Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

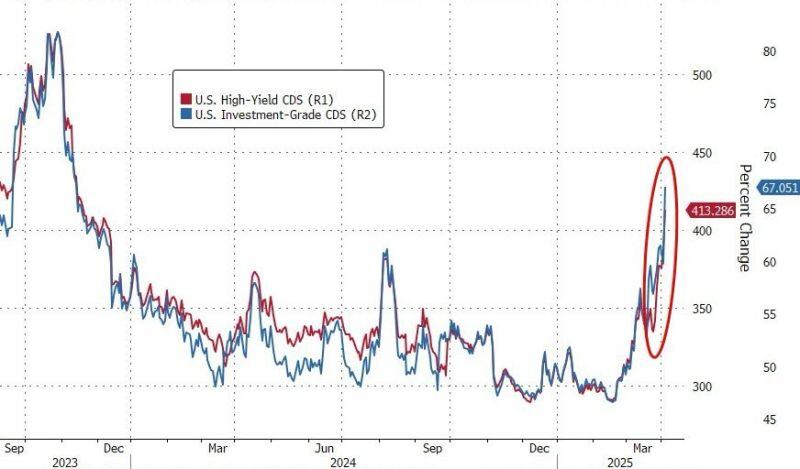

Never interrupt the compounding effect:

