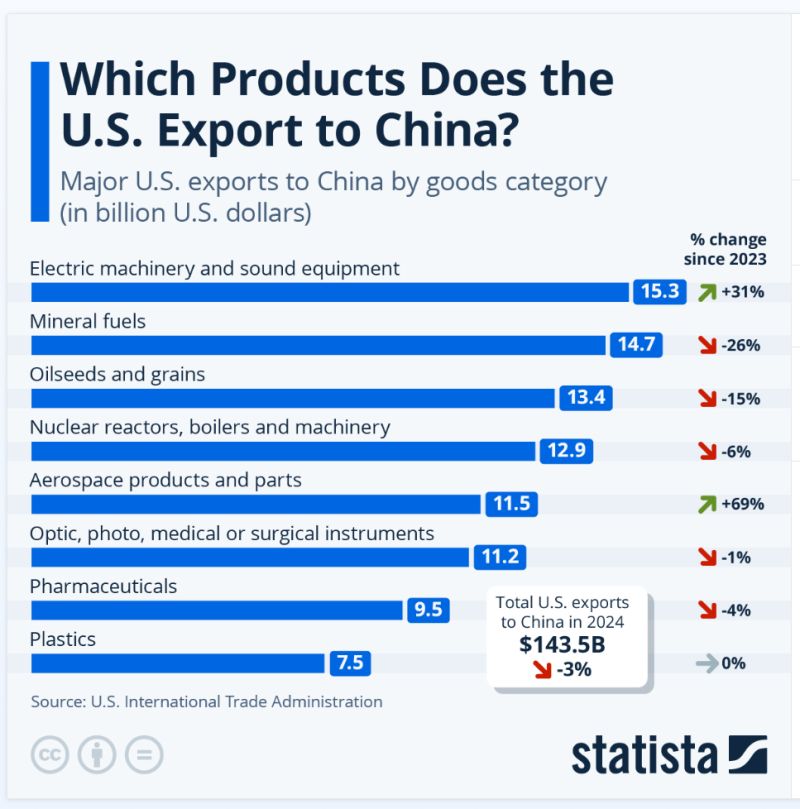

China has announced it will impose additional tariffs of 34% on imports from the US in retaliation for duties of the same amount unveiled by President Donald Trump this week as part of his aggressive trade agenda ▶️ The U.S. exported around $143.5 billion worth of goods to China in 2024. The category worth the most was electric machinery and sound equipment at $15.3 billion (up 31 percent from 2023). Aerospace products also saw a substantial increase year-on-year, up 69 percent to $11.5 billion in 2024. Meanwhile, mineral fuels and oilseeds and grains saw declines of 26 percent and 15 percent, respectively, since 2023. The U.S. has a trade deficit with China, meaning it imports more from China than it exports. Source: Statista, Mario Nawfal

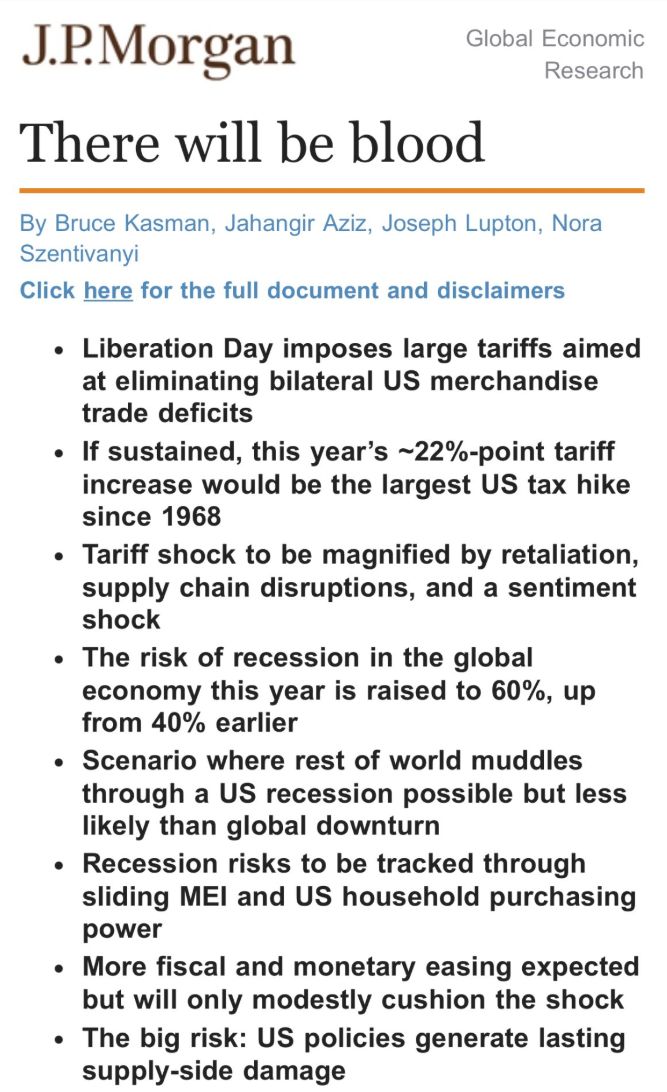

JPMorgan’s chief economist Bruce Kasman:

"There will be blood"

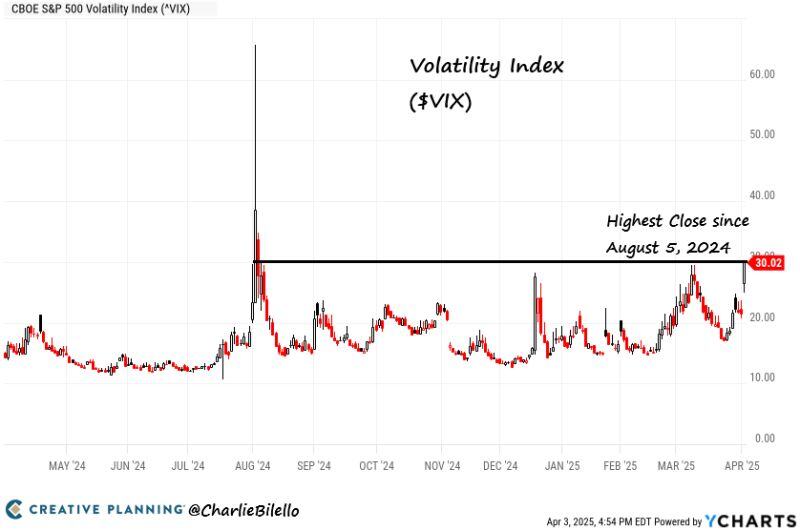

The $VIX ended the day at 30, its highest close since August 5, 2024

Fear is on the rise and stocks are on sale, providing more opportunities for long-term investors. Source: Charlie Bilello

US small caps russell 2000 is officially in bear market

First time since 2022

Investing with intelligence

Our latest research, commentary and market outlooks