Source: Invest in Assets

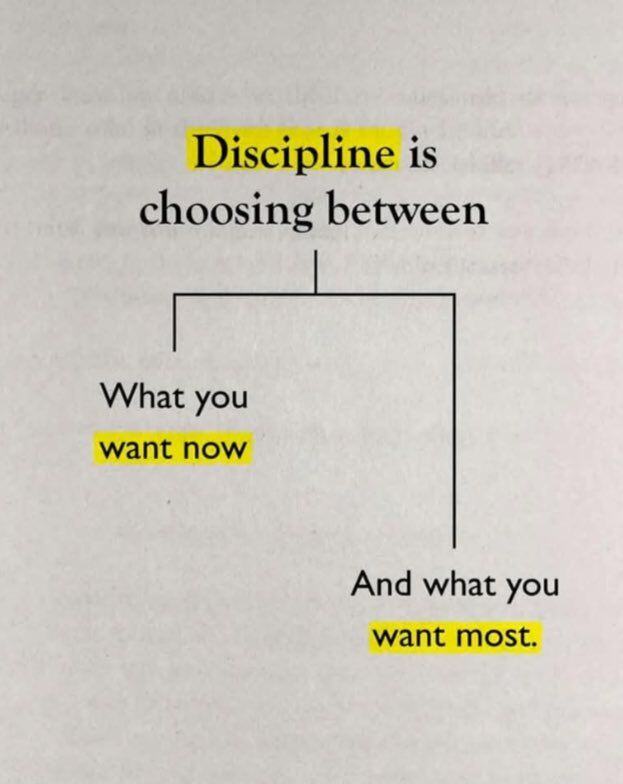

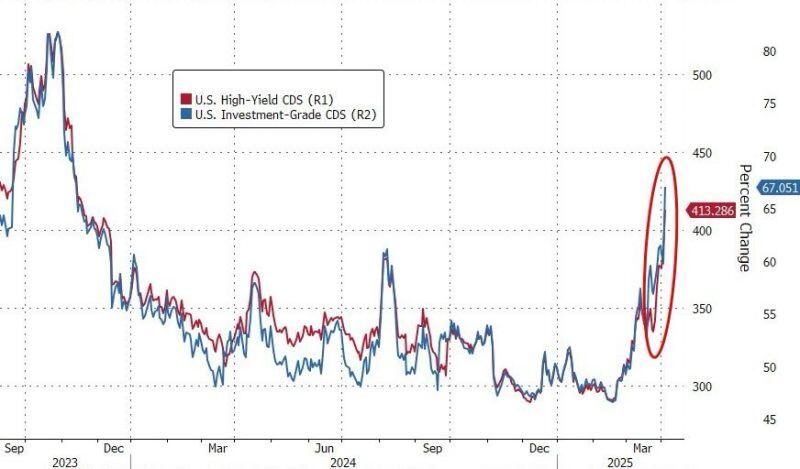

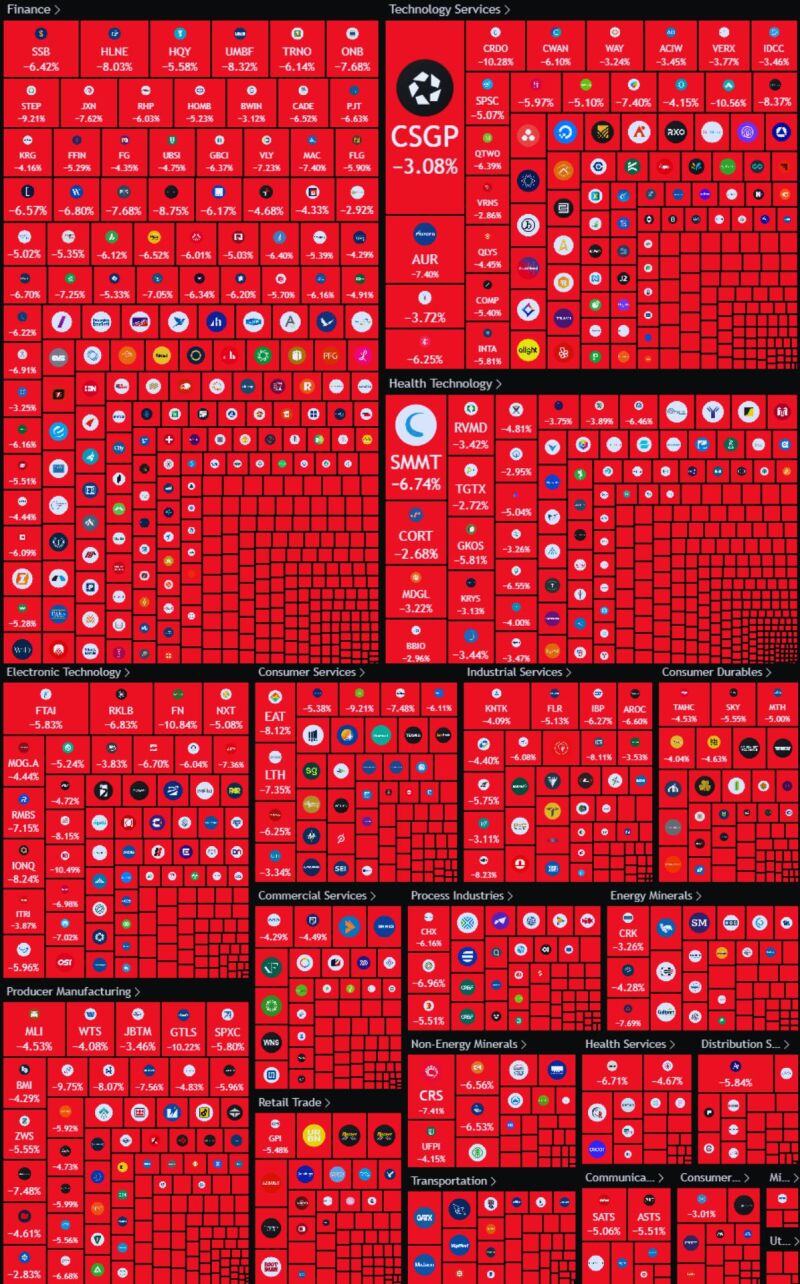

The S&P500 had yesterday its worst day since 2020

Source: Blossom @meetblossomapp

US smallcaps #Russell2000 is officially in bear market

First time since 2022

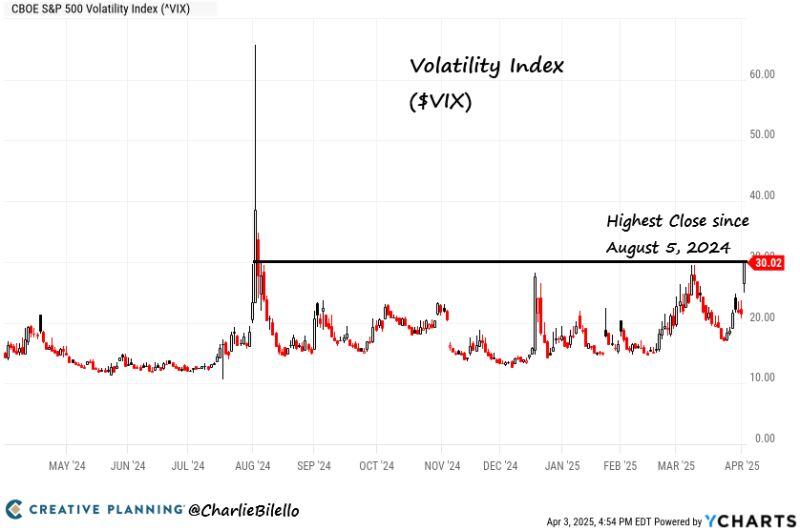

The $VIX ended the day at 30, its highest close since August 5, 2024.

Fear is on the rise and stocks are on sale, providing more opportunities for long-term investors. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks